Are you wondering how financial service brands use TikTok to connect with Gen Z and Millennials? With its billion-strong user base, TikTok is reshaping financial education. In this post, I’ll show you how brands simplify finance, collaborate with influencers, and use trends to build trust with younger audiences.

The Current Situation: Financial Services on TikTok

Did you know that TikTok has over 1 billion active users, with 60% of them belonging to Gen Z and Millennials? These younger generations are turning to TikTok not just for entertainment but also to learn about money management and investments.

But what’s driving this trend, and what challenges do these brands face along the way? Let’s break it down.

Growing Presence of Financial Content

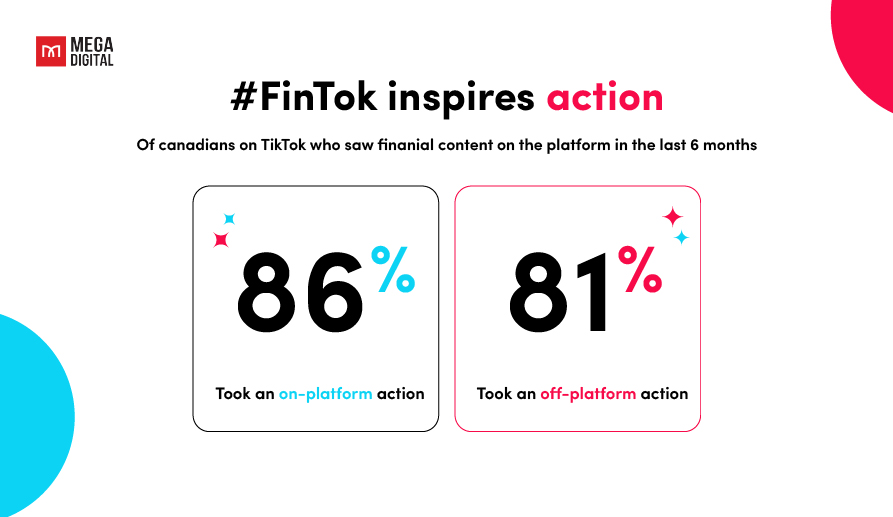

Financial content is rapidly gaining momentum on TikTok, with hashtags like #FinTok and #MoneyTips having already garnered over 10 billion views. This clearly highlights the growing demand for accessible and easy-to-understand financial advice.

In response, content creators have been breaking down complex financial topics such as managing credit or saving for retirement into short, engaging videos that feel more like a friendly conversation than a lecture.

These short, conversational clips resonate strongly with younger audiences, who prefer learning through authentic, relatable content.

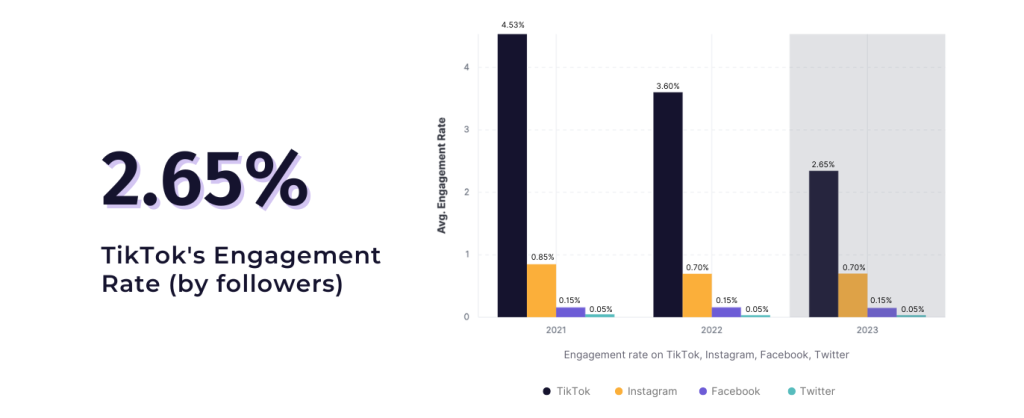

Engagement and Audience Insights

One of TikTok’s key strengths is its ability to foster engagement. Unlike traditional platforms, TikTok’s algorithm promotes discovery, ensuring that even niche content can reach a wide audience. For financial brands, this means the potential to go viral with the right message or campaign.

A recent example includes a campaign by a digital banking app that used TikTok to explain how users could save money on everyday purchases. By combining humor, trending sounds, and interactive challenges, the campaign generated thousands of comments and shares, proving that financial content doesn’t have to be boring.

Moreover, TikTok provides valuable audience insights. Brands can analyze metrics like watch time, likes, and shares to refine their content and better understand what resonates with users. This data helps them stay agile in an ever-changing digital landscape.

Challenges Financial Brands Face

Despite the opportunities, financial brands face unique challenges on TikTok.

First, they must navigate strict advertising regulations. Unlike lifestyle or entertainment brands, financial services are held to a higher standard of compliance, which can make content creation more complicated. Misleading information or unclear disclaimers can lead to penalties or damage to the brand’s reputation.

Second, breaking down complex financial concepts into short, engaging videos isn’t easy. Striking the right balance between educational value and entertainment requires creativity and expertise. Brands must ensure their content is accurate while keeping it accessible and engaging.

Finally, there’s the issue of trust. Many TikTok users are wary of financial scams, so brands must work extra hard to establish credibility. Therefore, authenticity and transparency are key to overcoming this barrier and building long-term relationships with their audience.

How Financial Service Brands Use TikTok to Reaching Younger Audiences

Reaching younger audiences on TikTok takes more than just showing up; it requires creativity, authenticity, and understanding what resonates with Gen Z and Millennials. Financial brands are stepping up with strategies that simplify finance, leverage influencers, and embrace TikTok trends. Here’s how financial service brands use TikTok to connect with the next generation.

Simplifying Finance Through Education

One of the most effective strategies financial brands are using is turning complex financial topics into easy-to-digest educational content. Instead of bombarding viewers with technical jargon, brands usually simplify concepts through relatable analogies, step-by-step tutorials, and quick hacks.

Take Robinhood, for example, which created a TikTok series to demystify investing. In one viral video, they explained dollar-cost averaging with an engaging animation comparing it to buying pizza slices over time.

The video earned 1.5 million views and hundreds of comments from curious young investors. This educational approach not only informs but also builds trust by showing users that finance doesn’t have to be overwhelming.

Collaborating with Influencers

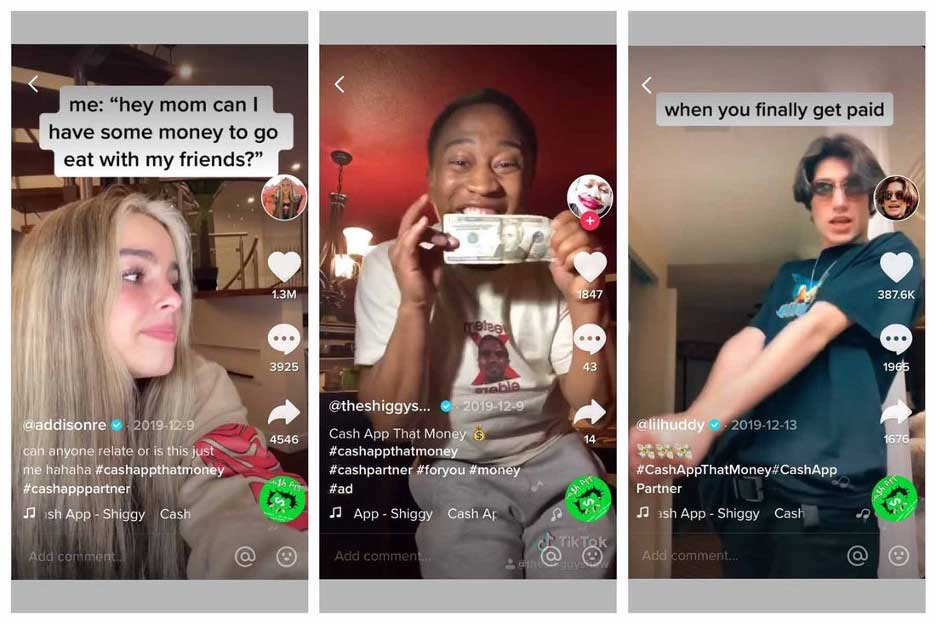

Nothing grabs attention on TikTok quite like an influencer who speaks the audience’s language. Financial brands are leveraging partnerships with creators who already have credibility among Gen Z and millennials.

To connect with younger audiences, many financial brands are teaming up with TikTok influencers who already have their trust. These influencers, often creators in the #FinTok niche, know how to make financial content engaging and relevant.

Take, for example, partnerships with “finfluencers” like Tori Dunlap from Her First $100K or Humphrey Yang, who explain complex financial topics with humor and simplicity. When these influencers promote a financial app or tool, it feels more like a trusted friend offering advice than a traditional ad campaign.

Additionally, influencers help bridge the gap between serious topics and TikTok’s lighthearted vibe. Through challenges, Q&A sessions, or humorous takes on common money mistakes, they make finance approachable and entertaining.

>>> Read more: 10 TikTok Finance Influencers to Follow for Smart Money Tips

Using Trends and Hashtags

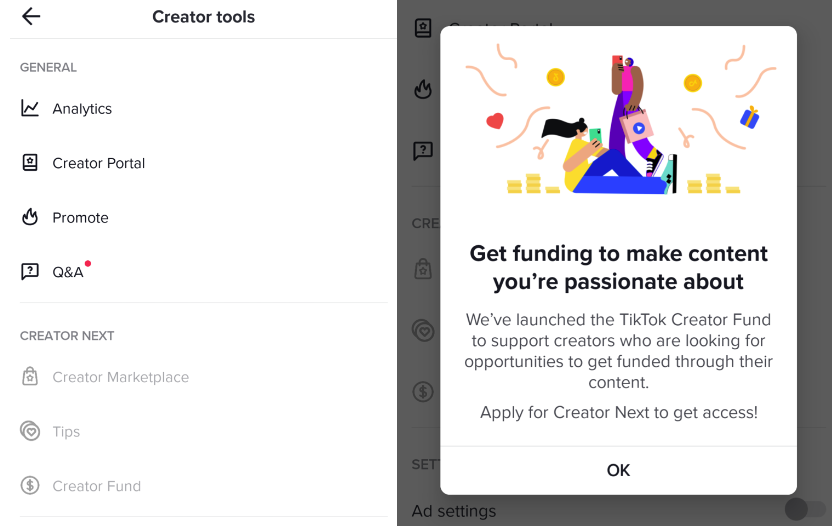

TikTok thrives on trends, and financial service brands use TikTok trends and hashtags to make their content feel more current and fun. I highly recommend you use the Branded Hashtag Challenge to make your content reach wider audiences.

By tapping into trending sounds, challenges, and hashtags, financial service brands are also able to reach users where they’re already engaged.

Recently, Acorns, a micro-investing app, joined the #MoneySavingChallenge, using a trending sound and step-by-step tips to show how users could save $5 daily to build an emergency fund. The video went viral, amassing 2 million views and inspiring thousands of users to take on the challenge.

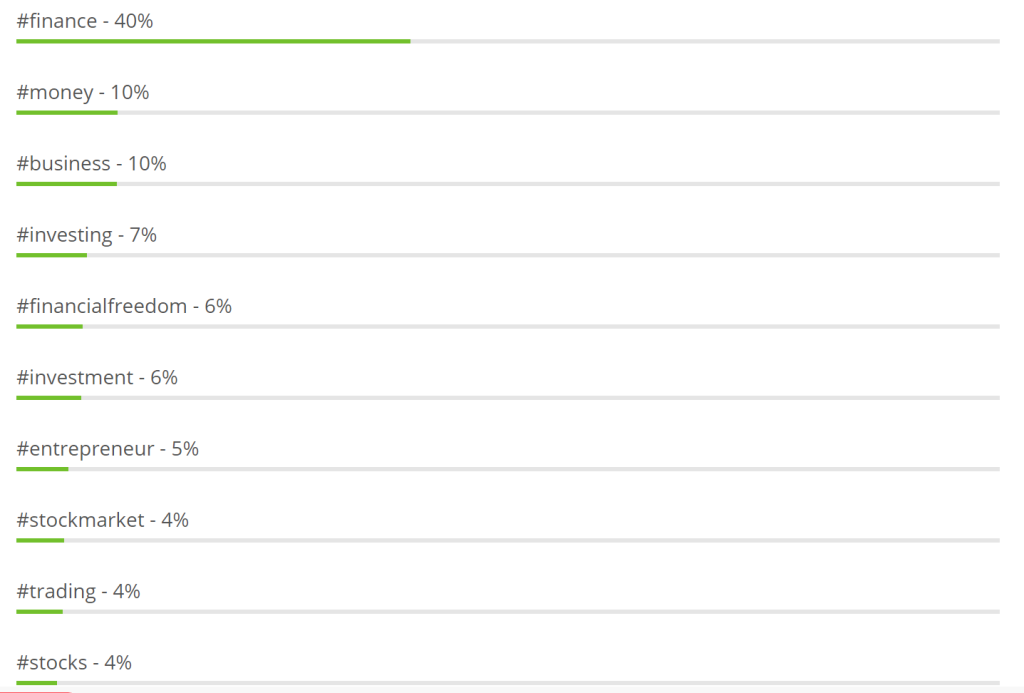

Besides some TikTok basic hashtags, here are some trending hashtags that financial brands can explore:

- #BudgetTips: Perfect for sharing quick, actionable advice on saving or managing expenses.

- #FinancialFreedom: Ideal for promoting long-term financial goals and investment products.

- #SideHustleTips: A great way to engage users looking for extra income ideas.

- #SavingsHack: Useful for sharing creative and practical ways to save money.

- #InvestingForBeginners: Helps attract young users interested in learning the basics of investing.

Running Interactive Campaigns

Engagement is key on TikTok, and interactive campaigns are a powerful way for financial brands to connect with their audience. Features like polls, Q&A stickers, and duet challenges allow brands to involve users directly in their content.

For instance, Bank of America launched a duet challenge called #MySavingsGoal, asking users to share their savings plans in response to a catchy branded video. Participants used creative ways to showcase their goals, from saving for a new car to paying off student loans.

Finally, the campaign generated over 10,000 duets, fostering a community of motivated savers while promoting the bank’s financial tools.

TikTok Trends Shaping Financial Services Marketing

TikTok also drives key trends that are reshaping how financial brands market their services. These trends aren’t just about following fads – they’re about creating impactful, lasting connections.

Growing Demand for Simple Financial Advice

To begin with, younger generations, particularly Gen Z, value financial advice that is straightforward and actionable so TikTok’s short videos are perfect for delivering this type of content.

For example, videos like “3 Easy Ways to Save $100 This Month” or “Understanding Credit Scores in 60 Seconds” are wildly popular. Creators often use storytelling, step-by-step visuals, and humor to simplify daunting topics. Financial apps and services, such as Mint or Robinhood, leverage these trends by collaborating with creators who specialize in demystifying finances.

This growing demand for simple advice reflects a broader shift: Gen Z and millennials want financial education, but they expect it to be as engaging and straightforward as scrolling through their For You page.

Making Financial Goals Fun and Engaging

Financial planning doesn’t have to be boring, and TikTok users are proving it by gamifying their money goals. Brands are leaning into this trend with creative content that transforms financial milestones into interactive challenges.

For instance, some brands promote budgeting by framing it as a game: “Save $5 every time you skip a coffee run” or “Can you save $1,000 in 30 days?” These fun, relatable challenges encourage users to participate and share their progress, creating a ripple effect of engagement.

Additionally, brands like Acorns use visuals like progress bars or reward animations to make financial goals feel tangible and rewarding. This approach resonates with younger audiences who thrive on instant feedback and a sense of achievement.

Focus on Sustainability and Ethical Finance

Young consumers increasingly care about where their money goes. Therefore, TikTok users are vocal about supporting brands that align with their values, including sustainability and ethical finance.

Financial services are responding to this need by promoting eco-friendly investment options, ethical banking practices, and socially conscious financial tools. For example, platforms like Aspiration highlight how users can offset their carbon footprints by saving or spending with them.

Then, TikTok creators amplify this trend by sharing content about sustainable spending, ethical investing, and responsible credit use to build trust and position themselves as leaders in ethical finance.

Real-Time Connections with Audiences

TikTok thrives on immediacy, and financial brands are using live features and real-time interactions to build stronger relationships with their audience. Financial brands can use Live Q&A sessions, for instance, to answer user questions about money in a casual, engaging format.

A great example of this trend is PayPal’s TikTok Lives, where they’ve partnered with creators to discuss topics like small business financing or personal savings tips. These sessions humanize the brand, making it more approachable and relatable.

Real-time connections also help brands gather instant feedback, respond to trends, and stay top-of-mind with their audience. For Gen Z, who values authenticity, this level of interaction fosters a sense of trust and loyalty.

Predictions for Future Growth

As TikTok continues to evolve, its influence on financial services marketing is only expected to grow. From my perspective, here are some key predictions shaping the future of this unique intersection between finance and social media.

Expansion of Financial Niche Content

The trend of expanding into financial niche content is only set to accelerate. As TikTok becomes more saturated with general advice, brands will likely shift toward creating hyper-focused content that targets specific communities.

For example, while creators are already discussing student loans or crypto trading, the future holds even more tailored content. In the future, brands such as Fidelity might create specialized content for first-time investors, while fintech companies like Lili could cater specifically to gig workers and freelancers.

By narrowing their focus, financial brands can foster deeper connections with audiences who feel like the content speaks directly to their unique needs.

Moreover, niche content allows brands to position themselves as authorities in their areas of expertise, which builds trust and long-term engagement.

Increased Regulation of Financial Content

However, with this expansion comes a greater need for regulation. The rapid spread of financial advice on TikTok has raised concerns about misinformation, and it’s highly likely that regulatory bodies such as the SEC (Securities and Exchange Commission) and FTC (Federal Trade Commission) will impose stricter rules for financial content on social platforms.

This shift will have significant implications for brands. They’ll need to ensure that all sponsored content is transparent, compliant, and fact-checked to avoid penalties. While these regulations might seem like a challenge, they also present an opportunity for financial brands to differentiate themselves.

Brands can also establish themselves as reliable sources in a sea of misinformation by prioritizing credible and trustworthy content. In fact, this could help them gain a competitive edge, as younger audiences increasingly value transparency and integrity.

Personalized Financial Tools Through TikTok

As personalization continues to dominate digital marketing trends, financial brands have a tremendous opportunity to integrate interactive tools directly into TikTok’s ecosystem. In the near future, we could see budgeting tools, investment calculators, or loan estimators becoming accessible within the platform itself.

For example, imagine a TikTok filter where users can visualize their savings growth based on specific goals or an interactive feature that helps calculate how much they need to save for a dream vacation to engage users and create tangible value by turning TikTok into a financial empowerment platform.

Furthermore, brands like Venmo and Robinhood could leverage this trend to solidify their presence among younger audiences who crave fast, convenient solutions.

Augmented Reality (AR) Campaigns

Finally, augmented reality (AR) campaigns will likely revolutionize how financial service brands use TikTok to market their products. While AR filters are already popular for entertainment purposes, the next wave of innovation will focus on financial education.

For instance, a bank could develop an AR experience that shows users how compound interest grows over time, or a budgeting app might allow users to visualize their monthly expenses in a fun and engaging way.

These immersive campaigns have the potential to make abstract financial concepts feel tangible and accessible. Additionally, they align perfectly with TikTok’s emphasis on creativity and interaction.

>>> Read more: TikTok for Financial Services: What You Need to Know in 2026

Conclusion

Above, I explained how financial service brands use TikTok to engage younger audiences through creative content, influencer collaborations, and relatable trends. By staying authentic and accessible, brands can make finance engaging and fun.

Ready to join the movement and transform your TikTok strategy? The time is now!