Are you looking to improve your financial habits in a fun and accessible way? TikTok finance influencers are transforming how we approach money by breaking down complex topics into simple, actionable advice. From saving hacks to investment strategies, these top creators are here to guide you toward smarter financial choices.

Top 10 Biggest Financial Influencers to Follow

TikTok is home to some of the most insightful and engaging financial influencers who simplify complex money topics for everyone.

Below, I’ve highlighted 10 finance-focused TikTok creators and how their advice can help you make smarter financial decisions. Let’s dive in!

#1 @erikakullberg

With 9.1M followers and 74M likes, Erika Kullberg stands out as the ultimate finance guru. As a lawyer-turned-content creator, Erika combines her legal expertise with practical money-saving advice. Her expertise shines in uncovering hidden opportunities to maximize your hard-earned cash.

What sets Erika apart is her ability to uncover hidden opportunities, like cashback perks and fee refunds, that most people overlook. Her tips are both actionable and reliable, earning her audience’s trust.

If you’re tired of losing money on fees or missing out on refunds, Erika’s channel will be your saver. She empowers her audience to take control of their finances, whether it’s disputing a transaction or learning how to make every dollar stretch.

In a nutshell, following her means never leaving money on the table again.

#2 @humphreytalks

Humphrey, with 3.3M followers and 54M likes, excels at simplifying personal finance. While Erika focuses on saving money already spent, Humphrey emphasizes building wealth through smart investing.

His content feels more like a beginner’s crash course in financial literacy. If you’ve ever felt overwhelmed by terms like “compound interest” or “asset allocation,” Humphrey’s relatable analogies will turn confusion into confidence.

Humphrey’s TikToks use creative visuals, like Legos and Pizza Slices, to explain complex financial concepts in ways that stick. For instance, in one memorable video, he uses a pizza analogy to show how diversification works in investing.

From understanding Roth IRAs to the effects of inflation, his content covers topics that are essential for building long-term financial security. With his approachable style, learning about finance feels less like a chore and more like a discovery.

If you’ve ever hesitated to start investing because it seems intimidating, Humphrey’s channel will ease your worries. He’ll teach you how to make smarter choices, whether it’s selecting the right accounts or managing risks in your portfolio.

#3 @herfirst100k

Tori Dunlap, known for her account @herfirst100k (2.4M followers, 30.3M likes), is an outspoken advocate for women’s financial empowerment. Her journey to saving her first $100,000 by age 25 inspired her to create content that breaks down barriers and motivates women to take control of their money.

Tori’s TikTok seamlessly blends personal anecdotes with actionable advice. For example, in one video, she shares her favorite salary negotiation scripts, equipping viewers with the confidence to ask for what they deserve..

Tori’s channel will inspire you to rethink your financial habits and make bold moves, like negotiating a higher salary or aggressively saving for an emergency fund. Her advice is especially impactful for women who want to break free from societal norms around money and build lasting financial independence.

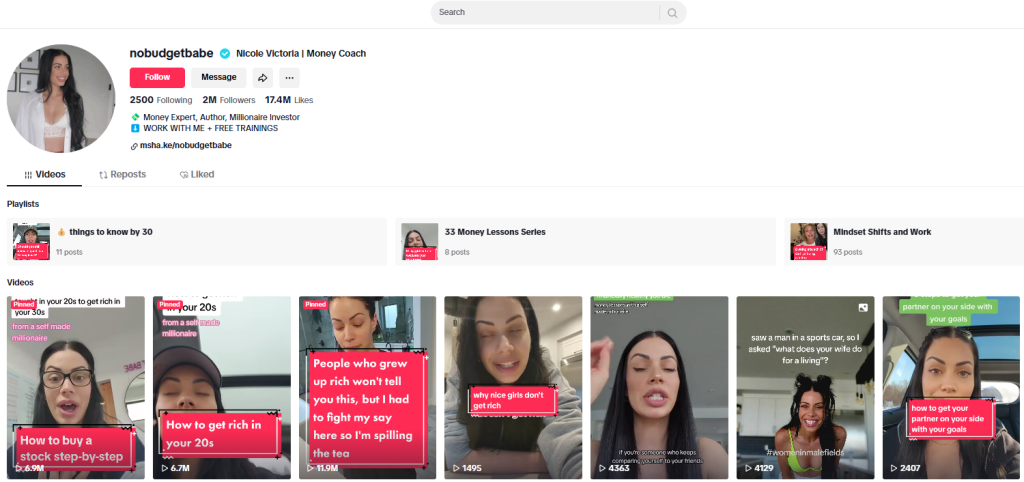

#4 @nobudgetbabe

Nicole Victoria, also known as @nobudgetbabe (2M Followers – 17.4M Likes), is all about teaching people how to achieve financial freedom without feeling restricted. Her approach focuses on shifting your mindset rather than relying on spreadsheets or strict budgets.

Nicole’s TikToks offer a refreshing take on personal finance. For example, her popular “anti-budget” system encourages viewers to save first and spend guilt-free on what’s left.

She also addresses emotional spending, offering tips to recognize triggers and make intentional purchases. Her content feels like a breath of fresh air for anyone tired of overly complicated financial plans.

Compared to Tori, who emphasizes discipline and long-term planning, Nicole’s approach feels more liberating and lifestyle-friendly. Following Nicole will teach you how to automate your savings, reduce financial stress, and stick to your goals – all without sacrificing your lifestyle.

If traditional budgeting methods have left you frustrated, her advice will help you find a sustainable way to manage your money.

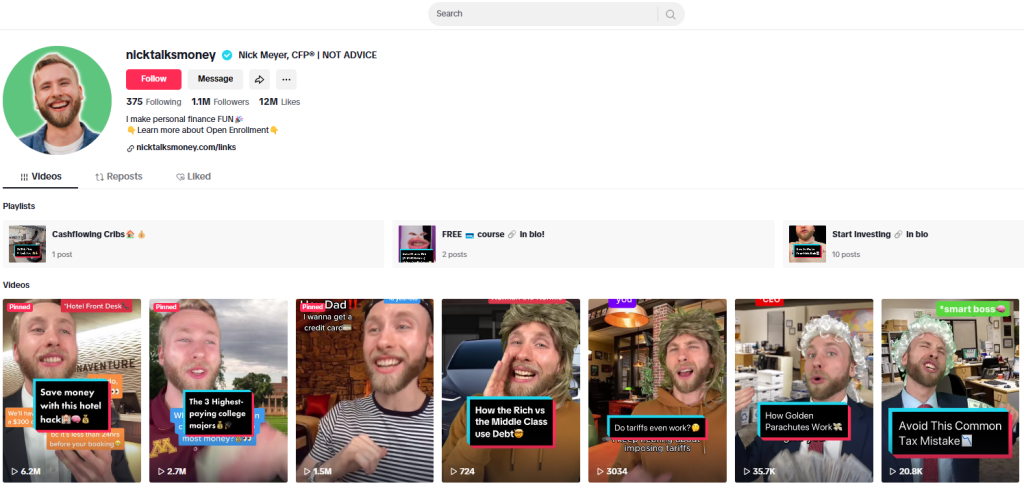

#5 @nicktalksmoney

Nick Meyer, with 1.1M followers and 12M likes on TikTok, focuses on simplifying everyday money decisions, helping his followers find a balance between saving for the future and enjoying life now. His practical tips make him a go-to resource for anyone looking to build wealth without feeling overwhelmed.

Nick’s TikToks cover a wide range of topics, from reducing unnecessary expenses to investing for retirement. He also dives into beginner-friendly investing advice, like how to start with index funds or open a Roth IRA.

With Nick’s guidance, you’ll master essential financial skills, like managing day-to-day expenses and creating a plan for long-term growth. His straightforward approach makes complex topics feel approachable, ensuring you’ll walk away with actionable steps to improve your finances.

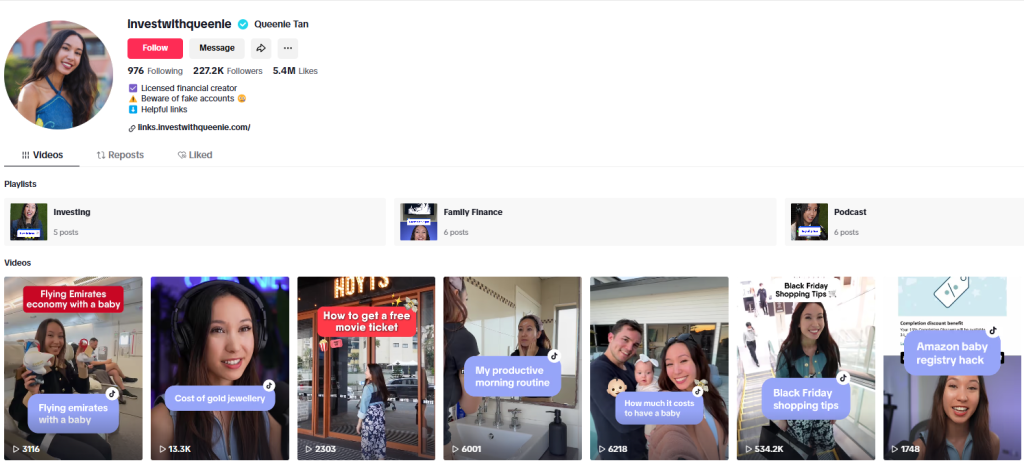

#6 @investwithqueenie

Queenie Tan (227.2K followers, 5.4M likes) is an inspiring figure who uses her platform to help people navigate the world of investing, especially focusing on the Asian community. She breaks down intimidating financial topics like stock market basics, real estate investing, and cryptocurrency in a way that anyone can understand.

Queenie’s TikToks are a treasure trove of practical advice, with many focused on helping beginners get started with investing. She also shares insights into passive income and real estate investment strategies, guiding her followers on how to start small and scale their wealth over time.

Queenie’s content is perfect for those who want to invest but feel overwhelmed by the jargon. She simplifies concepts like ETFs, dividend stocks, and real estate investing, offering easy-to-follow strategies that even beginners can implement. Whether you’re looking to dive into the stock market or grow a passive income stream, her advice will help you build a solid financial foundation.

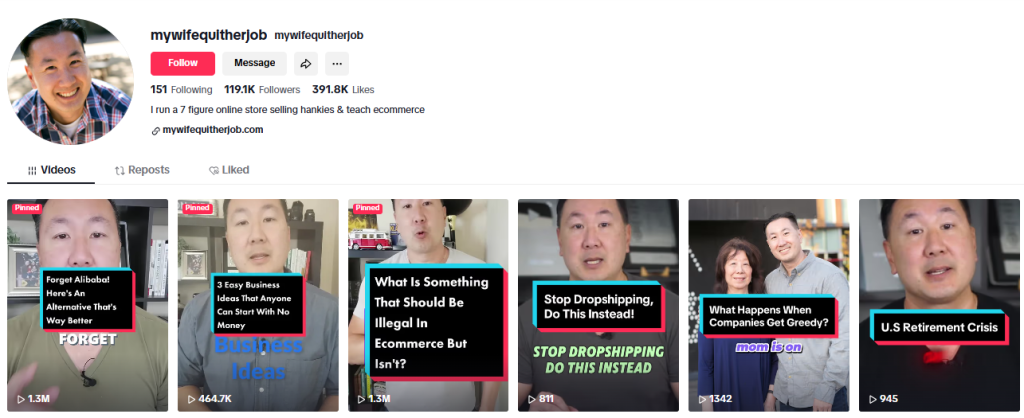

#7 @mywifequitherjob

With 119.1K followers and 391.8K likes, Steve Chou and his wife, Jennifer, made a name for themselves by turning an online store into a full-time business. Now, they share their journey and financial tips with a community eager to escape the 9-to-5 grind. Their focus is on entrepreneurship, passive income, and e-commerce.

On their TikTok, Steve and Jennifer share insights into starting and growing an online business. The channel also covers money management for entrepreneurs, with videos on reinvesting profits, managing taxes, and navigating the financial complexities of running a business.

If you’re interested in creating a business that generates passive income or turning a side hustle into a full-time venture, Steve and Jennifer’s channel is an invaluable resource.

They provide real-world strategies for managing business finances, reinvesting profits, and growing a sustainable income. Their advice will help you understand the financial side of entrepreneurship, so you can work smarter, not harder.

>>> Read more: How to Use TikTok for Business: Basic Steps for Beginners

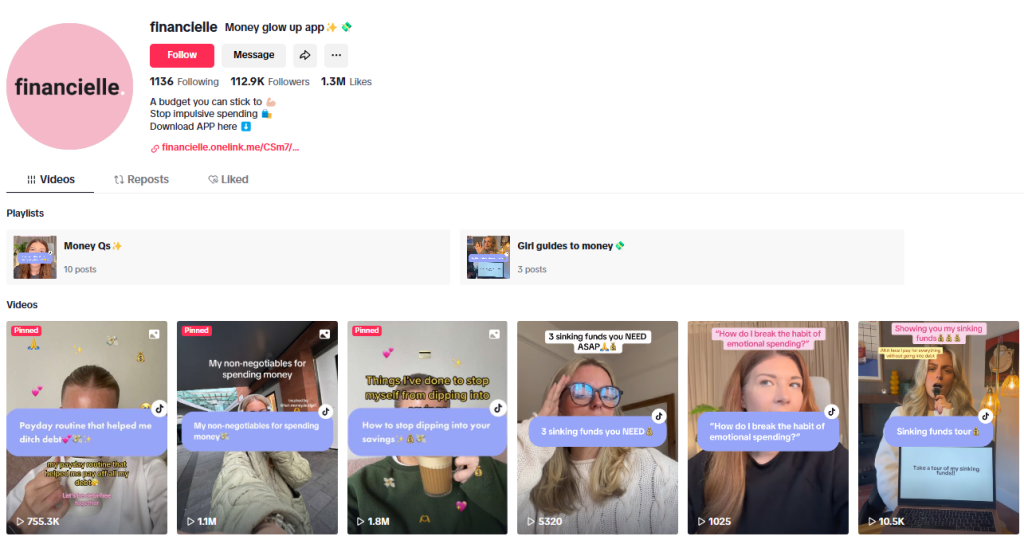

#8 @financielle

Financielle, aka Renée, who has 112.9K followers and 1.3M likes on TikTok, is a finance content creator who focuses on smart, strategic money moves for young professionals and millennials. Her content strikes a balance between fun and informative, offering advice on everything from managing debt to building a solid investment portfolio.

Renée’s relatable and fun approach feels like a bridge between Tori’s empowerment-focused content and Nick’s straightforward tips. Her videos are engaging and make even the most complex financial strategies feel approachable.

Financielle’s content is perfect for anyone looking to make smarter decisions with their money, especially if you’re just starting to think about long-term goals like investing and retirement. Her advice will help you maximize your income, avoid financial pitfalls, and make your money work for you.

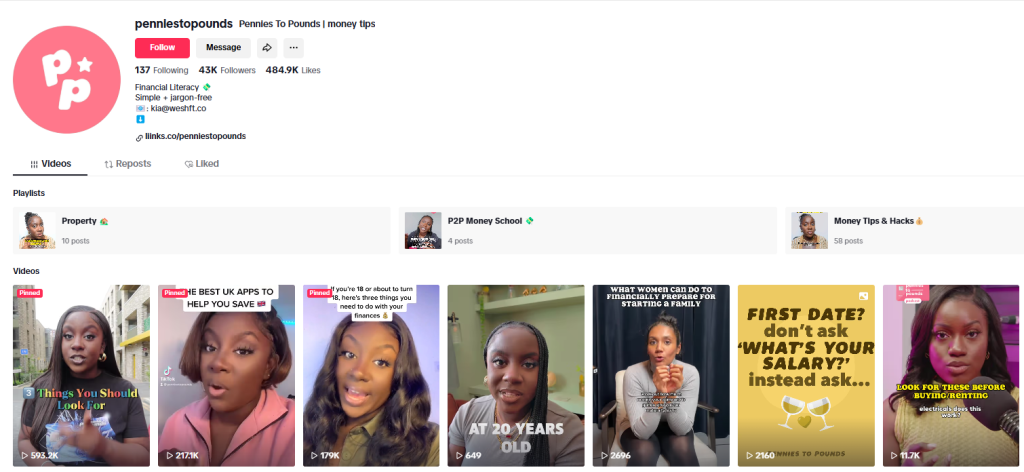

#9 @penniestopounds

Kia Commodore with her TikTok @penniestopounds (43K Followers – 484.9K Likes), is a passionate financial literacy advocate, podcast host, and content creator dedicated to educating young people about money. Known for her appearances on BBC Newsnight, she has also co-hosted the popular BBC 5 Live podcast, Your Work, Your Money, where she discusses financial topics relevant to the everyday person.

On her TikTok, Kia provides valuable insights into budgeting, investing, and money-making apps. One of her standout tips is the concept of a “fun fund” — a dedicated portion of your budget that allows for indulgence without feeling guilty.

By setting aside money for small treats like going out, getting your hair done, or buying new shoes, you can enjoy life’s pleasures while staying on track with your financial goals. She also breaks down the importance of investing, offering practical advice for beginners to start building wealth early on.

Kia’s approach is more lifestyle-driven than others and offers a refreshing approach to personal finance. She teaches that money management doesn’t have to be about deprivation; it’s about balance. By following her advice, you’ll learn how to structure your finances to ensure you can enjoy the present while securing your future.

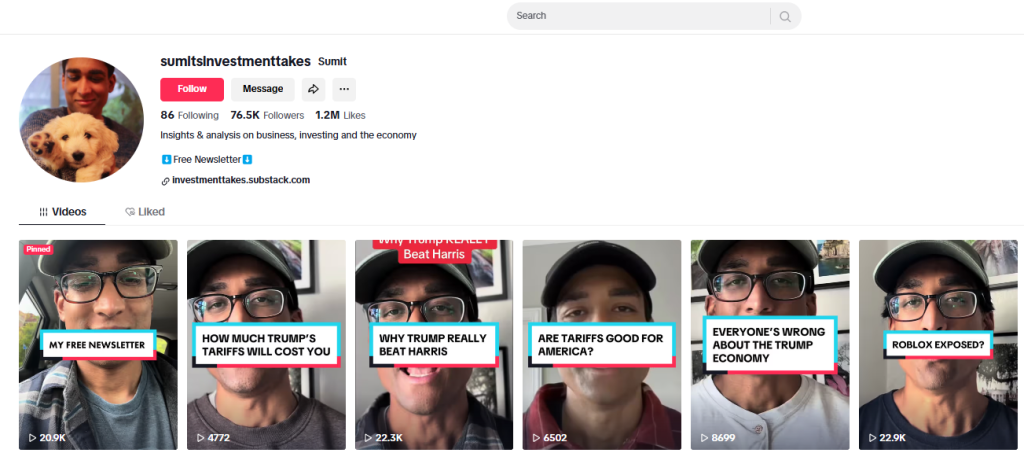

#10 @sumitinvestmenttakes

Finally, Sumit Arora Sumit, with 76.5K followers and 1.2M likes, is an investment educator and financial analyst who dives deep into the world of stocks, ETFs, and options trading. His channel is designed for those who are serious about growing their wealth through smart, data-driven decisions.

Sumit’s TikToks cover a wide array of investment topics, from stock analysis to tips on risk management. His content is geared towards those who want to gain a deeper understanding of the financial markets and start making informed investment decisions.

Sumit’s content is ideal for individuals who are looking to dive into the world of investing with a more analytical approach. He teaches you how to evaluate stocks, understand market trends, and use different investment strategies to maximize returns.

His insights will help you approach investing with confidence and precision, making your financial journey more strategic and informed.

>>> Read more: How to Become a TikTok Influencer and Start Gaining Profits?

Why You Should Follow TikTok Finance Influencers?

Even though staying on top of your finances can feel overwhelming, TikTok finance influencers make financial literacy easier to achieve by breaking down complex concepts into bite-sized, engaging content. Now I will show you why you should follow them:

Quick Learning with Bite-Sized Tips

One of the most significant advantages of following TikTok finance influencers is their ability to deliver complex financial concepts in quick, easy-to-understand segments.

TikTok’s short-form video format forces creators to focus on the essentials, giving you clear, actionable tips that are easy to digest. For instance, you might learn how to set a budget in under 60 seconds or discover a new investing strategy with a 30-second video.

This fast-paced approach is perfect for busy individuals who want to learn without feeling overwhelmed, making financial education feel more accessible and less time-consuming.

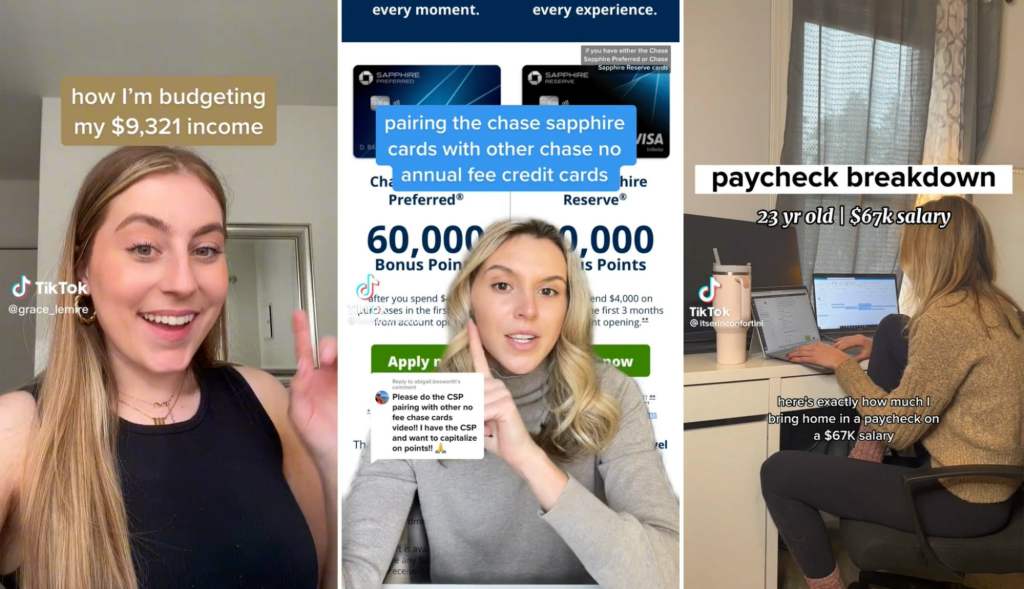

Relatable and Real-Life Financial Advice

What sets TikTok finance influencers apart is their authenticity. Instead of sharing abstract financial theories, they bring real-life, personal experiences to the table.

Creators often discuss their own financial mistakes, successes, and the strategies they’ve used to overcome financial challenges. This relatable, human approach makes their advice feel more achievable.

For example, a TikTok influencer might share their experience of paying off credit card debt or navigating the complexities of saving for a home. By sharing these personal stories, they help demystify money management and provide you with concrete examples of how to apply their tips in your own life.

Access to the Latest Money-Saving Trends

TikTok finance influencers are constantly on the pulse of emerging TikTok trends in the personal finance world. They often share the latest apps, tools, and strategies that are helping people save money, build wealth, or invest more effectively.

For example, one recent trend gaining popularity is the cash stuffing method, where people physically allocate cash into different envelopes for various budgeting categories. TikTok influencers have been showing how they use this strategy to control spending, save for specific goals, and stay more mindful of their finances.

In addition to budgeting trends, influencers are also sharing new investing platforms like M1 Finance, which allows users to build custom portfolios and invest with zero commissions. These platforms are particularly beneficial for those looking to make investing more accessible without high fees to help you stay ahead of the curve, take advantage of the latest financial tools, and participate in money-saving trends that might otherwise fly under the radar.

Motivation to Improve Your Financial Habits

Perhaps one of the most valuable benefits of following TikTok finance influencers is the constant motivation they provide. Many influencers openly share their financial goals and progress, making it easier for followers to stay inspired and focused.

By seeing influencers tackle their own financial hurdles such as saving for a vacation, paying off student loans, or investing for retirement. You’re encouraged to take action with your own financial goals.

In addition, these influencers often foster a sense of community, where viewers can share their own successes, ask questions, and celebrate progress together. This community-driven approach makes it easier to stay motivated and accountable for your financial journey.

>>> Read more: Everything about TikTok Crypto and Tips for Cryptocurrency promotion

Wrap Up

Above, I gave you a roundup of the top TikTok finance influencers to follow. These creators offer bite-sized tips, relatable advice, and the latest trends to help you make smarter financial decisions. So, take the first step towards financial freedom today and start learning from the best on TikTok!