Google Ads for insurance agents enables them to expand their reach by displaying ads across various websites and targeting ads to appear when specific keywords are searched. Agents can set their ad budgets, choose target keywords, and specify negative keywords to ensure they connect with the most relevant audience.

Here are the key factors to consider when evaluating if Google Ads will be effective for your insurance marketing strategy.

- Do Google Ads Work for Insurance Agents?

- Which Types of Google Ads are Best for Insurance Agents?

- How Much Should Insurance Agents Spend on Google Ads?

- Top Keywords for Promoting Insurance Agents on Google Ads

- How to Run Google Ads for Insurance Agents?

- Strategies for Google Ads Keyword Research for Insurance Agents

- Writing Compelling Google Ads Copy for Generating Insurance Leads

Do Google Ads Work for Insurance Agents?

Wondering if Google Ads can truly make a difference for insurance agents in reaching potential clients and growing their business? Let’s explore how effective these ads can be in generating leads and driving success.

Enhanced Local Visibility

Google Ads allows insurance agents to target potential clients in specific geographic areas. This local targeting ensures that your ads reach users who are more likely to convert into clients. A study found that 88% of local searches on smartphones lead to a store visit within a week, highlighting the importance of local visibility.

High-Quality Lead Generation

Insurance agents can use Google Ads to attract high-value leads by targeting specific keywords related to various insurance policies. Keywords like “life insurance quotes” or “best car insurance” help reach individuals actively seeking insurance, leading to higher conversion rates. The average cost-per-click for the insurance industry is $18.57, reflecting the value of these leads.

Data-Driven Campaign Optimization

Google Ads provides extensive data and analytics that enable insurance agents to fine-tune their advertising strategies. By analyzing metrics such as click-through rates and conversion rates, agents can optimize their campaigns for better performance. Personalized calls-to-action, for example, perform 202% better than basic ones, according to a HubSpot report.

These focused benefits demonstrate how Google Ads can effectively enhance the marketing efforts of insurance agents, leading to increased local visibility, high-quality lead generation, and optimize campaign performance.

Which Types of Google Ads are Best for Insurance Agents?

As an insurance agent, finding the most effective types of Google Ads can make a huge difference in attracting the right clients and getting the most out of your advertising budget.

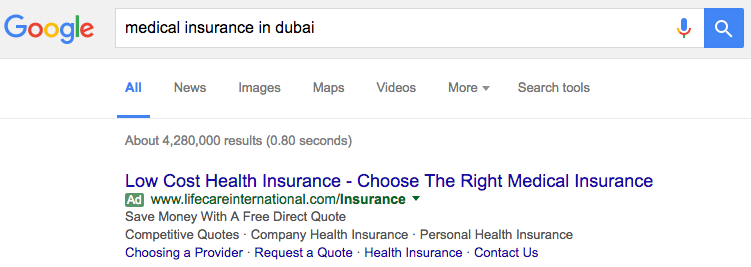

1. Google Search Ads (Most Recommended)

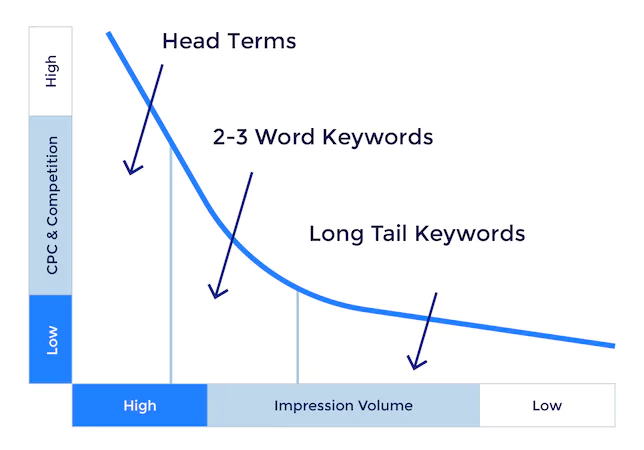

Google Search Ads are the most recommended type for insurance agents due to their ability to target users who are actively searching for insurance services. By focusing on long-tail keywords like “best car insurance” or “life insurance quotes”, agents can attract high-intent leads who are ready to purchase insurance.

According to WordStream, the average conversion rate for search ads in the insurance industry is around 5.31%, significantly higher than many other industries. The primary benefit of this ad type is the immediate connection with potential clients who have a clear need, increasing the chances of conversions and insurance policy sign-ups.

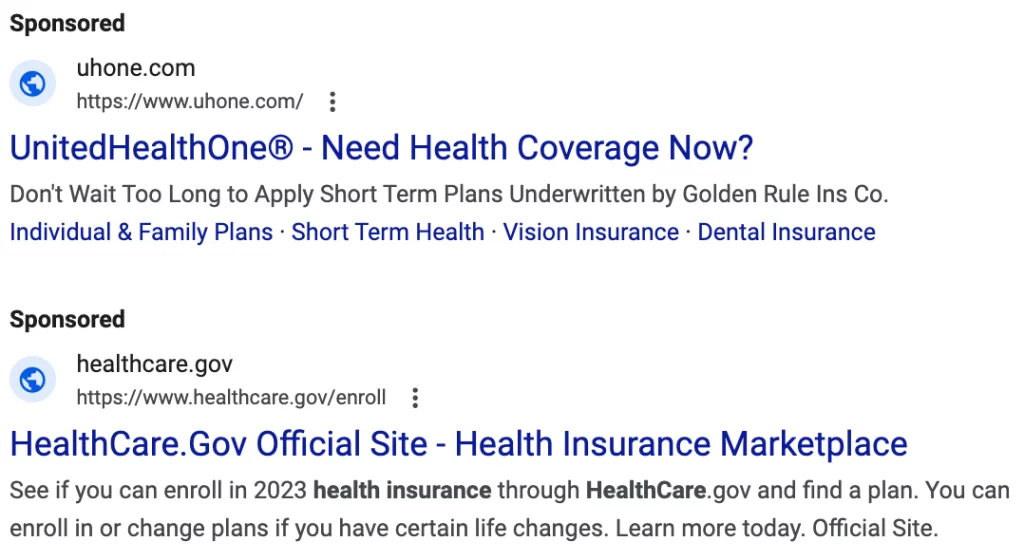

2. Local Services Ads

Local Services Ads are a powerful tool for insurance agents looking to attract clients in their local area. Google verifies businesses for these ads, which appear at the top of search results with contact information, reviews, and a Google Guarantee badge, building trust with potential clients.

According to Google’s internal data, businesses using Local Services Ads can see up to a 20% increase in conversion rates due to the trust and visibility these ads provide. This ad type is particularly beneficial for local insurance services where reputation and trust are crucial for client acquisition.

3. Display Ads

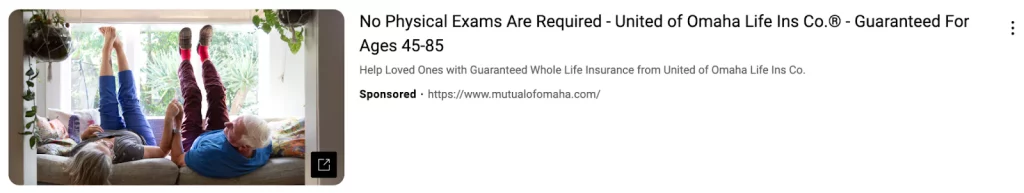

Display Ads are excellent for brand awareness and retargeting strategies. By leveraging demographic and interest targeting, insurance agents can effectively reach potential clients. Additionally, with retargeting, these ads are shown to users who have previously visited the agent’s website, keeping the brand top of mind and encouraging users to return to complete a transaction or learn more about insurance products.

According to Google, display ads have an average click-through rate (CTR) of 0.35%, and retargeting ads can increase conversion rates by up to 150%.

How Much Should Insurance Agents Spend on Google Ads?

Determining the right budget for Google Ads as an insurance agent involves several key factors, including your business goals, competition, and keyword costs. Typically, small to medium-sized insurance agencies might allocate 5-10% of their annual revenue to marketing, with a substantial portion dedicated to digital marketing.

For instance, if an agency generates $500,000 in annual revenue, it might allocate $25,000 to $50,000 for marketing. Assuming 50% of this budget goes to digital marketing, that’s $12,500 to $25,000 annually, or about $1,000 to $2,000 per month for Google Ads.

A practical starting budget might be $1,000 to $2,000 per month for small agencies, $3,000 to $5,000 per month for medium-sized agencies, and $5,000+ per month for larger agencies or in highly competitive markets. For example, with a monthly budget of $3,000, an average CPC of $12, and a conversion rate of 10%, an insurance agent would achieve 25 leads at a cost of $120 per lead, providing a clear framework for budget allocation and campaign effectiveness.

Top Keywords for Promoting Insurance Agents on Google Ads

| Keyword | Average CPC (USD) |

|---|---|

| best car insurance | 17.55 |

| cheap car insurance | 15.25 |

| life insurance quotes | 16.40 |

| affordable health insurance | 13.80 |

| home insurance | 11.90 |

| car insurance comparison | 14.50 |

| business insurance | 18.70 |

| insurance near me | 12.30 |

| health insurance plans | 14.20 |

| insurance brokers | 16.85 |

| auto insurance | 10.50 |

| cheap home insurance | 9.75 |

| term life insurance | 12.60 |

| online car insurance | 14.80 |

| pet insurance | 7.90 |

| insurance quotes | 11.20 |

| renters insurance | 9.10 |

| medical insurance | 13.50 |

| general liability insurance | 15.00 |

| travel insurance | 8.65 |

The table shows that “business insurance” has the highest CPC at $18.70, indicating fierce competition in that market. Conversely, “pet insurance” has the lowest CPC at $7.90, suggesting a less competitive and more cost-effective opportunity for insurance agents. Balancing high and low CPC keywords can help optimize ad spend and improve ROI.

>>> Read more: We Tried Google Ads for Lawyers: Here’s How We Succeeded

How to Run Google Ads for Insurance Agents?

Running a successful Google Ads campaign for insurance agents requires a strategic approach to ensure maximum reach and efficiency. Here are six detailed steps to help you create and manage an effective campaign:

Step 1. Define Your Campaign Goals

Begin by clearly defining what you want to achieve with your Google Ads campaign. Common goals for insurance agents include generating high-quality leads, increasing brand awareness, and driving traffic to your website. Establish specific, measurable objectives such as acquiring a certain number of leads per month or achieving a targeted conversion rate. Clear goals will guide your campaign strategy and help measure success.

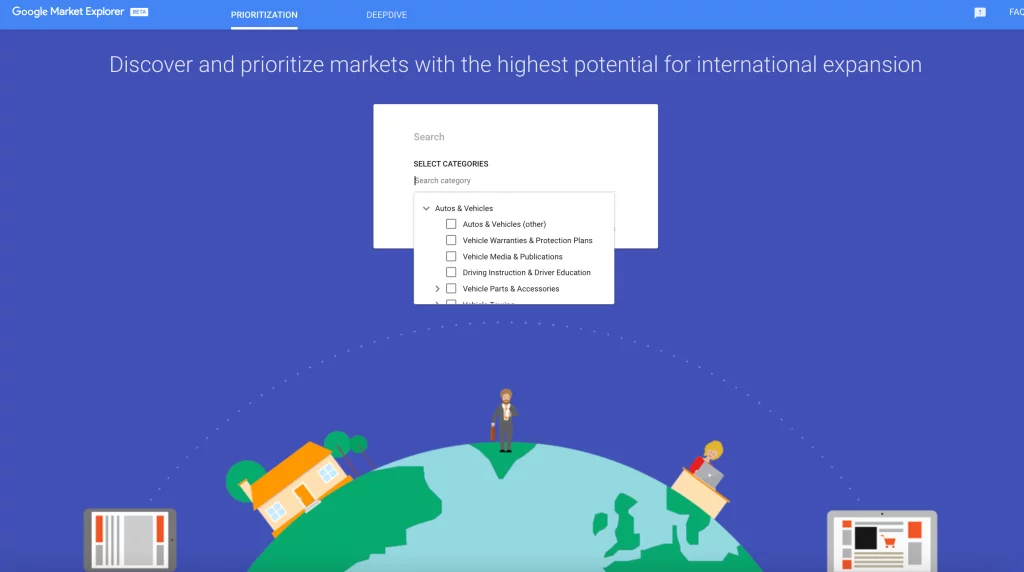

Step 2. Conduct Comprehensive Keyword Research

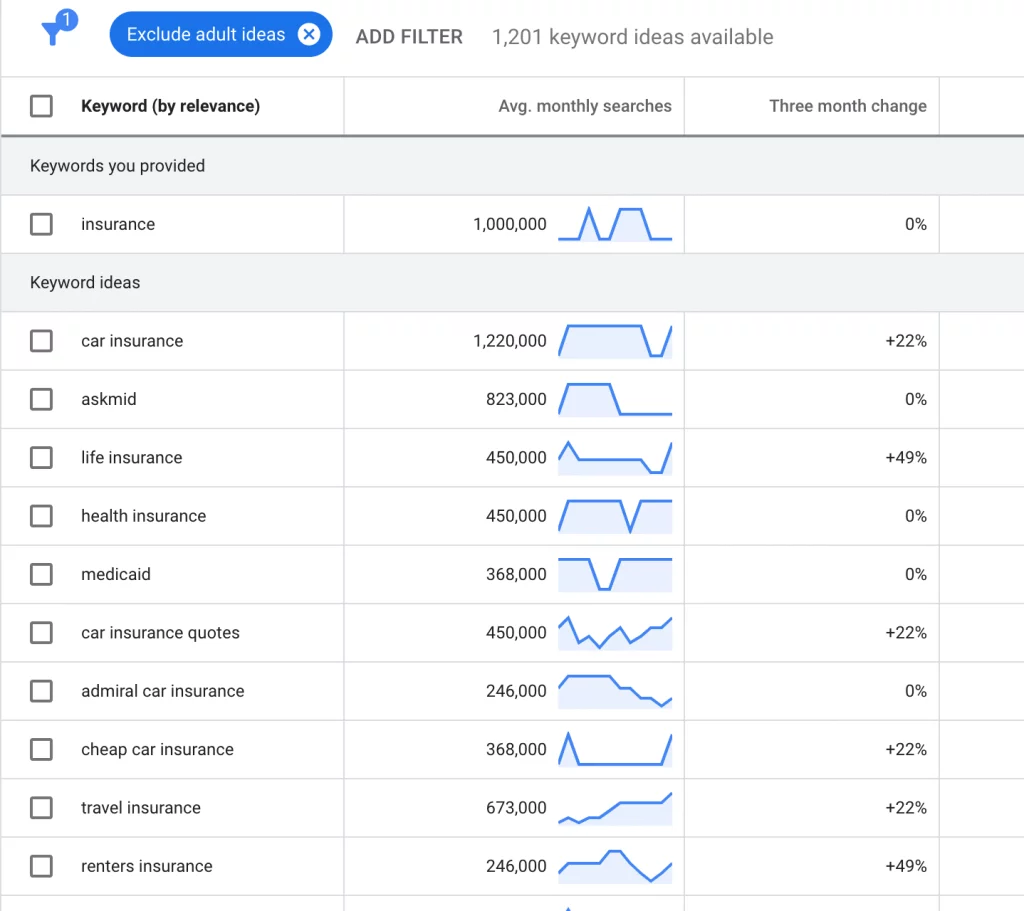

Use tools like Google Keyword Planner to identify relevant keywords that potential clients are searching for. Focus on high-intent keywords such as “best car insurance”, “life insurance quotes”, and “affordable health insurance”.

Analyze the search volume and cost-per-click (CPC) for these keywords to balance between competitive and cost-effective options. Group your keywords into tightly themed ad groups to create highly targeted ads, which can improve your Quality Score and ad performance.

Step 3. Create Targeted Ad Groups and Ad Copy

Organize your keywords into specific ad groups based on the type of insurance products you offer, such as car insurance, home insurance, and health insurance. Craft compelling ad copy for each group that highlights your unique selling points and addresses potential customers’ pain points.

Use strong calls-to-action (CTAs) like “Get a Free Quote Today” or “Compare Rates Now” to encourage clicks. Ensure your ad copy is relevant to the keywords and the landing page it directs to, enhancing the user experience and increasing conversion rates.

Step 4. Optimize Your Landing Pages for Conversions

Your landing pages should be highly relevant to the ad copy and keywords that brought users to them. Ensure that each landing page loads quickly, is easy to navigate, and has a clear call-to-action (CTA). Include contact forms, phone numbers, and trust signals such as customer testimonials and industry certifications. A well-optimized landing page can significantly increase your conversion rate by making it easy for potential clients to take the next step.

Step 5. Set a Realistic and Flexible Budget

Determine your daily and monthly budget based on your campaign goals and keyword CPCs. Start with a conservative budget to test the waters and understand which keywords and ad copies perform best.

Monitor your spending closely and adjust as necessary to ensure you’re not exceeding your budget while maximizing your return on investment. As you gather data and see positive results, gradually increase your budget to scale successful campaigns.

>>> Read more: Google Ads Budget: How Much to Spend? How to Reduce Ad Costs?

Step 6. Track, Measure, and Optimize Performance

Regularly monitor your campaign performance using Google Analytics and Google Ads reports. Track key metrics such as click-through rate (CTR), conversion rate, and cost per acquisition (CPA).

Analyze which ad groups, keywords, and ads are performing well and which ones need improvement. Based on this data, make informed adjustments to your bids, ad copy, and landing pages. Continuously test new keywords and ad variations to keep improving your campaign’s effectiveness. Implementing remarketing strategies can also help re-engage visitors who have shown interest but haven’t converted yet.

Strategies for Google Ads Keyword Research for Insurance Agents

Effective keyword research is crucial for insurance agents aiming to maximize their success with Google Ads campaigns. Here are some key strategies to help you get started:

Use Google Keyword Planner

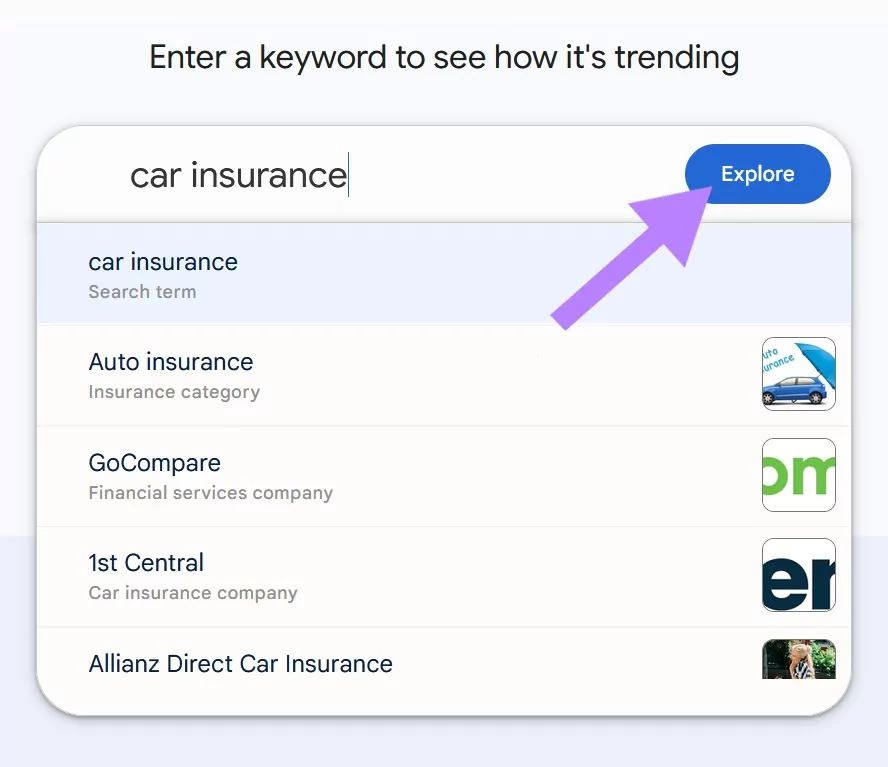

Start with Google’s Keyword Planner to find relevant keywords. Enter broad terms like “insurance” or “car insurance”, and review suggested keywords with their search volume, competition, and CPC. For example, “car insurance” might reveal keywords like “best car insurance rates” or “cheap car insurance”. This tool helps you identify high-potential keywords to create targeted ads.

Focus on Long-Tail Keywords

Target long-tail keywords that are more specific and less competitive to attract qualified leads. Combine specific services with broad keywords, like “affordable car insurance for new drivers” or “best life insurance for families”. Long-tail keywords usually have lower CPCs and higher conversion rates because they match specific search queries from potential clients ready to decide.

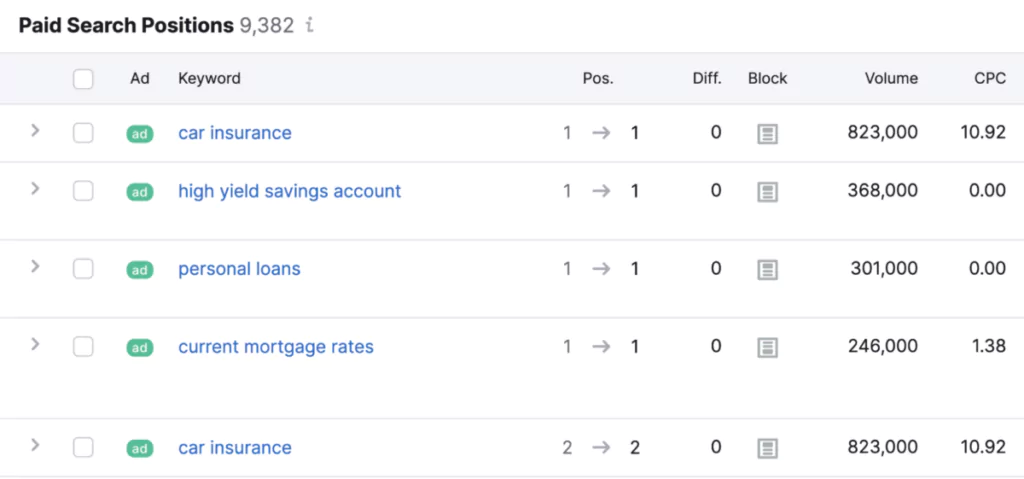

Analyze Competitor Keywords

Use tools like SEMrush or Ahrefs to discover which keywords your competitors are targeting. Identify high-performing keywords and gaps where you can position your ads more effectively. For instance, if competitors bid on “cheap home insurance”, you might include it in your campaigns. This strategy helps you leverage successful tactics and avoid overly competitive keywords, optimizing your budget.

>>> Read more: 8 Best Ways to Do Google Ads Competitor Analysis in 2024

Writing Compelling Google Ads Copy for Generating Insurance Leads

Using the right words in your ads can greatly increase your click-through rate, helping you stand out from competitors. Think of it as creating “clickbait” with a purpose! By blending powerful language, clear intent, and creative elements, you’re not just capturing attention—you’re effectively addressing searchers’ needs in a more engaging way.

This strategic use of language and presentation is crucial for attracting more clicks and outperforming your competition.

- Emotional Appeal: Use words that evoke feelings of safety and peace, such as “Protect your family’s future” for life insurance.

- Rational Appeal: Emphasize facts and figures, like “Save up to 30% on car insurance”.

- Clear Call to Action: Include a compelling CTA such as “Get a free quote today” or “Contact us for more information”.

- Visuals: For visual ads, use images that convey safety and trust, like family or health-related visuals for health insurance ads.

- Testimonials: Feature customer testimonials to build trust, particularly effective for types like Medicare supplement insurance.

- Special Offers: Highlight any special deals or discounts, for example, “First month free home insurance offer.”

Wrap up

In conclusion, Google Ads for insurance agents can be a powerful tool to generate leads and grow their business. By carefully selecting the right ad types, such as Search Ads, Local Services Ads, and Display Ads, agents can effectively target potential clients.

To make the most of your campaigns, consider renting a Google Ads agency account, where your ads are guided by certified consultants and receive support in case of suspension. At Mega Digital, you will even benefit from a service fee as low as 4% of your total ad spend. Get started now!