In today’s digital age, life insurance agents need new marketing strategies to stay competitive. Facebook Ads offer a cost-effective way to reach a targeted audience, generate quality leads, and boost policy sales. This blog post will cover everything about Facebook Ads for life insurance agents, from selecting the right ad type to mastering budget management and campaign optimization.

Why Use Facebook Ads for Life Insurance?

Facebook Ads offer a powerful platform for life insurance companies to reach and engage potential customers. Here are several compelling reasons to use Facebook Ads for life insurance, backed by statistics to justify and solidify the idea.

1. Extensive Reach and Targeting Capabilities

Facebook is one of the largest social media platforms in the world, with over 2.8 billion monthly active users as of 2023. This extensive user base allows life insurance companies to reach a vast audience.

Moreover, Facebook’s advanced targeting options ensure that your ads are seen by the people most likely to be interested in life insurance. You can target specific demographics such as age groups (e.g., 34-55 years old), parents, or individuals with particular financial interests.

2. Cost-Effective

For life insurance companies, a well-optimized Facebook Ads campaign can generate quality leads at a lower cost compared to traditional advertising methods, maximizing marketing budgets. The average Facebook ads cost-per-click for the insurance industry is $1.11, which is much lower than that of other advertising platforms, like Google Ads ($18.57).

According to Hootsuite, businesses make an average of $8.75 for every dollar spent on Facebook Ads, highlighting the platform’s potential for high return on investment (ROI).

3. Enhanced Engagement and Interaction

Facebook does offer a lot of Facebook ads types, and some of them are designed to encourage interaction and engagement. These formats help life insurance companies build relationships with potential customers.

By using engaging ad formats, life insurance companies can capture attention, convey complex information in an easy-to-understand manner, and encourage potential customers to take action, such as requesting a quote or signing up for more information.

4. Detailed Analytics and Insights

Facebook provides detailed analytics and insights that help advertisers measure the performance of their campaigns in real-time. This data-driven approach allows for continuous optimization and improvement.

For life insurance companies, access to detailed analytics means being able to track metrics such as conversion rates, cost per lead, and CTR in Facebook ads. This information is crucial for making informed decisions and refining ad strategies to achieve better results.

3 Facebook Ads Types That Suit Life Insurance The Most

When it comes to using Facebook ads for life insurance, choosing the right ad type can significantly impact your campaign’s success. Here are three Facebook ad types that are particularly effective for life insurance, along with explanations of why they work and examples to illustrate their use.

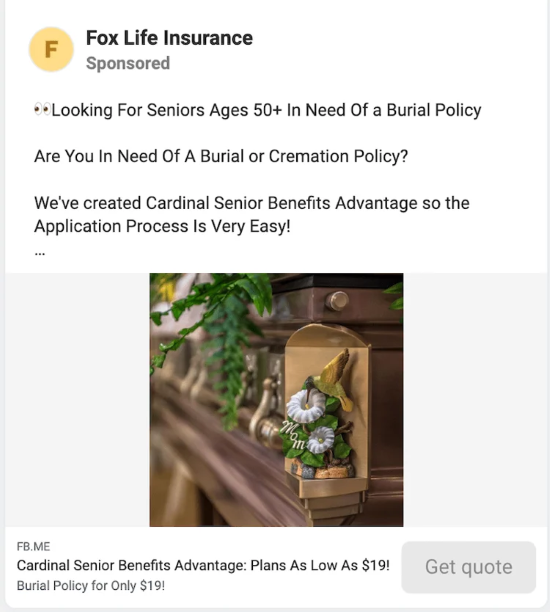

1. Lead Ads

Facebook lead ads are designed to collect user information directly within the platform, making them ideal for life insurance companies aiming to generate leads. These ads simplify the process for potential customers to express interest, as they don’t require leaving the app to fill out a form.

Benefits:

- Ease of use: Users can submit their contact information without navigating away from Facebook, reducing friction and increasing conversion rates.

- Pre-filled forms: Facebook pre-fills the forms with user information, such as name and email address, making it quick and convenient.

- Customizable fields: You can tailor the form fields to gather specific information relevant to life insurance, such as age, income, and coverage needs.

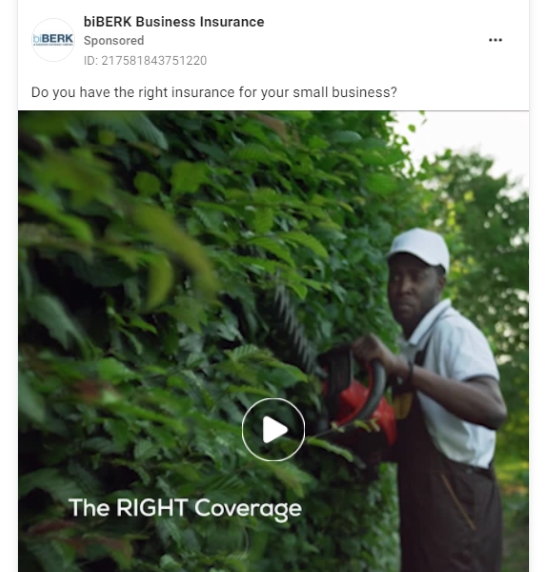

2. Video Ads

Facebook video ads are highly engaging and can effectively convey the emotional and practical benefits of life insurance. They allow you to tell a compelling story, explain complex concepts, and build trust with your audience through visual and auditory elements.

Benefits:

- Emotional engagement: Videos can evoke emotions and create a connection with viewers, which is crucial for a product like life insurance that is often purchased based on emotional factors.

- Complex information simplified: Videos can break down intricate details about life insurance policies in an easy-to-understand format.

- Higher engagement rates: Video content tends to attract higher engagement rates compared to static images or text, increasing the likelihood of users taking action.

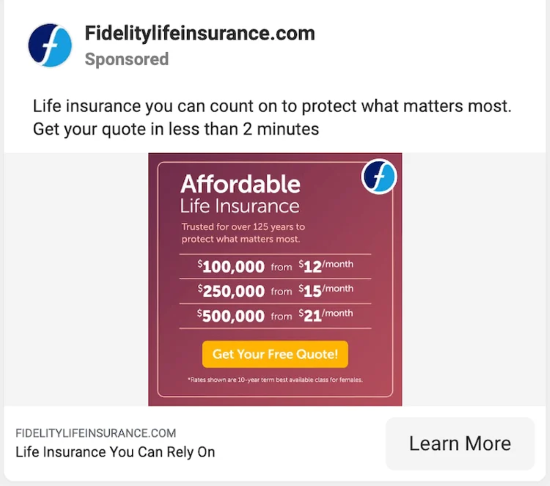

3. Image Ads

Facebook image ads are simple yet effective, allowing you to convey a clear message with a single powerful image. This ad type is ideal for brand awareness and driving traffic to your website, where users can learn more about your life insurance offerings.

Benefits:

- Visual appeal: A well-designed image can capture attention quickly and convey your message at a glance.

- Simplicity: Image ads are straightforward, making them easy to create and understand for your audience.

- Cost-effective: Generally, image ads can be more budget-friendly compared to video ads while still being effective in generating interest and clicks.

How Much Should Life Insurance Agents Spend on Facebook Ads?

Determining the right budget for Facebook Ads is crucial for life insurance agents aiming to maximize their return on investment (ROI) and effectively acquire leads. The budget can vary significantly depending on the size of the agency. Here’s a breakdown of how different-sized agencies should allocate their ad spend:

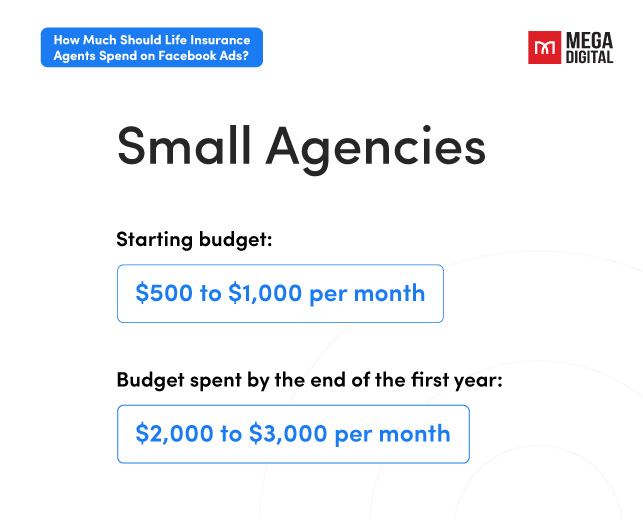

Small Agencies

For small agencies just beginning with Facebook Ads, a modest budget is advisable to test different strategies without overspending. A starting budget of $500 to $1,000 per month is reasonable. This allows for testing various ad creatives, audience segments, and bidding strategies.

As you gather data and identify what works best, gradually increase your budget. Aim to double your ad spend every 3-6 months, assuming you’re seeing positive results. By the end of the first year, a small agency might be spending $2,000 to $3,000 per month.

Middle-Sized Agencies

Middle-sized agencies can afford to be a bit more aggressive with their initial spending. A starting budget of $2,000 to $5,000 per month enables more extensive testing and quicker optimization.

After identifying successful strategies, middle-sized agencies should look to increase their budget by 20-30% every quarter. By the end of the first year, the monthly ad spend could range between $8,000 to $12,000.

Large Agencies

Large agencies have the capacity to invest significantly from the start. An initial budget of $10,000 to $15,000 per month is suitable, providing ample room for comprehensive testing and high-volume lead generation. This budget supports running diverse campaigns across different audience segments and ad formats.

For large agencies, the focus should be on maintaining and optimizing high-performing campaigns while steadily increasing the budget. A quarterly increase of 15-20% is advisable. By the end of the first year, a large agency might be spending $20,000 to $30,000 per month.

Let’s take a look at this example:

A small life insurance agency began with a budget of $1,000 per month, focusing on individuals aged 30-50. They saw positive results and increased their budget to $3,000 per month over 6 months. By continuously optimizing their campaigns, they managed to achieve a CPL of $25. After a year, they were spending $5,000 per month and generating a steady stream of high-quality leads.

4 Tips for Insurance Agents Running Facebook Ads

Running successful Facebook ads as an insurance agent requires strategic planning and execution. Here are four essential tips to help you maximize the effectiveness of your campaigns:

Target Local Users

Almost half of smartphone users prefer insurance agents to be within a 5-mile radius. Use geo-targeting to reach individuals near your agents or branch locations and personalize your ad content by including a local address and phone number.

Incorporating a “Call Now” button in your Local Awareness Ads can also effectively drive direct calls to your agents from the ads.

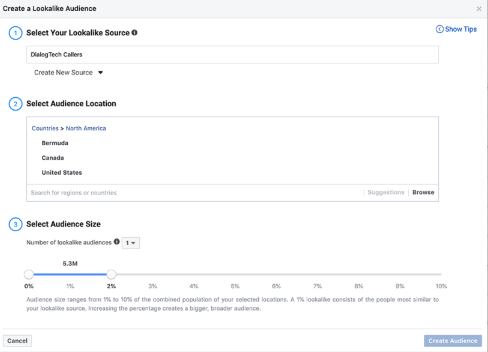

Create Lookalike Audiences Based on Online and Phone Conversions

Facebook’s lookalike audience feature allows you to expand your reach by targeting new potential customers who share similar characteristics with those who have already converted from your ads.

Insurance marketers often leverage their call tracking data to create lookalike audiences based on individuals who converted over the phone. This strategy is particularly effective for acquiring new policyholders, as 72% of insurance shoppers make their purchases offline by speaking with a call center or a local agent.

Craft Compelling Ad Creatives

The quality of your ad creatives can make or break your campaign. Ensure your visuals are high-quality and your messaging is clear and compelling. Use images or videos that evoke emotions and highlight the benefits of your insurance products.

Don’t forget to incorporate a strong call-to-action (CTA) in your ad copy, such as “Get a Free Quote” or “Secure Your Family’s Future Today.”

Leverage Lead Generation Forms

Facebook’s lead generation ads are a powerful tool for collecting contact information from potential clients without them having to leave the platform. This seamless experience can significantly improve your conversion rates.

Remember to keep your lead form short, asking for only essential information like name, phone number, and email address. Offering an incentive, such as a free consultation or e-book, can also increase the likelihood of form submissions.

Closing

With the right strategy and execution, Facebook Ads can become a powerful tool in your arsenal, helping you to grow your business and provide invaluable peace of mind to your clients. I hope that this guide has provided you with the insights and steps needed to launch effective Facebook ads for life insurance.

>>> Read more: How to Run Google Ads for Insurance Agents and Best Practices