Before starting a dropshipping business, many entrepreneurs wonder: Do I need an LLC for dropshipping? It depends on your business goals, risk tolerance, and long-term vision.

This guide will break down everything you need to know about forming an LLC for your dropshipping business. By the end, you’ll be able to decide if an LLC is the right choice for your dropshipping journey.

What is an LLC?

An LLC (Limited Liability Company) is a business structure that combines the flexibility of a sole proprietorship with the legal protection of a corporation. In simpler terms, it acts as a legal shield between your business and personal finances.

Key Features of an LLC

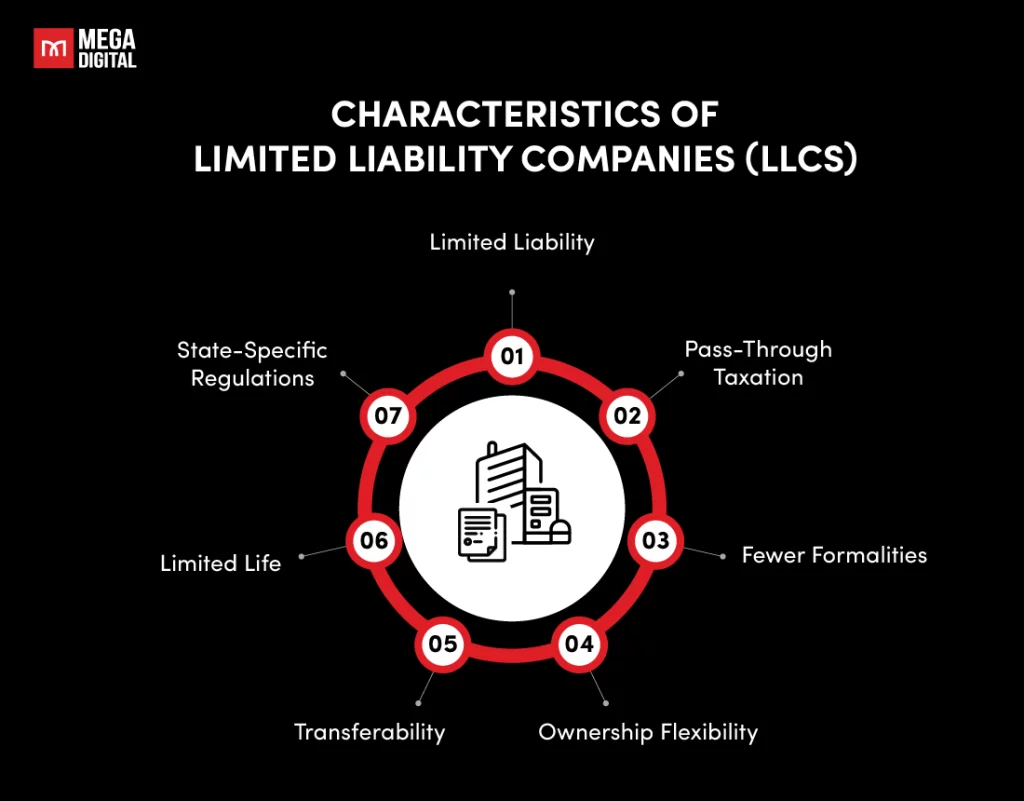

The key features of an LLC include:

- Limited Liability Protection: If your business is sued or falls into debt, your personal assets (home, car, personal bank accounts) are protected.

- Pass-Through Taxation: Instead of being taxed twice like corporations (once at the company level and again on personal income), LLC owners report business profits or losses on their individual tax returns.

- Flexible Management Structure: LLCs can be run by a single owner or multiple partners, making operations simpler and less bureaucratic.

- Increased Credibility: Having an “LLC” in your business name adds professionalism. Suppliers, banks, and even customers may view your business as more trustworthy.

LLC vs. Sole Proprietorship

As you look into how to start dropshipping,

If you’re just starting, you might be debating between staying a sole proprietor or forming an LLC. Here’s how the two compare:

Pros and Cons of Having an LLC for Dropshipping

Starting an LLC for your dropshipping business comes with clear benefits, but it also has some drawbacks. Understanding both sides will help you make a well-informed decision.

Pros

Even though an LLC isn’t legally required, many dropshippers choose to form one. And if you want to become a real dropshipper, here’s the reason you need to know:

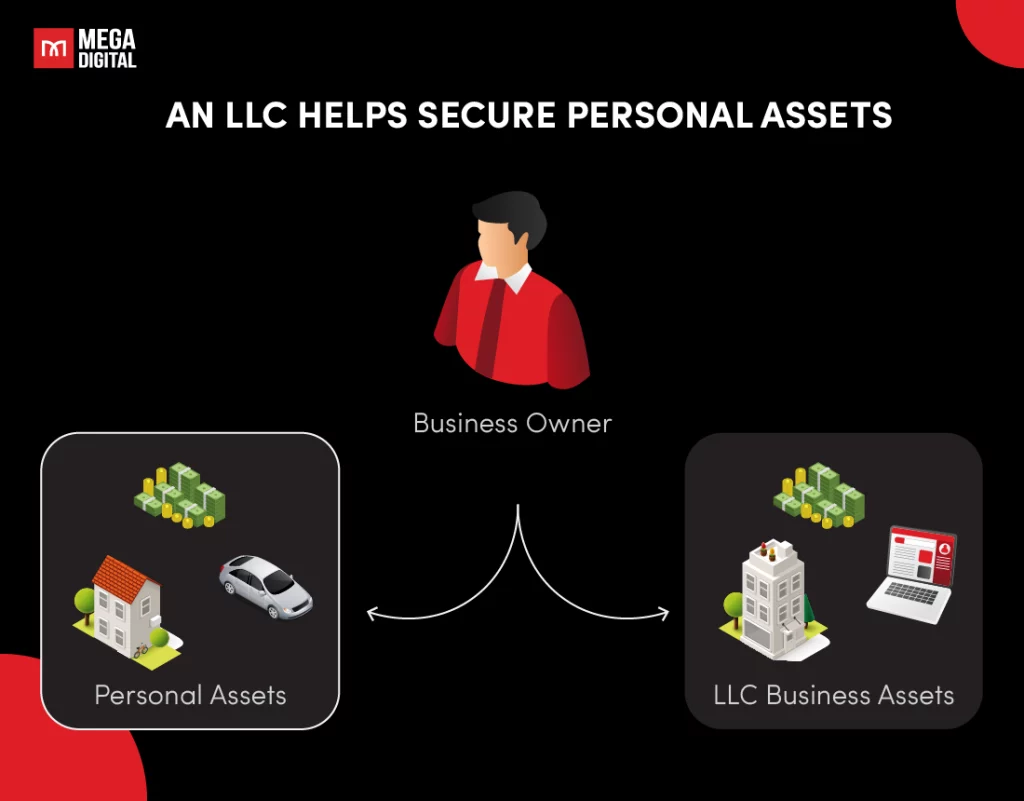

Personal Asset Protection

One of the most crucial reasons to form an LLC is liability protection.

Dropshipping seems low-risk since you don’t handle products, but legal risks still exist. Customers could sue over defective products, unauthorized transactions, or misrepresented items.

If you run your business as a sole proprietor, your personal assets—your home, car, and savings—could be at risk. With an LLC, only your business assets are liable in a lawsuit.

Establishing Credibility & Building Supplier Trust

Reputable suppliers and payment processors prefer working with registered businesses. Some high-quality suppliers require you to have an LLC before they agree to partner with you. Having an LLC for eCommerce businesses makes your store appear more legitimate, helping you secure better deals and higher-quality products.

Additionally, payment processors like PayPal, Stripe, and Shopify Payments may have fewer restrictions on businesses registered as LLCs. If your account is flagged for suspicious activity or high transaction volumes, proving your legitimacy is much easier when you have an LLC.

Tax Benefits & Deductions

LLCs offer flexible taxation options. By default, LLCs are taxed as pass-through entities, meaning your business profits are only taxed once on your personal return (avoiding double taxation like corporations).

Additionally, LLCs can deduct business expenses, including:

- Advertising costs (Facebook Ads, Google Ads, influencer marketing)

- Website expenses (domain, hosting, Shopify fees)

- Business-related travel & education

- Office supplies and software

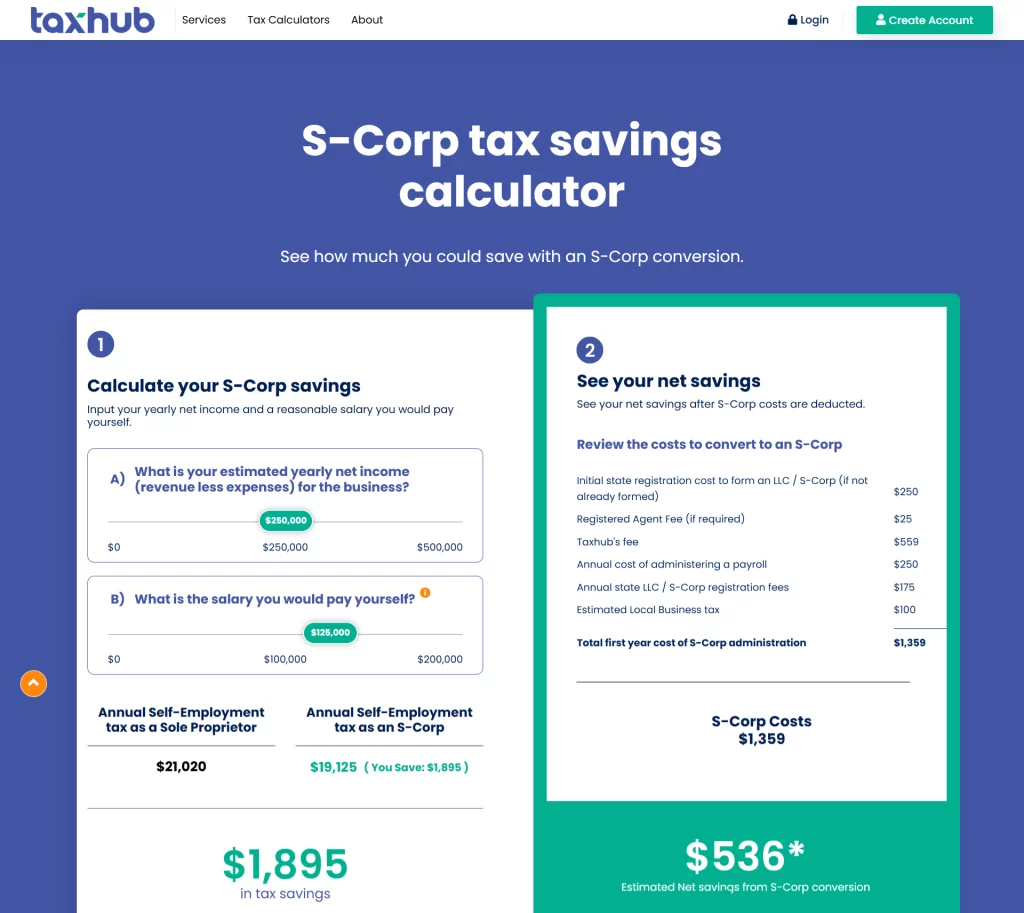

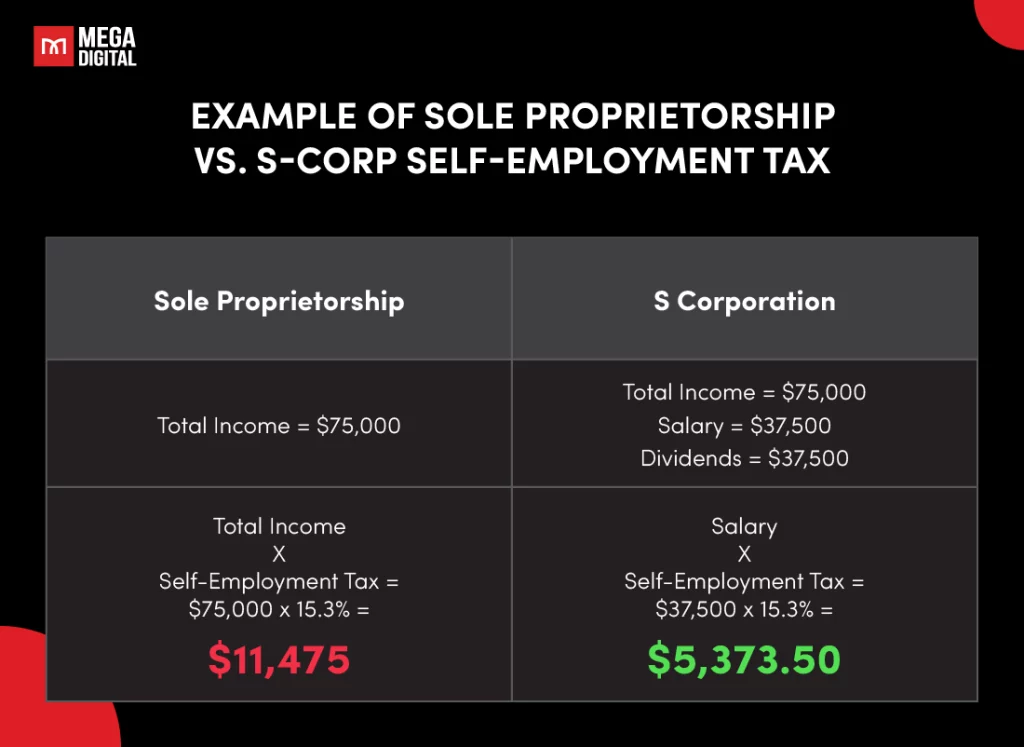

If your profits grow significantly and you decide to expand your business, you may also elect S-Corp taxation, allowing you to reduce self-employment tax. Tools like Taxhub can help you quickly calculate and visualize how much you can save with an S-Corp conversion.

Easier Business Scaling & Long-Term Growth

An LLC helps future-proof your business. If you plan on scaling your dropshipping business, an LLC makes it easier to:

- Open a business bank account to separate personal and business funds

- Apply for loans or business credit cards

- Hire employees or bring in business partners

- Secure better supplier relationships and wholesale deals

Cons

LLC dropshipping comes with tons of benefits, but honestly speaking, they are not without drawbacks. Here are the cons I can tell you based on my experience:

Cost of Formation and Maintenance

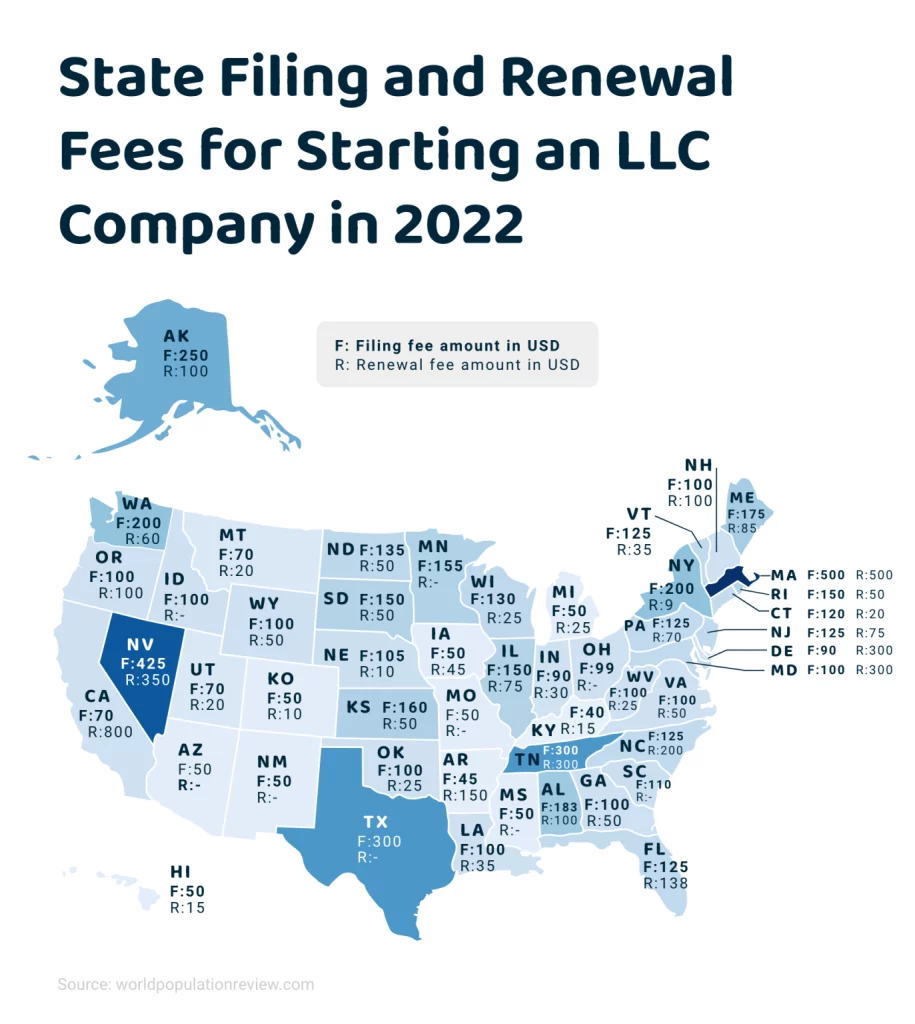

Setting up an LLC requires a one-time filing fee and potential annual renewal fees, which vary by state. Some states also require periodic reporting, adding administrative expenses.

Administrative Responsibility

Unlike sole proprietorships, LLCs require documentation such as operating agreements, annual reports, and compliance with state regulations. This may involve more effort and legal oversight.

Potential Tax Complexities

While LLCs provide tax flexibility, they may also lead to additional tax obligations such as self-employment taxes. Some LLC owners may find tax filings more complicated than those of a sole proprietor.

How Much Does an LLC for Dropshipping Cost?

When starting a dropshipping business, one of the most important financial considerations is the cost of forming and maintaining an LLC (Limited Liability Company).

The cost of forming and maintaining an LLC varies by state, and it generally consists of two primary expenses:

Let’s explore these costs in detail and provide examples of state-specific fees so you can budget effectively for your dropshipping business.

Initial Filing Fee

The initial filing fee is the amount you pay when submitting the necessary documents to legally form your LLC. These fees vary significantly from state to state, typically ranging from $40 to $500.

State-Specific Examples of Initial Filing Fees

While the average LLC filing fee across all U.S. states is approximately $132, some states charge significantly more than others. Below are some key examples:

- Massachusetts LLC – $500

- California LLC – $70

- Illinois LLC – $150

- Texas LLC – $300

- Florida LLC – $125

- Wyoming LLC – $100

For entrepreneurs seeking a low-cost option, Kentucky ($40), Montana ($35), and Mississippi ($50) offer some of the most affordable LLC filing fees.

Annual or Biennial LLC Fees

Once your LLC is formed, you’ll need to pay annual or biennial fees to keep it in good standing with your state. These fees cover state compliance requirements, business reporting, and legal maintenance.

State-Specific Examples of Ongoing Fees

Some states require annual reports and payments, while others operate on a biennial (every two years) basis. Below are some notable examples:

- California LLC – $800 annual tax + $20 filing fee (every 2 years)

- Massachusetts LLC – $500 annual fee

- Delaware LLC – $300 annual franchise tax

- Illinois LLC – $75 annual fee

- Texas LLC – No annual fee for most LLCs, but required to file reports

- Wyoming LLC – $60 annual fee

States with No Ongoing Fees

A few states do not charge annual or biennial fees, making them attractive options for LLC formation:

- Arizona – $0 annual fee

- Missouri – $0 annual fee

- New Mexico – $0 annual fee

Right here, I have compiled a full list of states and their respective LLC mandatory costs for your reference:

| State | LLC Filing Fee | LLC Annual/Biennial Fee |

| Alabama | $200 | $50 minimum (every year) |

| Alaska | $250 | $100 (every 2 years) |

| Arizona | $50 | $0 (no fee and no information report) |

| Arkansas | $45 | $150 (every year) |

| California | $70 | $800 (every year) + $20 (every 2 years) |

| Colorado | $50 | $10 (every year) |

| Connecticut | $120 | $80 (every year) |

| Delaware | $90 | $300 (every year) |

| Florida | $125 | $138.75 (every year) |

| Georgia | $100 | $50 (every year) |

| Hawaii | $50 | $15 (every year) |

| Idaho | $100 | $0 (an information report must be filed every year) |

| Illinois | $150 | $75 (every year) |

| Indiana | $95 | $31 (every 2 years) |

| Iowa | $50 | $30 (every 2 years) |

| Kansas | $160 | $50 (every year) |

| Kentucky | $40 | $15 (every year) |

| Louisiana | $100 | $35 (every year) |

| Maine | $175 | $85 (every year) |

| Maryland | $100 | $300 (every year) |

| Massachusetts | $500 | $500 (every year) |

| Michigan | $50 | $25 (every year) |

| Minnesota | $155 | $0 (an information report must be filed every year) |

| Mississippi | $50 | $0 (an information report must be filed every year) |

| Missouri | $50 | $0 (no fee and no information report) |

| Montana | $35 | $20 (every year) |

| Nebraska | $100 | $13 (every 2 years) |

| Nevada | $425 | $350 (every year) |

| New Hampshire | $100 | $100 (every year) |

| New Jersey | $125 | $75 (every year) |

| New Mexico | $50 | $0 (no fee and no information report) |

| New York | $200 | $9 (every 2 years) |

| North Carolina | $125 | $200 (every year) |

| North Dakota | $135 | $50 (every year) |

| Ohio | $99 | $0 (no fee and no information report) |

| Oklahoma | $100 | $25 (every year) |

| Oregon | $100 | $100 (every year) |

| Pennsylvania | $125 | $7 (every year) |

| Rhode Island | $150 | $50 (every year) |

| South Carolina | $110 | $0 (no fee and no information report, unless LLC is taxed as an S-Corp ) |

| South Dakota | $150 | $50 (every year) |

| Tennessee | $300 | $300 (every year) |

| Texas | $300 | $0 for most LLCs (a No Tax Due Report and Public Information Report must be filed every year) |

| Utah | $54 | $18 (every year) |

| Vermont | $125 | $35 (every year) |

| Virginia | $100 | $50 (every year) |

| Washington | $200 | $60 (every year) |

| Washington DC | $99 | $300 (every 2 years) |

| West Virginia | $100 | $25 (every year) |

| Wisconsin | $130 | $25 (every year) |

| Wyoming | $100 | $60 minimum (every year) |

Additional Costs to Consider

Aside from state fees, there are a few additional costs to factor into your budget when forming an LLC:

1. Registered Agent Fees

Most states require an LLC to have a registered agent, a designated individual or service responsible for receiving legal documents on behalf of the business. While you can act as your own registered agent, many business owners opt for professional services to ensure compliance and privacy.

The cost of a registered agent service is typically between $50 to $300 per year.

2. Business Licenses and Permits

Depending on where you operate, you may need additional licenses and permits to legally run your dropshipping business.

- Seller’s Permit: Allows you to collect and remit sales tax (varies by state).

- Reseller Permit: Required if you purchase products tax-free from suppliers.

- Costs: Typically range from $0 to $100, depending on the state and industry.

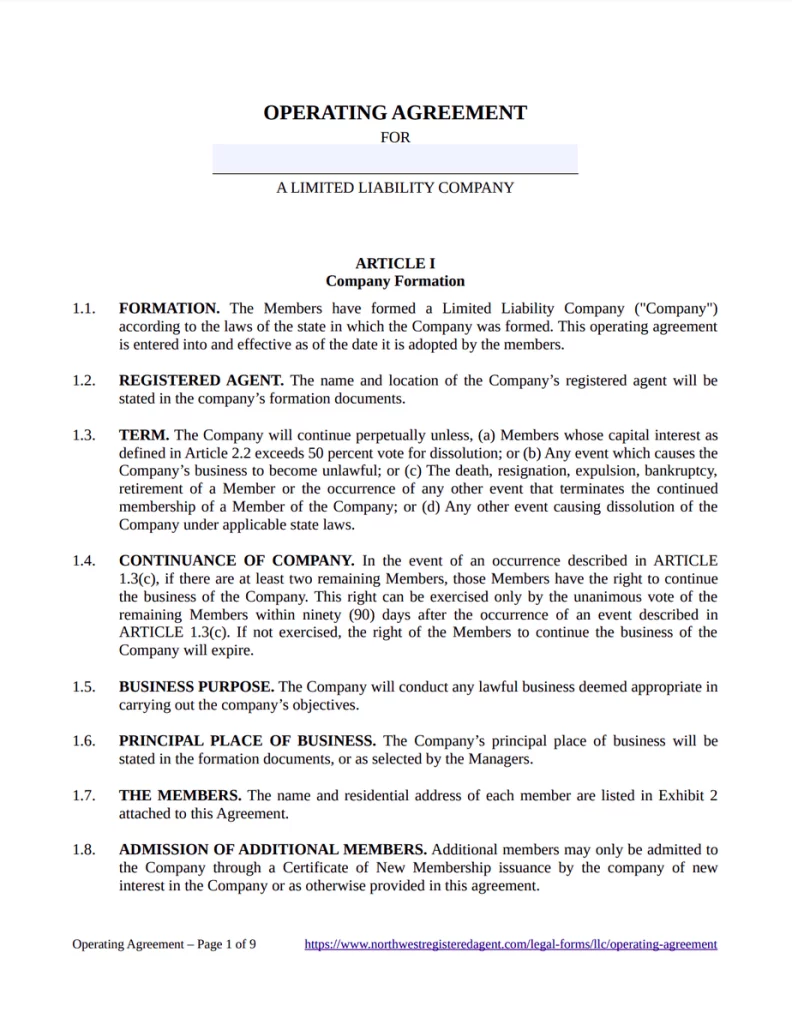

3. LLC Operating Agreement

Although not legally required in all states, an Operating Agreement helps establish clear rules and ownership structure for your business.

- DIY Option: Free templates available online.

- Legal Assistance: Professional drafting can cost $50 to $200.

How to Set Up An LLC For A Dropshipping Business?

If you’ve decided that an LLC for Shopify or other eCommerce platforms is the right move, here’s how to get started:

Step 1: Choose a Unique and Brandable LLC Name

Your business name is the foundation of your brand, and choosing the right one can make a huge difference in how your store is perceived. It needs to be unique, professional, and legally compliant.

Best Practices for Naming Your LLC:

- Ensure It’s Unique: Check your state’s business database and the United States Patent and Trademark Office (USPTO) to make sure no one else is using it.

- Make It Memorable & Marketable: Tools like Shopify Name Generator, Namelix, and BrandBucket can help generate creative names.

- Secure a Matching Domain: Use Namecheap, GoDaddy, or Google Domains to check and purchase an available domain name.

Pro Tip: When I launched my first dropshipping store, I spent hours brainstorming a name, only to find out it was already taken. Save yourself the hassle by verifying availability before falling in love with a name!

Step 2: Select a Registered Agent

A registered agent is responsible for receiving legal documents on your behalf. This role is crucial for ensuring you don’t miss important notifications, such as tax filings or lawsuits.

How to Choose the Right Registered Agent:

- Must Have a Physical Address: P.O. Boxes don’t count.

- Available During Business Hours: They must be able to receive documents promptly.

- Consider Professional Services: Companies like Northwest Registered Agent, Bizee (previously Incfile), and ZenBusiness can manage this for you.

Expert Insight: If you don’t want your home address on public records, I highly recommend using a professional registered agent service. It keeps your privacy intact and ensures compliance.

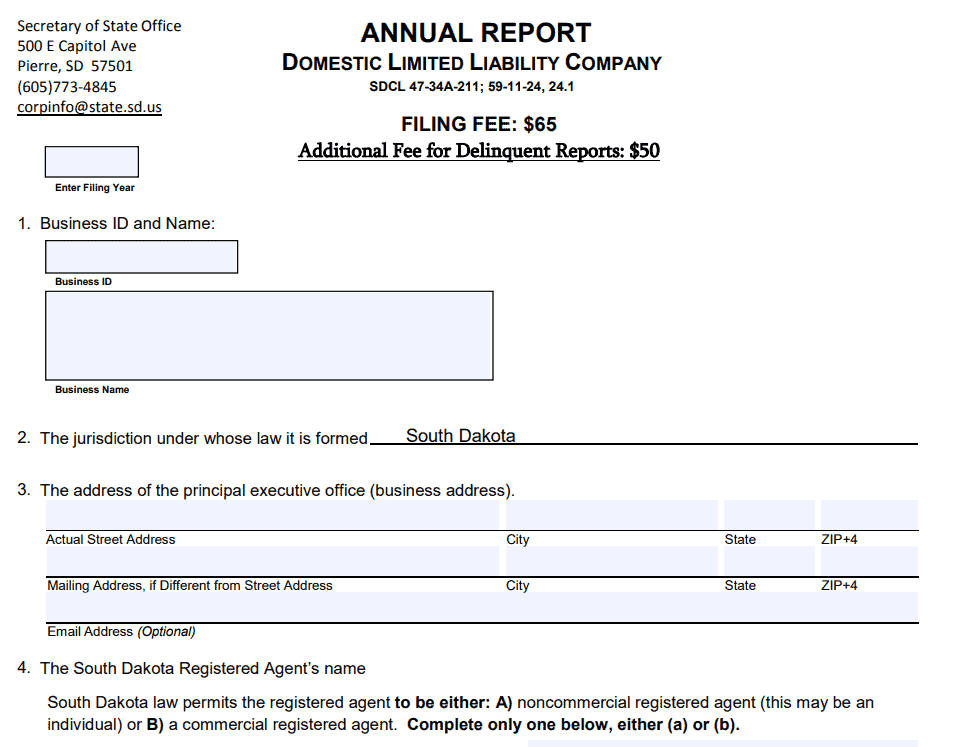

Step 3: File Your LLC Formation Documents

Now it’s time to make things official by submitting the necessary paperwork to your state’s Secretary of State office.

What You’ll Need to File:

- Your LLC Name & Address

- Member/Owner Information

- Registered Agent Details

- Business Purpose (if required by your state)

Where to File & Costs?

- Every state has different filing fees, typically ranging from $50 to $500.

- Some states allow online applications, while others require mailed submissions.

- Services like Swyft Filings, LegalZoom, and MyCorporation can simplify the process.

Example: When I helped a client set up their dropshipping LLC in Wyoming, the total cost was only $100, whereas in California, it was nearly $900 due to additional state taxes.

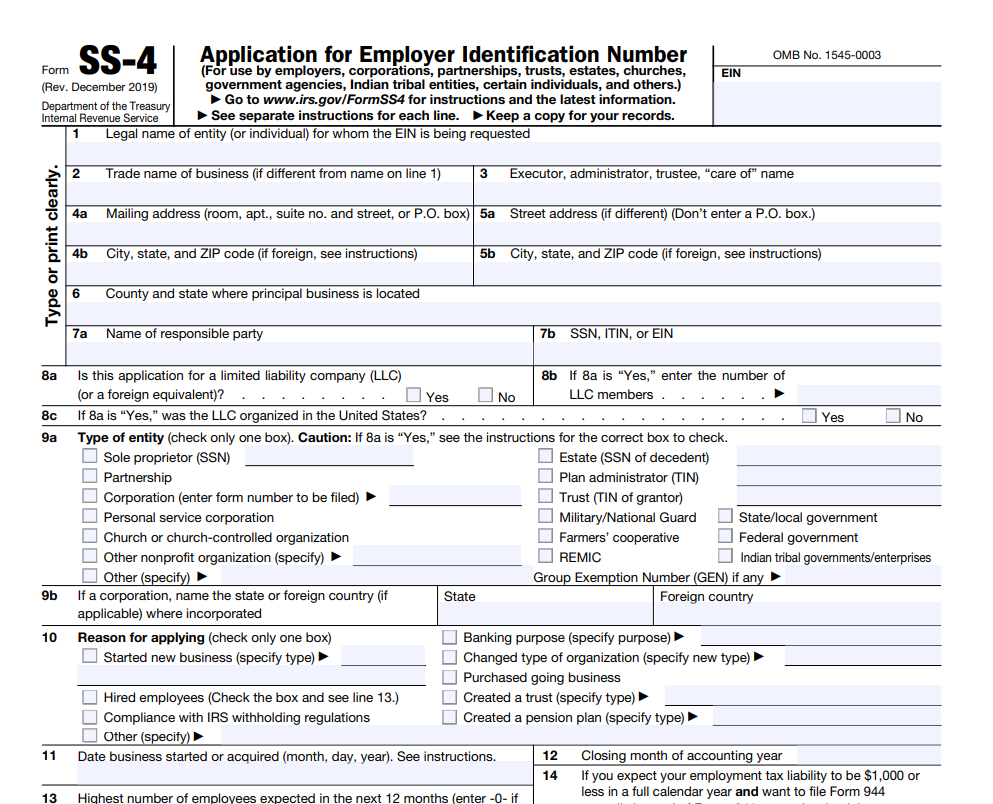

Step 4: Get an EIN (Employer Identification Number)

An EIN is like a Social Security number for your business. It’s required for taxes, opening a business bank account, and hiring employees.

How to Obtain an EIN:

- Apply Online: The fastest option through the IRS website (instant approval).

- Apply by Mail or Fax: Using Form SS-4 (takes 4-6 weeks).

- For Non-US Residents: Services like Doola can help secure an EIN remotely.

Pro Tip: If you plan to accept payments through Shopify Payments or Stripe, an EIN is often required for verification.

Step 5: Draft an Operating Agreement

While not required in all states, an Operating Agreement is a must-have document that outlines the management structure and rules of your LLC.

What to Include in Your Operating Agreement:

- Ownership Breakdown: Who owns what percentage of the business?

- Profit & Loss Distribution: How will money be shared among owners?

- Decision-Making Process: Voting rights and responsibilities.

- Exit Strategy: What happens if an owner leaves the company?

Real-World Scenario: A client of mine started a dropshipping business with a partner but never defined clear financial responsibilities. When the business took off, conflicts arose over profit distribution. An Operating Agreement could have prevented the headache.

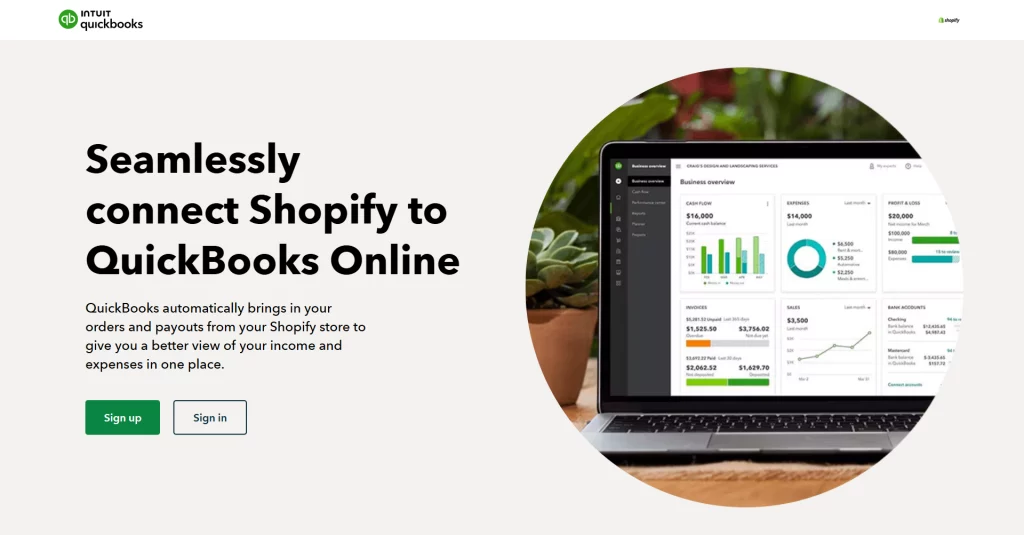

Step 6: Set Up Your Financial Infrastructure

Now that your LLC is legally established, it’s time to get your finances in order.

Financial Steps You Should Take:

- Open a Business Bank Account: Use banks like Chase Business, Novo, or Bluevine to separate personal and business funds.

- Get a Business Credit Card: Helps build business credit; consider American Express Business Platinum or Brex Business Card.

- Use Accounting Software: QuickBooks, Xero, or Wave can help you manage bookkeeping and tax filings.

Expert Advice: I always recommend integrating your Shopify store with QuickBooks so your sales, expenses, and taxes are tracked automatically.

Step 7: Apply for Business Licenses & Permits

Depending on your location, you may need additional licenses and permits to operate legally.

Common Licenses for Dropshipping:

- Business License: Required in most states to operate legally.

- Sales Tax Permit: Needed if your state requires collecting sales tax from customers.

- Reseller Permit: Allows you to buy products tax-free from suppliers.

Where to Apply?

- Check your state’s Department of Revenue website.

- Use filing services like GovDocFiling to streamline the process.

Example: In California, a Seller’s Permit can be obtained online through the California Department of Tax and Fee Administration (CDTFA).

Expert Tips: Optimizing LLC for Dropshipping

Forming an LLC is just the beginning; optimizing it for efficiency, cost savings, and compliance is where the real strategy comes in. Here are expert tips to help you maximize the benefits of your LLC while keeping costs under control.

How to Minimize LLC Costs for Dropshipping

Running a dropshipping business requires keeping expenses low, and that includes reducing the cost of forming and maintaining an LLC. If you’re on a budget, these strategies can help you set up an LLC without overspending.

1. Choose a State with Low Fees

Not all states have the same filing fees and annual maintenance costs. Some, like Wyoming, New Mexico, and Montana, have lower annual fees and no franchise taxes, making them excellent choices for cost-conscious entrepreneurs.

If you don’t need to register in a specific state, opting for a business-friendly state can save you hundreds of dollars per year.

2. Act as Your Own Registered Agent

Every LLC requires a registered agent to receive legal documents and official correspondence. Many business owners pay $50-$300 per year for professional services, but if you have a physical address in the state where your LLC is registered, you can serve as your own registered agent to eliminate this cost.

3. File Online to Avoid Extra Fees

Some states charge extra processing fees for paper filings. Filing your LLC paperwork online is not only faster but also helps you avoid additional costs. Always check your state’s business registration website for the most affordable filing method.

Maximizing Tax Benefits for Your LLC

One of the biggest advantages of an LLC is its tax flexibility. If you want to make the most of your business’s financial benefits, here’s how you can legally minimize your tax burden.

1. Elect S-Corp Status

If your dropshipping business is making a steady profit, electing S-Corp taxation can help reduce self-employment taxes.

Unlike a traditional LLC, which requires owners to pay self-employment tax on the entire business profit, an S-Corp allows you to split income between salary and distributions, lowering your tax liability.

2. Leverage Business Deductions

Owning an LLC allows you to deduct several business expenses, reducing your taxable income. Keep detailed records and take advantage of deductions like:

- Marketing costs (Facebook Ads, Google Ads, influencer partnerships)

- Website expenses (Shopify fees, domain registration, hosting services)

- Software and automation tools

- Home office deductions (if you work from home)

- Business travel and education (courses, seminars, and conferences related to eCommerce)

Tracking these expenses properly can maximize your deductions and lower your taxable income significantly.

Optimizing Business Operations Under an LLC

Once your LLC is up and running, you’ll want to ensure smooth business operations. Here’s how to get the most out of your LLC while keeping your business compliant and efficient.

1. Separate Personal and Business Finances

One of the main advantages of an LLC is liability protection, but that protection only works if you maintain a clear separation between personal and business finances. Opening a business bank account and using a business credit card will help you:

- Keep better financial records

- Simplify tax filing

- Reinforce liability protection

Mixing personal and business finances can put your LLC at risk of being legally disregarded in the event of a lawsuit (known as “piercing the corporate veil”).

2. Establish a Strong Supplier Network

Some suppliers exclusively work with registered businesses, which makes establishing an LLC a valuable asset when negotiating better wholesale rates. In addition, having an LLC not only helps you build credibility with high-quality suppliers but also enables you to secure exclusive deals and expand your product catalog under more favorable terms.

Moreover, if you plan to collaborate with international suppliers, an LLC will significantly simplify the process of setting up accounts with trusted vendors and logistics companies. This added layer of legitimacy can open doors to more reliable partnerships and smoother business operations across borders.

3. Ensure Compliance to Avoid Penalties

Many states require LLCs to file annual reports and pay renewal fees to remain in good standing. Missing deadlines can lead to penalties or even dissolution of your LLC.

To stay compliant:

- Set calendar reminders for key state filing dates.

- Use business compliance services (such as Incfile or Northwest Registered Agent) to receive deadline notifications.

- Check your state’s LLC requirements annually to avoid surprises.

Keeping your LLC compliant ensures that your business remains legally protected and avoids unnecessary fees or complications.

>>> Read more: 120 Best Winning Products for Dropshipping: 2025 Newest List

Final Verdict: Do You Need an LLC for Dropshipping?

The short answer: It is not mandatory—but it’s highly recommended if you’re serious about long-term success.

Legally, you don’t need an LLC to start a dropshipping business. If you begin selling online without registering a business, you are automatically considered a sole proprietor (or a general partnership if you have co-owners). This means you can start immediately without paperwork.

However, skipping the LLC step isn’t always the best idea.

When an LLC is Worth It

- You’re making consistent revenue and want to protect your personal assets.

- You plan to work with high-quality suppliers who require a registered business.

- You want tax flexibility and the option to reduce self-employment tax.

- You’re thinking about scaling your business and bringing in partners or investors.

When an LLC Might Not Be Necessary

- You’re just testing the waters and aren’t making steady sales yet.

- Your dropshipping business is purely a side hustle with minimal financial risk.

- You don’t plan to scale beyond a small operation.

If you’re only making a few hundred dollars a month, it might not be worth the registration costs yet. But once you start seeing regular profits, setting up an LLC is highly recommended.

Conclusion

So, do you really need an LLC for dropshipping? Not necessarily—but it’s a smart move if you’re serious about scaling and protecting your business.

If you’re just starting out, a sole proprietorship might be fine. But once you start making steady sales, an LLC can provide legal protection, credibility, and financial benefits that make it worth the investment.

Thinking about taking your dropshipping business to the next level? Setting up an LLC might be the next step toward long-term success!