Google Ads serves as a bridge between financial advisors and individuals actively seeking financial advice. Are you interested in starting out with Google Ads for Financial Advisors? If you’re unfamiliar with the process, here’s a comprehensive guide that provides all the essential information you need to get started effectively.

- Can You Advertise Financial Services on Google Ads?

- Why Google Ads for Financial Advisors?

- How Google Ads for Financial Advisors Work?

- Which Ad Type is Best for Financial Advisors?

- Top Google Ads Keywords for Financial Advisors

- How to Set up a Google Ads Campaign for Financial Advisors?

- 7 Tips from Mega Digital – Google Premier Partner

Can You Advertise Financial Services on Google Ads?

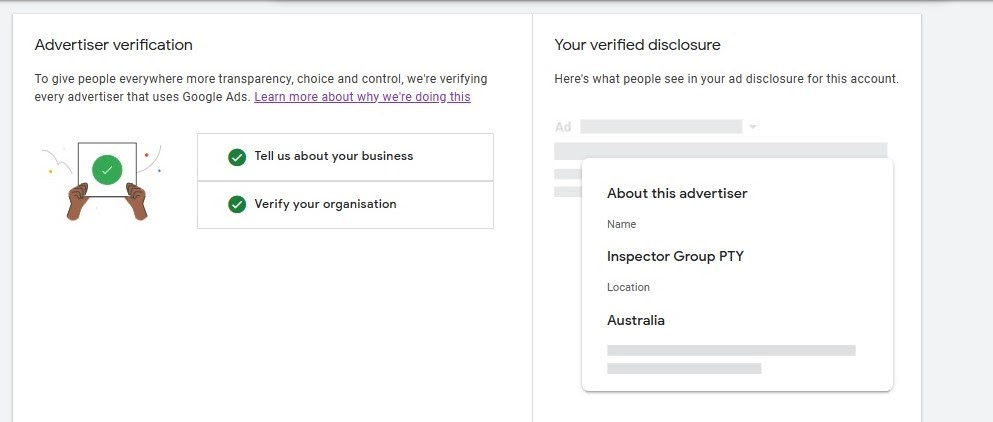

Yes, you can, but first, you have to pass the “advertiser verification”.

Verification for financial services on Google Ads is mandatory for advertisers looking to promote ads related to any financial service covered by its policy. However, before undergoing this verification process, advertisers must also pass the “advertiser verification program”, indicating the need for 2 verification steps to advertise their services.

Why Google Ads for Financial Advisors?

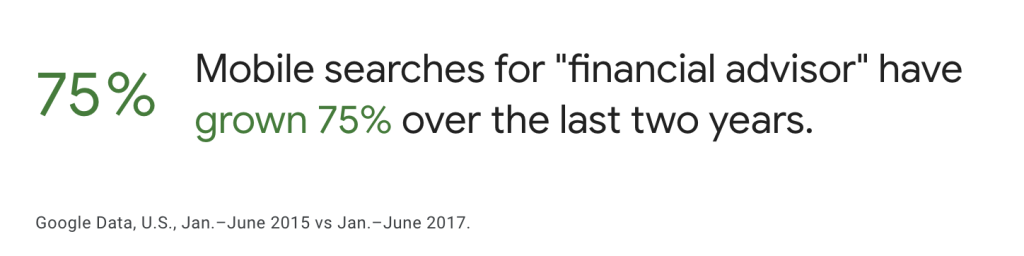

According to Google, mobile searches for “financial advisors” have increased by 75% in the past 2 years.

Moreover, there are several notable points to consider:

- Google receives more than 3.5 billion searches daily.

- 43% of investors under 45, with $500k in investable assets, begin their search online.

- Mobile searches for “financial advisor” have surged by 75% in the past two years.

- On average, businesses earn $2 in revenue for every $1 invested in Google Ads.

Now, here’s why Google Ads can be a game-changer for financial advisors:

Targeted Reach

Google Ads allow you to target specific demographics, interests, and behaviors. This means you can tailor your ads to reach people who are more likely to be interested in financial planning or investment services.

High Intent Audience

People who are actively searching for financial advice or services on Google are usually in the market for assistance with their finances. By placing ads on Google, you’re reaching an audience with a high intent to engage with financial advisors.

Cost-effective

With Google Ads, you have control over your budget and can set limits on how much you want to spend. You only pay when someone clicks on your ad, so you can track your ROI more effectively compared to traditional advertising methods.

Measurable Results

Google Ads provides detailed analytics that allows you to track the performance of your campaigns in real-time. You can see metrics such as clicks, impressions, conversions, and more, which helps you understand what’s working and what’s not so you can optimize your campaigns accordingly.

Local Targeting

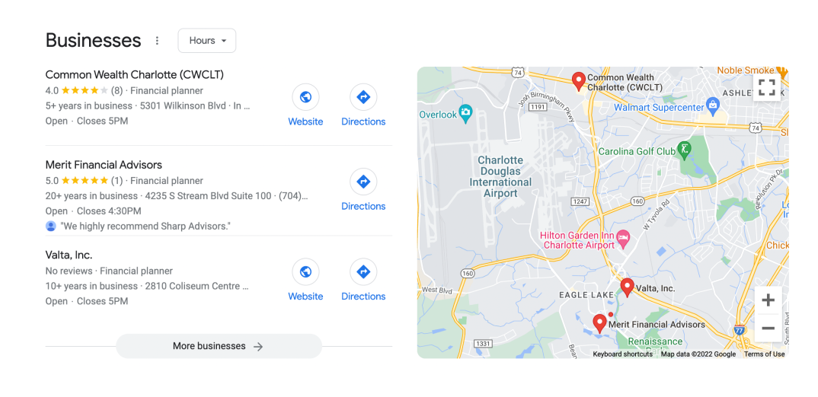

For financial advisors who primarily serve a local market, Google Ads can be especially beneficial. You can target your ads to specific geographic locations, ensuring that you’re reaching potential clients in your area.

How Google Ads for Financial Advisors Work?

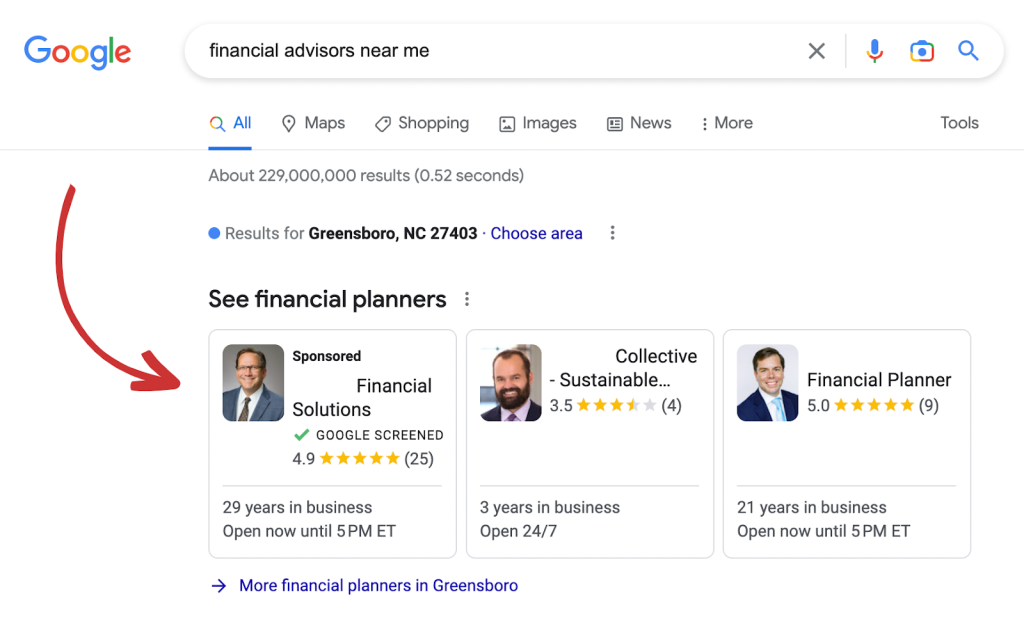

Google ads are advertisements showcased on Google’s search engine results page. Advertisers compete for prime positions in these results by bidding on keywords anticipated to be used by potential clients seeking services. They incur charges only when a user clicks on their ad, a system referred to as Pay-Per-Click (PPC).

Google Ads placements encompass various online spaces, including Google Search results, Google Play, the Shopping tab, Google Maps, and partner websites. Financial advisors can use Google Ads to promote their website or YouTube channel, particularly if they produce video content for their audience.

If compared with SEO, Google Ads delivers fast and reliable results. If you’re in need of immediate outcomes, Google Ads is the most effective avenue to achieve your objectives. We’ve seen clients, even those new to Google Ads, delighted with the results it brings. Once your business starts to grow, you can focus on SEO for steady, long-term goals.

Which Ad Type is Best for Financial Advisors?

There isn’t a single “best” ad type for Google Ads for financial advisors, but the two most effective ones are:

- Search Network Ads: These are the text-based ads that appear on Google Search results pages (SERPs) when people search for terms related to financial advice. They are a good option because they target users with high intent, who are already looking for what you offer.

- Call Ads: These ads display a phone number with a prominent call button, encouraging users to contact you directly. This can be a good option for advisors who want to generate leads quickly and easily.

Tips from Mega Digital: Here are some additional factors to consider when choosing an ad type:

- Your goals: Are you looking to generate leads, drive website traffic, or build brand awareness?

- Your target audience: Who are you trying to reach with your ads?

- Your budget: Call Ads can be a more expensive option than Search Network Ads.

Top Google Ads Keywords for Financial Advisors

You need to stay updated on the leading keywords relevant to your financial business. Based on research using Google’s Keyword Planner, here are some keywords that ranked among the top 50 for financial advisors:

- financial advisor

- financial consultant

- financial advisor near me

- financial planner

- financial consultant near me

- certified financial planner

- equitable advisors

- wealth advisor

- financial planning near me

- retirement planner near me

- investment advisor near me

- wealth advisor near me

- independent financial advisor

- best financial advisors

- registered investment advisor

- personal financial advisor

- fiduciary financial advisor

- financial advisor cost

- fee only financial planner

- financial planning advice

- wealth management advisor

- mutual financial advisor

- independent financial advice

- certified financial advisor

- licensed financial advisor

- top financial advisors

- forbes best in state wealth advisors

- becoming a financial advisor

- wealth management

- fiduciary near me

- find a financial advisor

- certified financial planner near me

- fiduciary financial advisor near me

- local financial advisor

- fee only financial advisor

- best financial planners

- best financial advisors near me

- fiduciary advisors

- investment adviser search

- financial advisor companies

- personal financial planner

- investment advisor near me

- licensed financial advisor

- financial advisor fee

- financial planning firms

- emoney advisors

- retirement financial planner

- financial advisor reddit

- private wealth advisor

- investments advisor

How to Set up a Google Ads Campaign for Financial Advisors?

Here are 4 detailed steps for setting up a Google Ads campaign for financial advisors. Simply follow these steps accurately, and anyone can do it.

Step 1: Choose Campaign Type

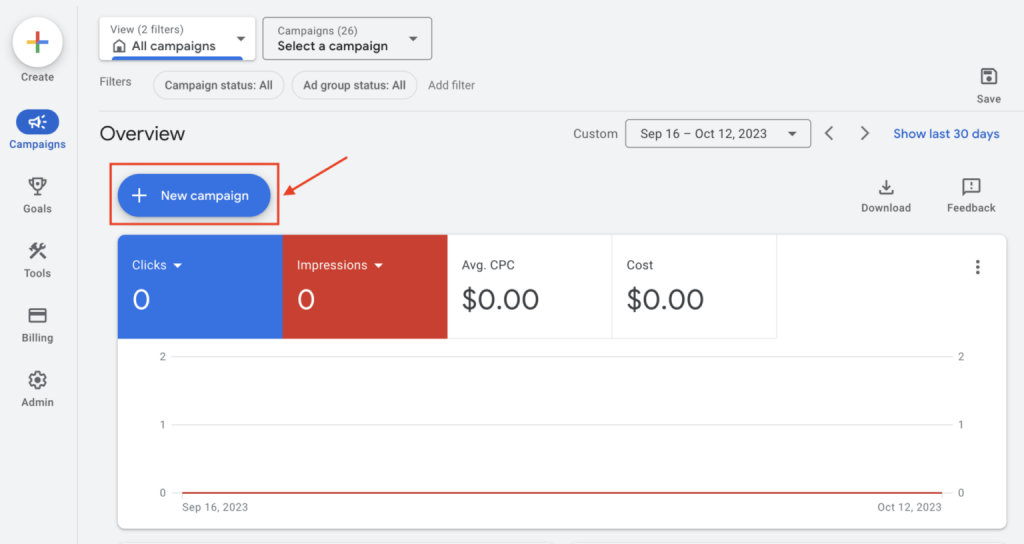

Before setting up your campaigns, you’ll need a Google Ads account. You can either create your own account or consider using a Google Ads agency account from a trusted Google Partner, like Mega Digital, to get started faster with expert support and optimized campaign management.

Upon logging into your Google Ads account, click on “Create Campaign” or “+New Campaign”.

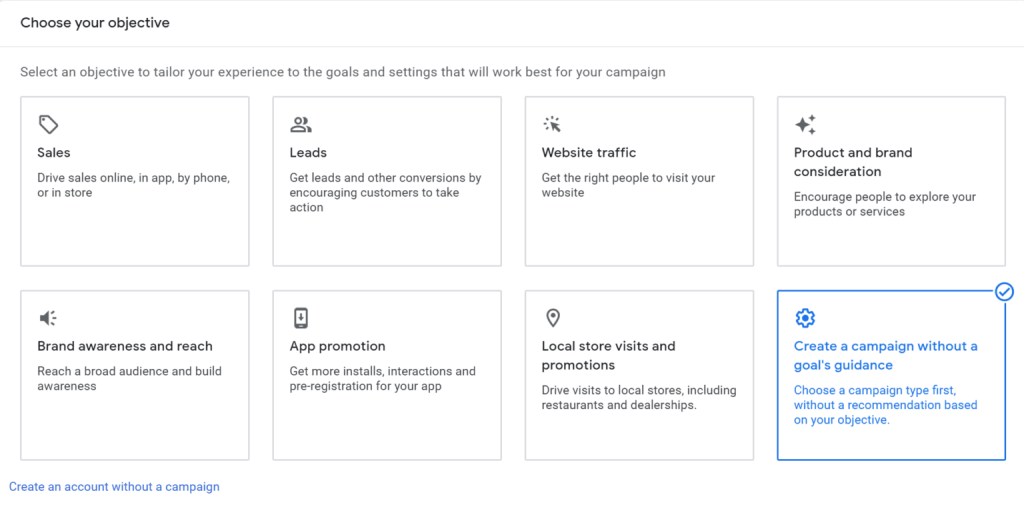

For optimal outcomes, opt to create your campaign without specifying any particular goal. Refrain from using unnecessary features that might not justify their cost.

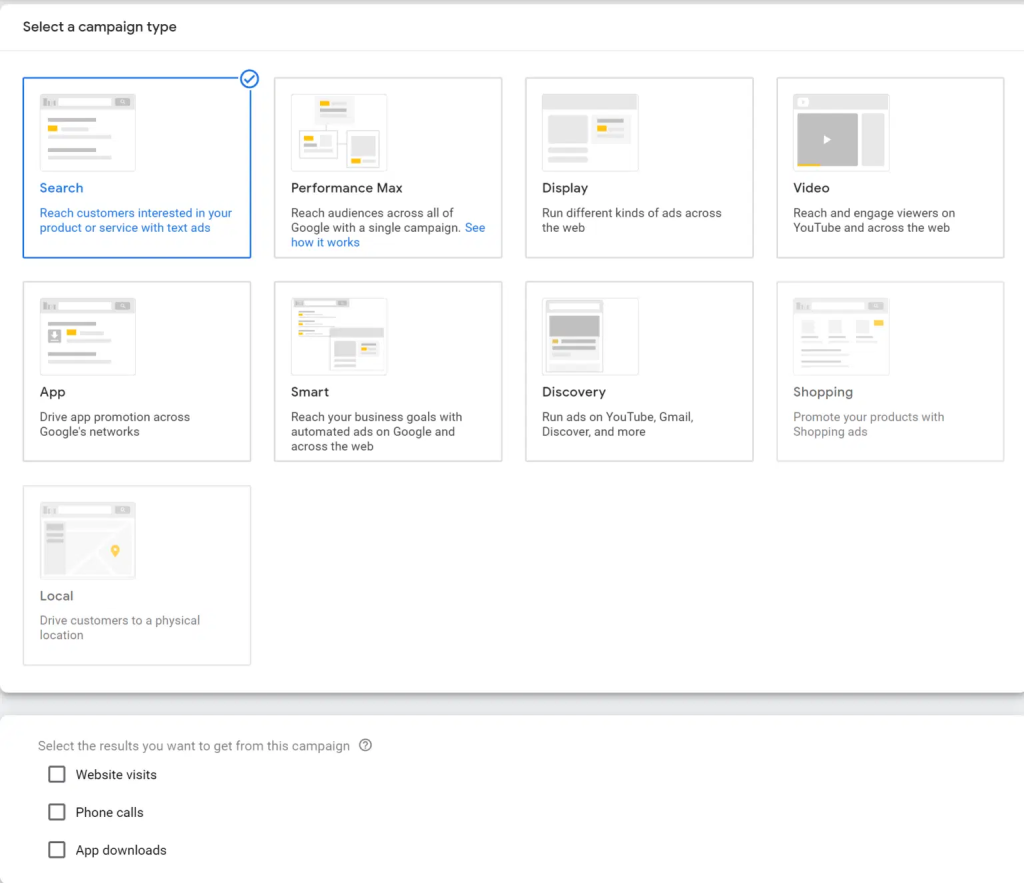

Next, choose “Search” as the campaign type, as it’s the most beginner-friendly option to begin with.

You don’t need to select any results or methods for tracking conversions at this stage; we’ll address this later.

Step 2: Set up Settings

1. General Settings

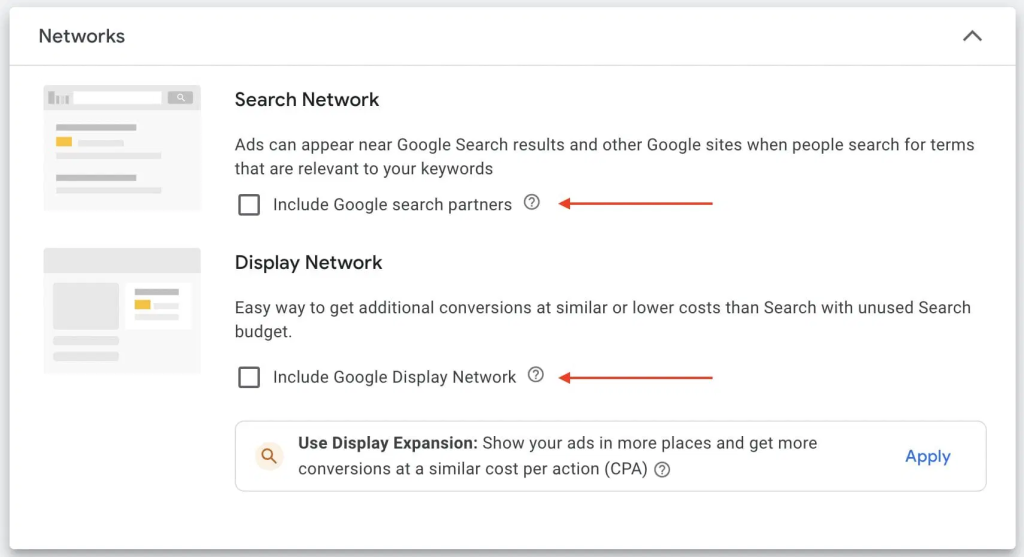

For Networks, ensure that neither box is checked.

- We don’t want the Search Network option checked because we only aim to appear in the Google Search Engine, not Google’s search partners.

- Similarly, we don’t want the Display Network option checked because we only want to appear in results for specific keywords we target.

2. Dates and URL Settings

Here are some pointers for managing dates and URL settings in your Financial Advisors Campaign:

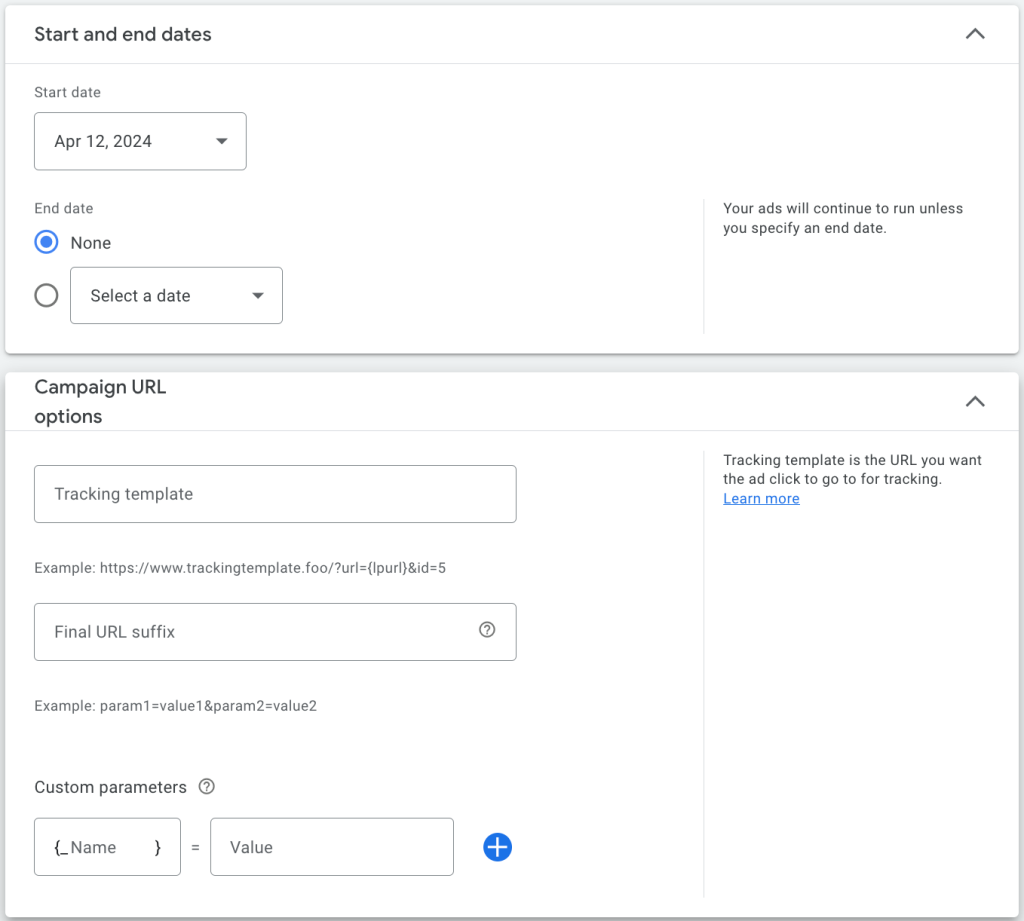

- If you don’t set a specific end date for your campaign, it will run continuously until you manually stop it.

- Be sure to monitor your ads regularly to prevent incurring additional charges for underperforming ads.

- You can disregard the tracking template unless you have experience with it and wish to track conversions using it.

- Dynamic ads are generated based on your website content. Unless your budget permits, you can overlook this option for now.

3. Targeting Locations

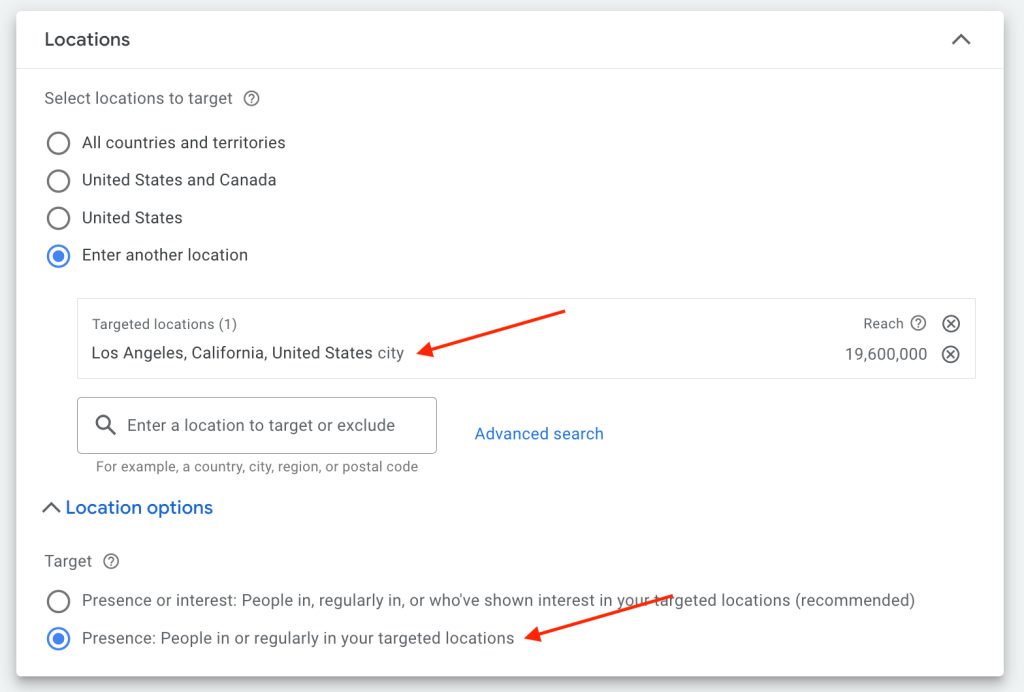

Refine your targeting to the specific locations where your services will be available. Use the “Advanced search” option to pinpoint your location through a map search or by setting a radius.

When selecting your target audience, prioritize “Presence” over “Presence or Interest.” This ensures that your ad is shown to users physically located in your targeted area, which is more reliable for investment in their clicks.

The language targeting should align with the searcher’s interface. When appropriate, consider including “English” to reach English-speaking users.

4. Audience Segment

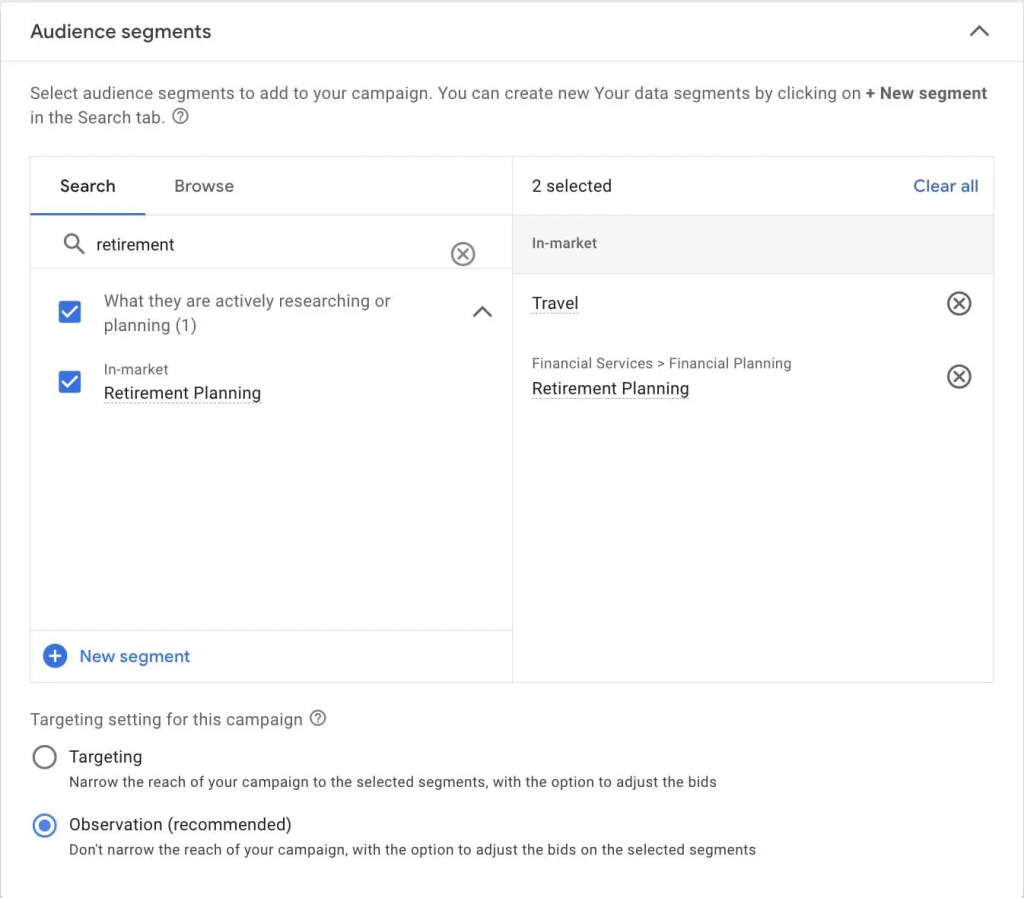

Identify and analyze segments relevant to potential clients’ interests. Opt for “Observation” to avoid restricting your reach based on assumptions derived from Google’s data.

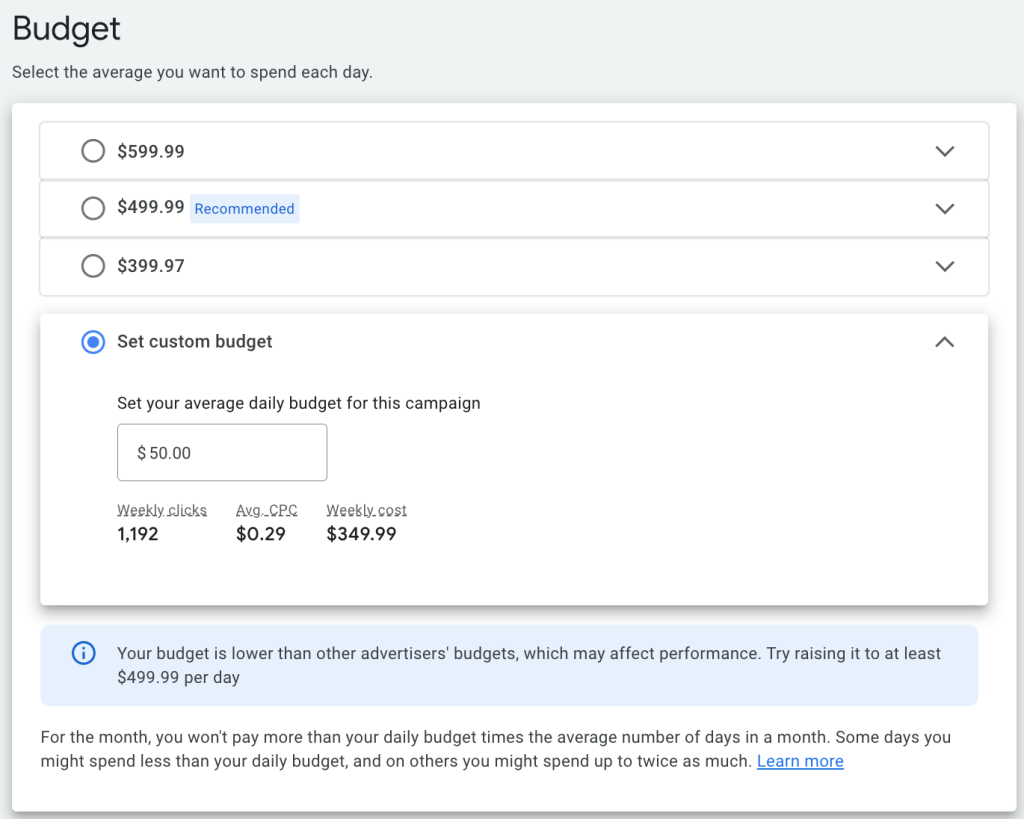

5. Budget and Bidding

Set your average daily budget to 10-20 times the cost of your chosen keywords for optimal results. The sooner you gather sufficient data, the quicker you can make necessary adjustments. Your bidding strategy follows this formula: (Ad Rank of Person Below/Quality Score) + $0.01. Quality Score is influenced by post-click actions, ad relevance, and click-through rate, so aim for a high score to reduce bidding costs.

You’ll bid based on clicks for your website, with the option to adjust bid limits for each ad later in campaign settings. Consider rotating your ads if you anticipate certain ones performing better at specific times or on certain days.

Step 3: Create Ad Groups

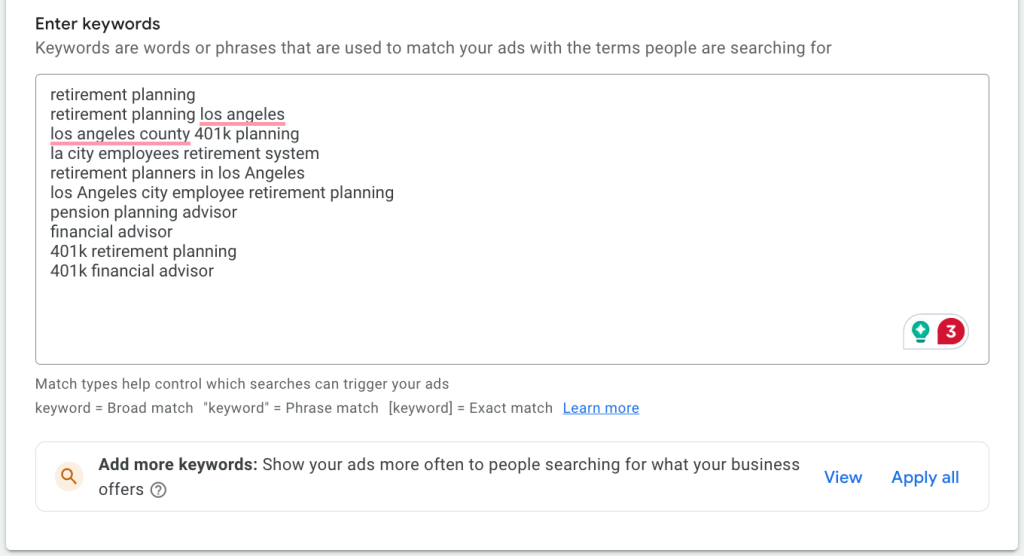

Create several ad groups tailored to your business’s various services, including:

- Tax planning

- Retirement planning

- Insurance coverage

- And more!

Take into account the interests and intentions of your potential clients. When inputting keywords (you can also add them post-campaign creation using Keyword Planner), think about what your clients would search to find your services. Be sure to exclude your competitors and searches indicating the user is solely seeking tutorials or guides.

Step 4: Create the ads for Financial Advisors Services

You’ll craft one or more ads for each group.

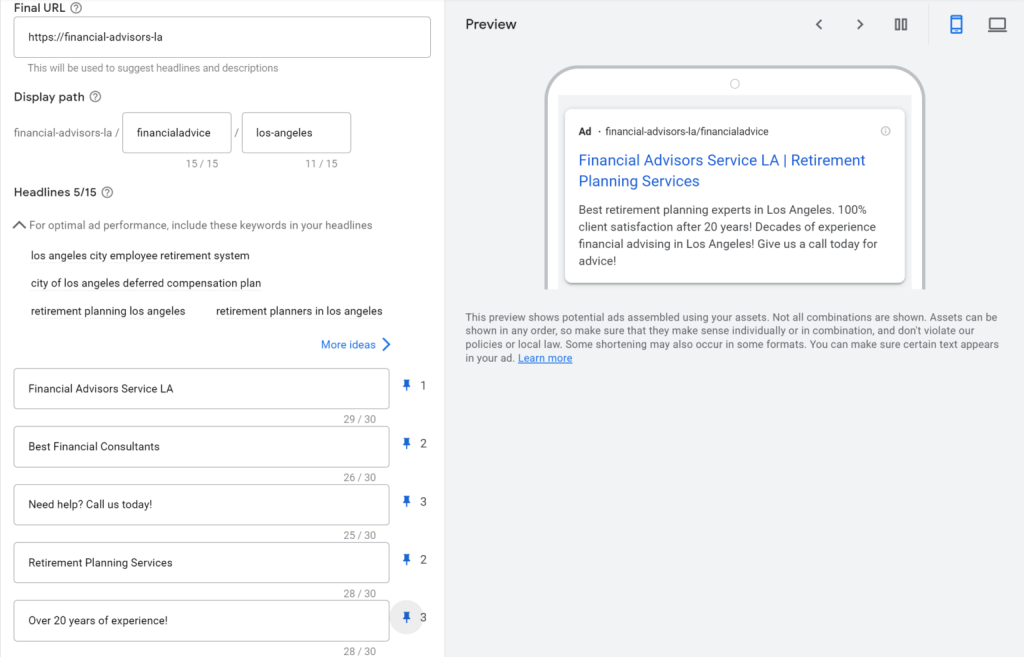

1. Final URL

Select a landing page that encourages searchers to explore your services. This could be a link to information on your website or your services page.

2. Display Path for Financial Planning

This determines how the URL will appear in the ad. Exclude unnecessary articles (“a”, “an”, “the”) to keep the link concise.

3. Headlines for Different Ads

Craft various headlines to capture attention. Ensure to prioritize headline positions, as the most relevant ones should appear first and second. The third headline may not always be displayed.

4. Descriptions for Financial Advisors

You have 90 characters to describe your services briefly. Use all available characters to maximize the ad size.

With your payment plan in place, you’re now prepared to monitor your campaign.

Want your ads to stand out? Let us, Mega Digital, help you create campaigns tailored to your business. As a Google Premier Partner, we have access to Google’s exclusive tools, like Looker Studio (currently the only agency in Asia with access). We can view real-time data and trends for each industry, helping you run campaigns that yield the highest profits with optimized costs.

7 Tips from Mega Digital – Google Premier Partner

The next step will be tips for optimizing the campaign, from a Google Ads expert with years of experience at Mega Digital.

#1 Understand your cost per lead

Your time is precious, and while setting up Google Ads requires effort, it can run with minimal hands-on management once optimized.

It’s crucial to assess the cost of lead generation through Google Ads. While the average cost per click (CPC) ranges from $1 to $2, the financial services sector typically faces higher CPCs. For example, targeting “financial advisor Orlando” may cost around $15 per click, while “financial advisor Minneapolis” could command $32 per click.

While reducing click costs is possible, aiming for significantly lower CPCs might be unrealistic given market conditions. Bidding too low could result in Google not displaying your ad at all.

I strongly advocate for generating your own leads to maintain control over your business. Outsourcing lead generation means relinquishing control to a third party, which may not prioritize your interests as you would.

#2 Measure Your Results

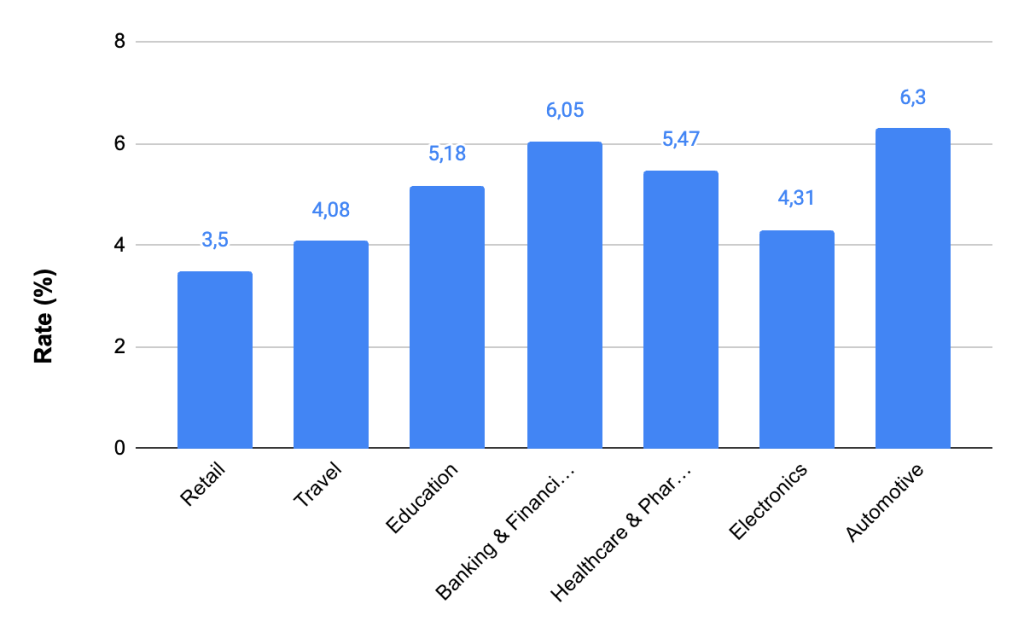

When using Google Ads, it’s essential to track effectiveness by analyzing top-performing keywords and their costs. This data refines your marketing strategy, maximizing your ad budget’s value. Monitoring metrics like CTR, quality score, and conversion rate is crucial. CTR indicates user engagement, with a rate below 1% suggesting underperformance. Quality Score influences your cost per click, reflecting ad relevance.

However, the most critical metric is your conversion rate, measuring the frequency of ad clicks resulting in desired actions. Understanding the value of each conversion allows effective ad spending optimization. For instance, if your average client is worth $3,500, you can justify spending up to $3,499 per acquisition while remaining profitable.

Knowing these figures empowers you to make informed decisions and refine your advertising strategy for continued growth.

#3 Use Ad Extensions to Boost Click-through Rate (CTR)

Here’s an excellent tip you can put into action right away. Surprisingly, many people overlook the use of extensions in their Ads campaigns. By integrating them, you’ll distinguish yourself from your competitors.

Ad extensions offer the opportunity to provide more information in your ad beyond the typical headline, URL, and ad copy. Have you ever seen ads with phone numbers or multiple website URLs? Those are examples of ad extensions.

The extra information provided by these extensions sets your ad apart and enhances its chances of being clicked on, ultimately improving your Quality Score and lowering your cost-per-click.

There are several types of extensions to choose from:

- Sitelinks extensions: These let you display additional links to your website.

- Location extensions: They allow you to present your address, phone number, and a map marker.

- Call extensions: One of my favorites, these extensions enable you to showcase your phone number on Google ads, making it incredibly convenient for people to call you, especially on mobile devices.

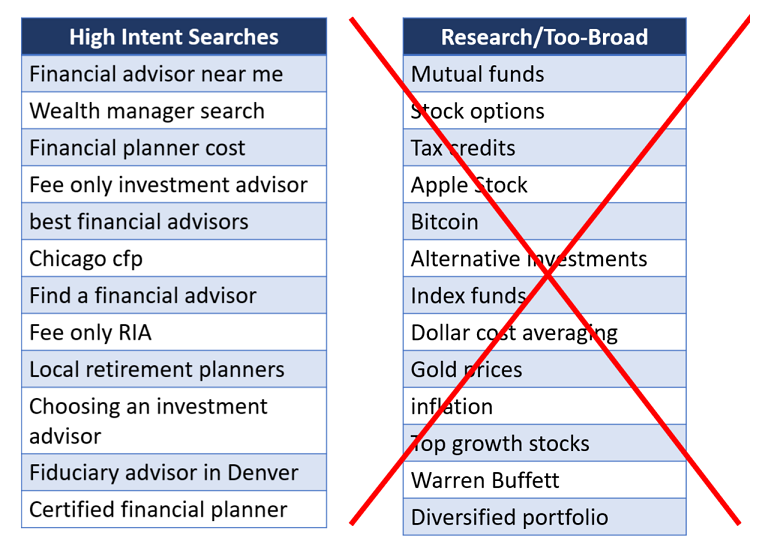

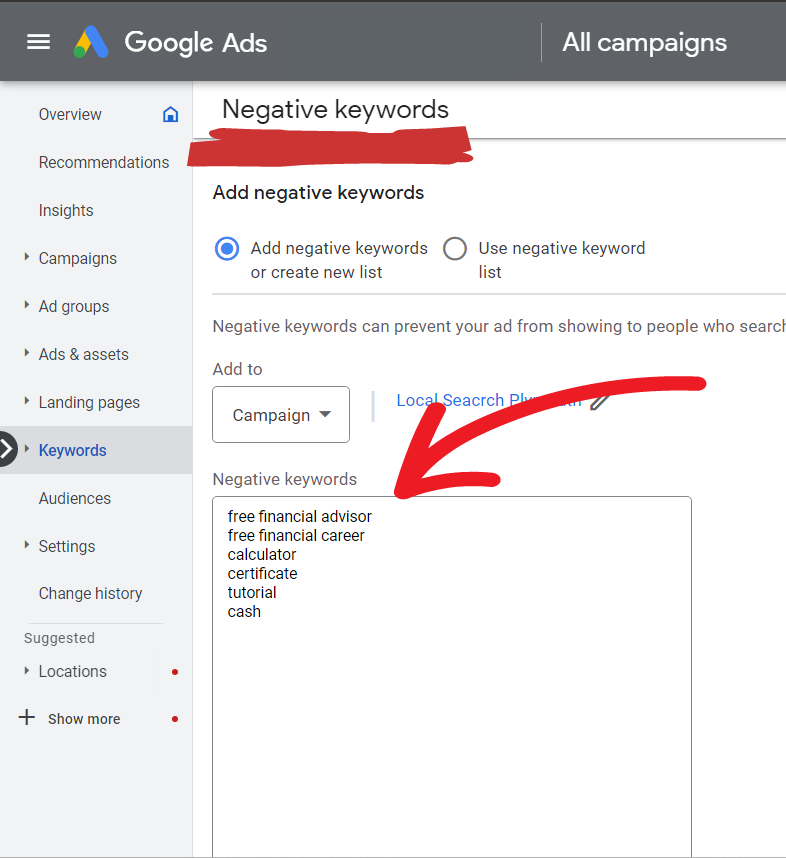

#4 Create a List of Negative Keywords

Neglecting to set up negative keywords is a common mistake among advertisers. While I commend individuals for managing their own campaigns, it’s essential to establish a list of negative keywords.

Negative keywords are terms that, when used by an irrelevant audience, trigger your ad unnecessarily.

For instance, if you’re selling hard copy calendars for home delivery, you’d want to exclude terms like “Mayan calendar” and “online calendar” to avoid displaying your ad to users unlikely to purchase your product.

In the financial advisory field, useful negative keywords include “cheap” and “discount”, helping filter out searches for “cheap financial advice” and “discount financial advisor”.

#5 Tailor Ads to Your Local Region

Many financial advisors prefer to focus their advertising efforts within a specific radius, typically around 50 miles from their location. To achieve this, Google Ads provides geolocation settings.

Customize your ads to target specific areas or locations. While keywords like “financial advisor Orlando” may not require such specificity, using location settings is crucial for terms like “financial advisor near me”, popular among those actively seeking financial advice.

Configuring your ad to display within a specific area can save costs by avoiding clicks from individuals outside your target region. However, use this approach only if you’re certain you want clients from a specific geographic area.

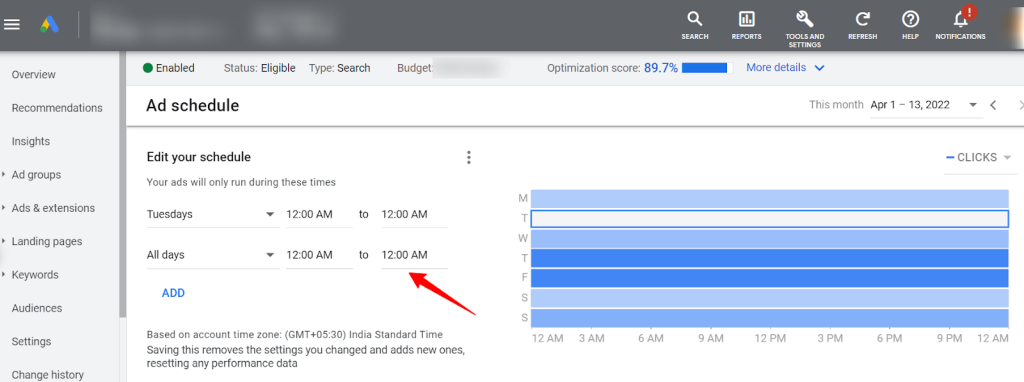

#6 Get More Calls with Dayparting

Dayparting, also known as ad scheduling, involves scheduling your ads to appear at specific times. For example, if your office hours are from 9 a.m. to 5 p.m., showing your ads outside of these hours would be inefficient since there wouldn’t be anyone available to answer the phone.

For financial advisors and others aiming to encourage phone calls, it’s essential to run ads only when you’re available to take calls. Additionally, by analyzing your data, you can identify the most profitable times of day and use dayparting to display your ads exclusively during those periods.

#7 Don’t rely too heavily on Google Ads

Recognize that Google Ads should complement your marketing mix, not replace it. Expecting Google Ads to surpass other channels like email, social media, or direct mail is unrealistic.

Running Google Ads enhances existing efforts; it won’t fix inadequate marketing strategies. Due to limited search volumes, Google Ads shouldn’t be the primary focus of your campaign. For instance, “Financial advisor Orlando” receives only 110 searches monthly, while “Financial advisor Fort Worth” gets just 20 searches.

Even in major cities like Chicago, capturing a share of these searches can be challenging. The top Google result typically receives 33% of search traffic, translating to around 85 clicks monthly. Keep in mind that users often skip ads, so the actual clickthrough rate (CTR) for Google Ads is roughly 2%.

Wrap up

Google Ads provides a fantastic opportunity for financial advisors to connect with their audience, boost their brand presence, and ultimately, attract more clients.

With a keen eye on metrics like clickthrough rates and conversion rates, advisors can fine-tune their campaigns over time, ensuring they get the most out of their advertising budget. Google Ads for financial advisors is all about finding the right balance and continually optimizing to drive success.