TikTok for financial services is gaining traction as more users turn to the platform for budgeting tips, credit advice, and investment content. This guide breaks down how financial brands can advertise on TikTok, what the platform allows under its ad policies, and which strategies drive real results.

Quick Summary:

- Agencies like Mega Digital help financial brands launch compliant, performance-driven campaigns.

- TikTok allows licensed financial brands to advertise, but policies restrict high-risk offers like crypto and payday loans.

- Educational, compliant content drives the highest engagement in finance.

- Partnering with FinTok creators builds trust and expands reach.

- Lead generation ads and storytelling formats are most effective for conversions.

Why Should Financial Services Providers Use TikTok?

Many financial services providers still hesitate to explore TikTok, often viewing it as a platform built for trends and entertainment. But that perception is outdated. With 1.04 billion monthly active users worldwide, this platform has seen rapid adoption across age groups and demographics.

In 2026, TikTok for financial services has evolved into a high-potential channel for reaching a financially curious audience, especially Millennials and Gen Z, who actively seek budgeting tips, credit advice, and investment insights.

According to TikTok’s internal data, over 35% of U.S. users are now between the ages of 25 and 44, prime financial decision-making years. These users are not just watching; they’re engaging, learning, and even making product decisions based on the content they see. Finance-related hashtags like #FinTok, #PersonalFinance, and #InvestingTips have collectively amassed billions of views, proving that financial content has a home on the platform.

For financial brands, this means three key opportunities:

- Educate at scale: Use short-form videos to explain complex topics like budgeting, credit scores, or mortgage basics.

- Build trust: Show up consistently with transparent, helpful advice to position your brand as a reliable financial partner.

- Drive action: Leverage TikTok’s native ad formats like Lead Ads and Spark Ads to convert views into qualified leads.

In short, TikTok is no longer a nice-to-have; it’s a valuable space for compliant, strategic marketing in the financial sector.

What Financial Services Can Advertise on TikTok?

If you’re considering running ads on TikTok for financial services, understanding the platform’s advertising policies is the first step. TikTok applies strict guidelines to financial content to protect users and ensure transparency. While many financial services are allowed to advertise, there are important limitations you need to know.

TikTok permits licensed and legally compliant financial institutions to promote services such as banking, personal loans, credit cards, insurance, and budgeting tools. However, some categories like high-risk investments, payday loans, cryptocurrency, and forex trading are either restricted or entirely prohibited unless you receive prior approval and provide appropriate disclosures.

Summary: What Financial Services Can Advertise on TikTok

| Category | Allowed | Restricted/Prohibited | Requirements |

|---|---|---|---|

| Banking & Credit Services | Yes – licensed banks, credit unions, and credit cards | No deceptive claims or guaranteed approvals | Must include disclaimers and licensing info |

| Personal Loans | Yes – with legal approval | Payday loans, high-interest short-term loans | Transparent terms, repayment details, and legal compliance |

| Insurance | Yes – auto, health, life, property | None if licensed | Requires proof of authorization and proper disclosures |

| Investment Platforms | Yes – mutual funds, retirement accounts | Crypto, forex, binary options (without pre-approval) | Must avoid promising returns and explain investment risks |

| Budgeting & Finance Apps | Yes – apps that help users manage money | None | Educational and clearly branded content is preferred |

| Cryptocurrency | No (except with special approval from TikTok) | Most crypto-related ads are prohibited | Requires platform review and country-specific regulatory documentation |

| Get-Rich-Quick Schemes | No | Any ad promoting unrealistic income claims | Not allowed under any circumstances |

To stay compliant, financial advertisers must:

- Clearly identify their business and include necessary licensing information

- Avoid misleading claims, exaggerated benefits, or promises of guaranteed returns

- Provide disclaimers about financial risk or eligibility where required

For example, if you’re promoting a loan product, your ad should explain repayment terms and highlight that approval depends on certain qualifications. Ads must also follow local laws in each region where they are shown.

TikTok reviews all financial ads closely, and violations can lead to rejection or even account suspension. This is why many brands choose to work with certified TikTok agencies who understand both creative strategy and compliance agencies like Mega Digital can help ensure your campaign is both effective and policy-safe.

Tips and Tricks for Promoting Financial Services with TikTok Ads

To make the most of TikTok’s unique platform, it’s essential to use strategies that resonate with its audience. Here’s how to promote financial services effectively on TikTok, following best practices tailored to its highly engaged user base.

1. Make your content educational

Many people turn to TikTok for quick, digestible learning moments. So why not tap into that with financial insights?

Providing educational content can make financial services feel accessible and build trust. You might wonder if education-based ads will bore TikTok’s audience; however, short, engaging videos can simplify complex topics, making them appealing and valuable.

Create brief videos explaining financial basics, investment tips, or budgeting advice. For example, if your financial service offers budgeting tools, showcase how they help users take control of their finances in three simple steps.

2. Leverage storytelling with relatable scenarios

Finance is personal, so why not use TikTok ads to connect emotionally? Real-life scenarios make it easier for viewers to see how your service fits into their lives.

While finance topics might seem serious, storytelling with relatable situations can transform them into engaging and memorable messages.

Use In-Feed ads to tell a story from a customer’s perspective, such as how a young professional managed student loans or saved for their first home with your service. Storytelling resonates when viewers see themselves in the narrative, making them more likely to take action.

3. Stay on trend

TikTok is all about trends, and brands that align with them can capture attention quickly.

Some might argue that trends don’t suit the ‘serious’ nature of financial services, but joining relevant trends can actually humanize your brand. After all, staying current signals that your brand understands and relates to the modern consumer.

Keep an eye on trending hashtags, audio, and video formats and incorporate them into your ads where appropriate. For instance, if there’s a popular challenge focused on saving or budgeting, participate by adding a financial twist that ties back to your service.

4. Collaborate with “FinTok” influencers

Why go it alone when FinTok influencers already have an established audience seeking financial content? Partnering with influencers builds instant credibility and boosts your reach. Financial services might shy away from influencers, but consider this: when influencers have a loyal following, their recommendations can carry the weight of trust that ads often lack.

Identify FinTok influencers who align with your brand’s values and target audience. Consider sponsored content where they use your service or product in a real-life financial scenario, such as managing monthly expenses, to show followers exactly how it works.

5. Create interactive content

Engaging users interactively, whether through polls, challenges, or Q&A sessions, invites them to actively participate in your content rather than just passively watch. Financial brands may ask, “Is interaction worth it on TikTok?” Yes, because when viewers interact, they remember your brand better and are more likely to engage in the future.

Use Branded Hashtag Challenges or polls to encourage users to share their budgeting tips or financial goals. For example, create a challenge like #MySavingsJourney, encouraging users to share how they’re building savings, with your brand providing tips or support.

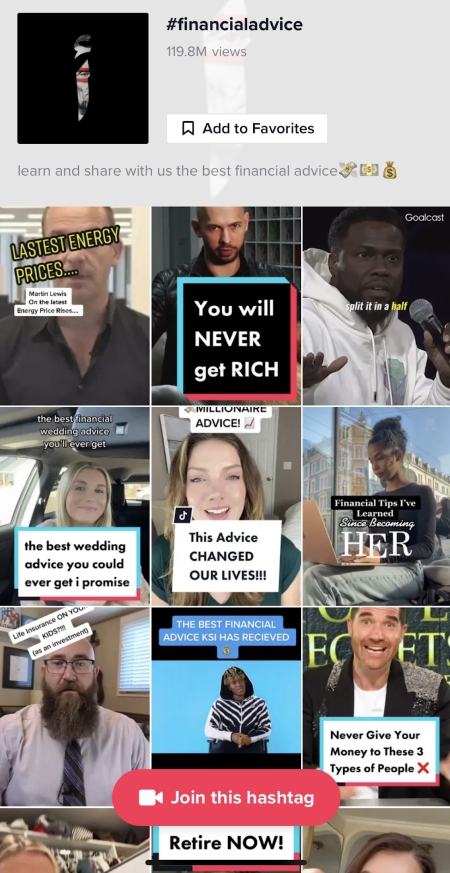

6. Use hashtags wisely

TikTok’s algorithm heavily relies on hashtags to categorize content. While it may seem tempting to use popular hashtags only, niche tags related to finance can better target interested viewers. The hashtag mix matters: choose tags that help your content appear in the right places without being lost in a sea of unrelated videos.

Bellow are some TikTok hashtags for financial services:

| Hashtag | Purpose | Best For |

|---|---|---|

#FinTok | General finance community content | All financial services and influencer collaborations |

#PersonalFinance | Personal budgeting, saving, and spending tips | Budgeting apps, financial planners |

#BudgetingTips | Quick, practical money-saving advice | Banking, saving tools, personal finance brands |

#FinancialAdvice | Expert-led educational content | Financial consultants, loan services |

#InvestingTips | Beginner-friendly investment education | Investment platforms, brokers, fintech apps |

#MoneyTok | Broad, catch-all for money topics | Fintech brands, content creators |

#CreditScoreHelp | Improving and managing credit scores | Credit repair, financial wellness services |

#StudentLoans | Loan advice and repayment strategies | Loan providers, refinancing tools |

#FirstTimeHomeBuyer | Mortgage and home-buying education | Mortgage lenders, real estate finance content |

#SmallBusinessFinance | Financial content for entrepreneurs and business owners | Business banking, accounting platforms |

#DebtFreeJourney | Personal stories about paying off debt | Finance coaches, budgeting apps |

To use them wisely, notice some tips:

- Combine 2–3 broad hashtags with 2–3 niche ones per post

- Avoid overloading your caption with too many hashtags

- Use hashtags naturally, and pair them with high-quality, relevant content

- Monitor which hashtags bring the most engagement and refine your strategy over time

Top 5 TikTok Agencies for Financial Services

Sometimes, TikTok can be challenging for financial services, given the need for compliance, trust-building, and creative strategies to engage a younger audience.

Here are the top TikTok agencies that specialize in helping financial brands reach their goals effectively on the platform:

#1 Mega Digital

As an official TikTok partner, Mega Digital has carved out a strong reputation in digital marketing. Mega Digital’s expertise lies in designing campaigns that balance creativity with compliance, helping financial brands expand their reach without compromising regulatory requirements.

Mega Digital offers a tailored approach for each client, leveraging advanced targeting strategies and tracking mechanisms that are essential for high-quality lead generation.

#2 Viral Nation

Viral Nation is a global leader in influencer marketing and social media advertising, known for its data-driven approach.

For financial services, Viral Nation excels in creating campaigns that resonate with audiences while maintaining regulatory compliance. Their expertise in influencer partnerships is particularly beneficial for financial brands looking to build trust through authentic connections.

#3 The Social Shepherd

The Social Shepherd is a results-driven TikTok agency that prioritizes social-first, native content to quickly scale brands on the platform.

For financial services providers, they focus on creating content that educates and engages, making complex financial concepts easy to understand. The Social Shepherd’s strength lies in their ability to deliver strong results in a cost-effective manner.

#4 Ubiquitous

Ubiquitous specializes in TikTok influencer marketing and has a network of creators ready to bring brand stories to life.

Ubiquitous focuses on building campaigns that resonate with audiences through relatable and credible influencers. Their comprehensive campaign management includes everything from content creation to performance tracking.

#5 Disruptive Advertising

Disruptive Advertising is a full-service digital marketing agency with a dedicated focus on financial services.

They understand the unique challenges of advertising in the financial sector and have the expertise to create TikTok ads that meet compliance standards. Disruptive Advertising’s data-focused approach and targeted strategies make them a strong choice for financial brands.

>>> Read more: TikTok Crypto: Rules, Influencers & Tips to Run Profitable Ads

Case Study of a Financial Services Provider Succeeding on TikTok

This case study explores how a financial services provider, Lend Wallets, partnered with Mega Digital to leverage TikTok’s advertising platform for impactful lead generation.

Lend Wallets is a U.S.-based financial services company that offers a range of financial products and services. The company is recognized for its transparent operations and is supported by a team of experienced professionals.

Challenges

Although they had seen success across multiple platforms, TikTok was entirely new, requiring tailored strategies and testing to see if it could deliver the same level of performance.

Besides, their advanced CRM system required precise integration with TikTok Pixel for accurate tracking and optimization.

Solutions

Mega Digital team has worked closely with the client’s technical team to resolve Lend Wallets’ challenges:

- Precise Pixel setup: Mega Digital collaborated with the client’s technical team to configure the TikTok Pixel for accurate tracking across the customer journey.

- Customized UTM parameters: Unique TikTok UTM parameters (aid, subacc, ttclid, etc.) were set for each ad, ensuring precise attribution and meeting the client’s specific tracking requirements.

- Insight-driven creative strategy: Mega Digital identified key audience pain points, such as low credit scores and the need for short-term loan, to develope targeted ad templates focusing on consumer loans.

Results

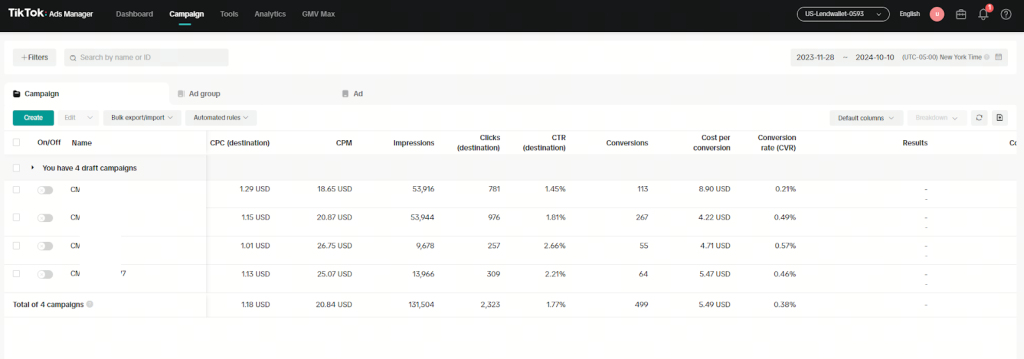

This campaign demonstrated strong performance on TikTok, thanks to the collaborative efforts between Mega Digital and Lend Wallets in refining tracking and ad strategies.

- 2323 clicks

- 499 conversions

- CPC of $1.18

- CPA of $5.49

>>> Read more: Lend Wallets: Generating Financial Leads with TikTok Ads

Wrap-up

TikTok for financial services is more than a trend. For brands willing to step into this innovative space, TikTok offers a chance to make an impact that resonates well beyond the screen. By embracing TikTok, financial brands can break down complex topics, build trust, and help shape the financial futures of young audiences in a memorable and impactful way.