If you don’t know what a chargeback in PayPal is, or if you are currently having any issues related to it, Mega Digital’s experts are here to help! Dive right in and understand exactly how PayPal chargebacks work and the steps to tackle the problem immediately, as well as learn how to protect your business.

What are PayPal Chargebacks?

Chargeback in PayPal refers to when a client has disputed a charge with his credit card company, most of the time long after any actual transaction.

The customer can also chargeback for an item in which they claim they never got the item; the item received was not that described, or was fraudulent in nature.

The chargeback itself is handled outside of PayPal, and that means the decision will come from your bank, rather than PayPal itself. While sales refunds are initiated to refund customers for complaints, chargebacks are entirely in the hands of the buyer and thus place much limited control in the seller’s hands.

Chargebacks are stressful to small businesses due to the fact that they freeze funds and give uncertain income. You may even lose not just the transaction amount but also be liable for some extra fees in case a chargeback is found in the favor of a buyer.

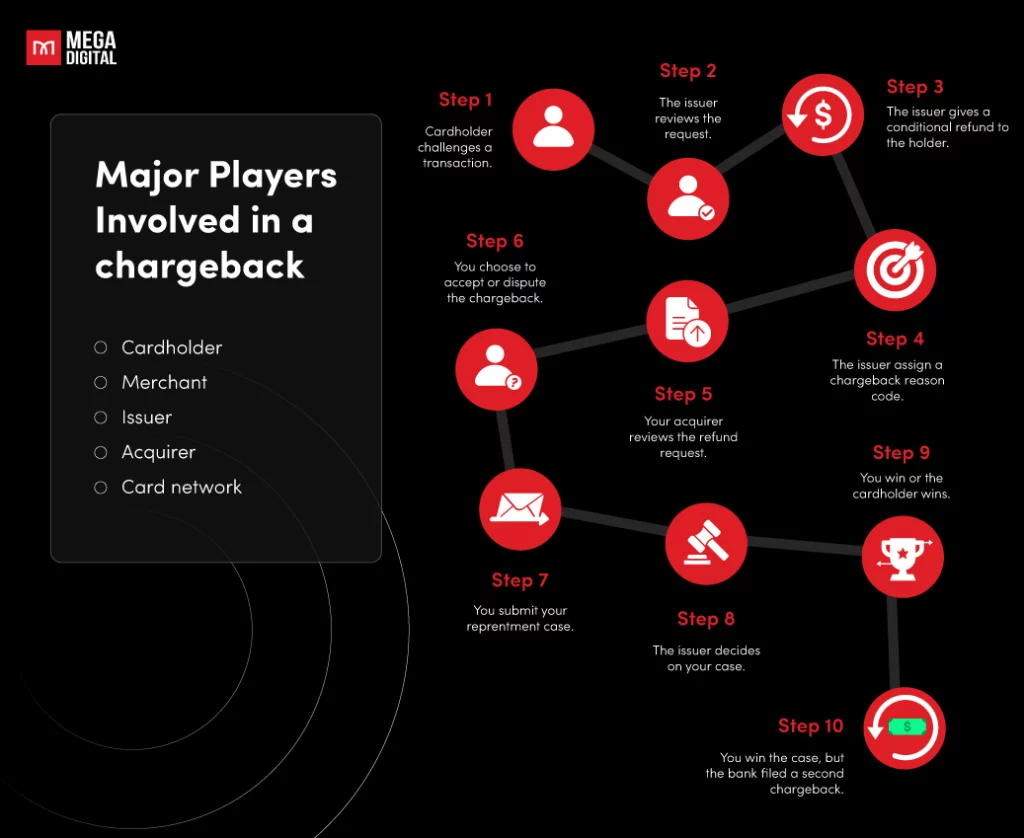

How does Chargeback in PayPal Work?

When a buyer initiates a chargeback through their bank, PayPal becomes the mediator by collecting evidence from you and forwarding it directly to the card issuer.

Here’s how it works step by step:

- Chargeback Filing: The buyer calls his/her credit card company and explains to them why he is disputing the charge.

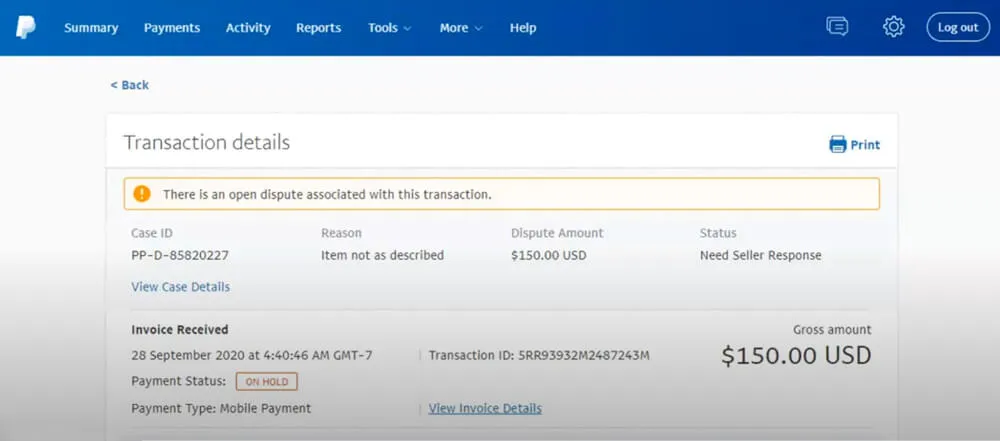

- PayPal Notification: PayPal contacts you about the chargeback and locks up the disputed funds in your account, informing you about the claim.

- Seller Response: You are given a certain timeline, usually 10 days, in which you can respond with your proof. It may contain tracking numbers, proof of delivery, product photos, or screenshots of customer communication.

- Card Issuer Review: The buyer’s bank reviews all the evidence provided by both parties and gives the verdict. In case the verdict comes in your favor, the funds will be deducted from your account permanently.

This process can take weeks or even months, depending on the complexity of the case. Sellers must act swiftly and provide clear, compelling evidence to have a chance of winning the dispute.

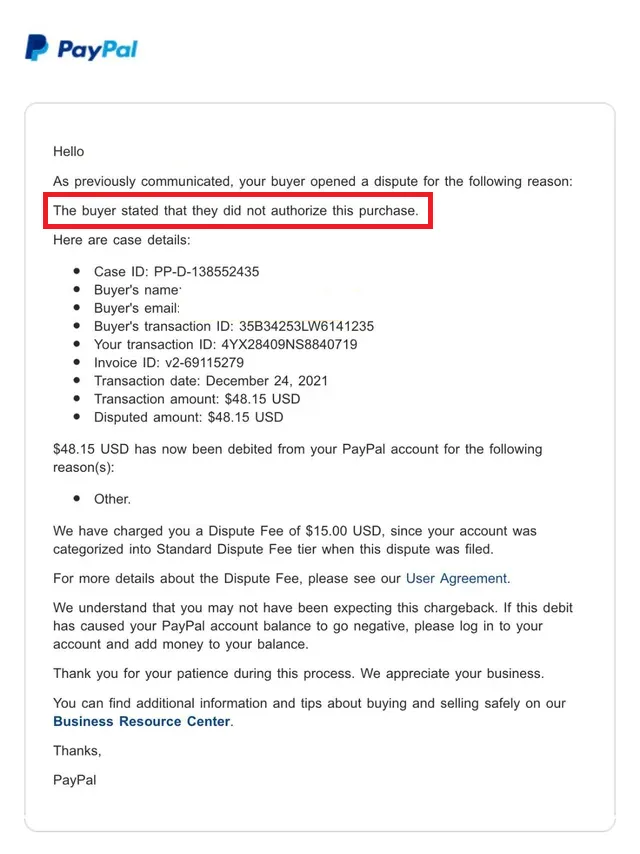

Example of Chargeback in PayPal

To make it clearer, let’s consider a real-world scenario.

Imagine you run an online store selling custom-made products, like T-shirts, and a customer places an order. They pay through PayPal, and the item is shipped. One week later, the customer calls the bank and initiates a chargeback, claiming never to have authorized such a transaction.

You would then have to provide proof of shipment, such as a tracking number that the item shipped to the correct address, in case it has already shipped out. Plus, include payment-related proof and purchase records.

If the evidence is sufficient, the card issuer may rule in your favor, and the funds will remain in your account.

However, if you lack proper documentation, you could lose both the payment and a chargeback fee.

PayPal Chargeback Time Limit

Another critical aspect of chargebacks is the time frame. Buyers can file a chargeback up to 120 days after the original transaction date. However, this time limit can vary depending on the card issuer’s policies.

As a seller, it’s a good practice to retain transaction records, shipping confirmations, and customer communications for at least six months to ensure you’re prepared to respond to disputes. Without this documentation, defending against a chargeback becomes nearly impossible.

PayPal Chargeback Fee

Apart from the risk of losing the transaction amount, the sellers may face some other types of costs, for instance, the chargeback fee. PayPal generally charges up to $20 for each dispute, and it is a non-refundable fee even if you eventually win against your chargeback.

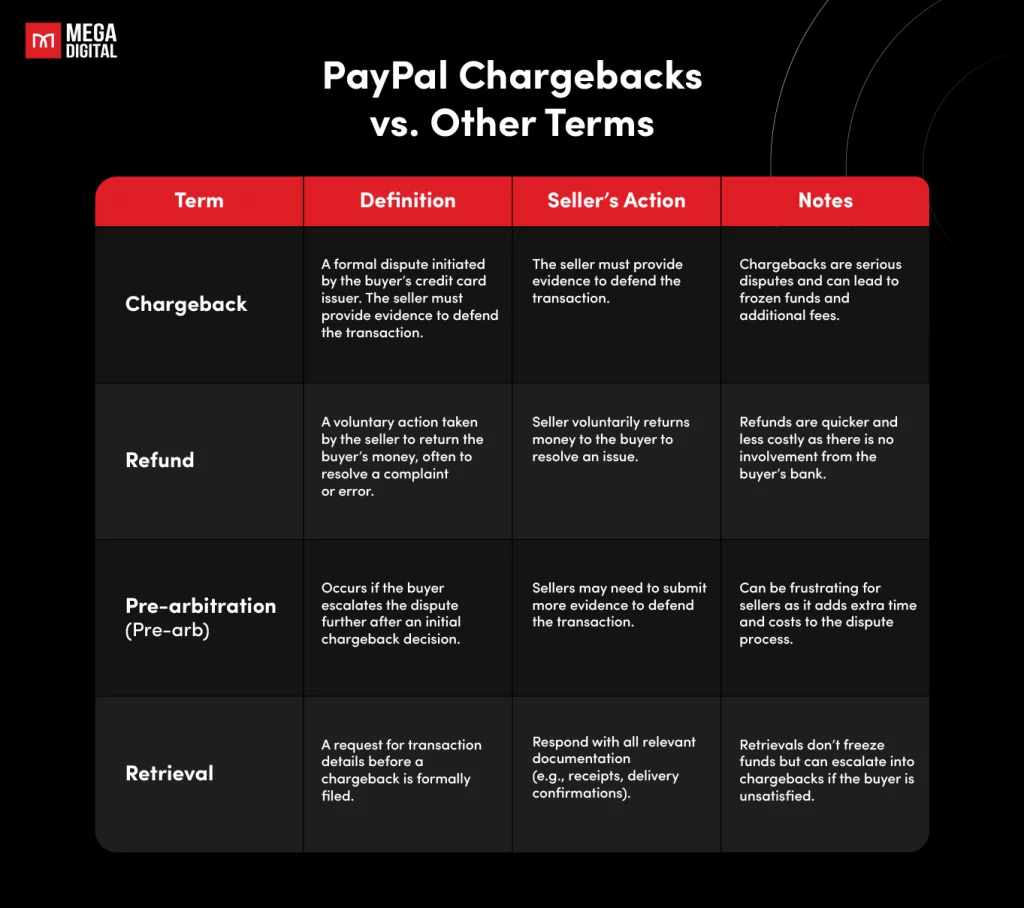

PayPal Chargebacks vs. Other Terms

With regard to the chargeback, it is necessary to differentiate it from a few other terminologies, such as refund, pre-arbitration, and retrieval requests. Most of these terms would create considerable confusion among a great number of sellers.

Causes of PayPal Chargebacks

Understanding the reasons for chargebacks will help you find the weak points in your business processes and fix them before they can cause disputes. The following are some of the most common reasons buyers file chargebacks on PayPal:

Fraudulent Transactions

The most prevalent causes of chargebacks involve fraud. That is where the buyer claims never to have approved the transaction, usually in a case where their credit card details have been stolen or used without permission. While this may be the case with some, others might try to commit friendly fraud by lying about the fraud to get out of paying for merchandise.

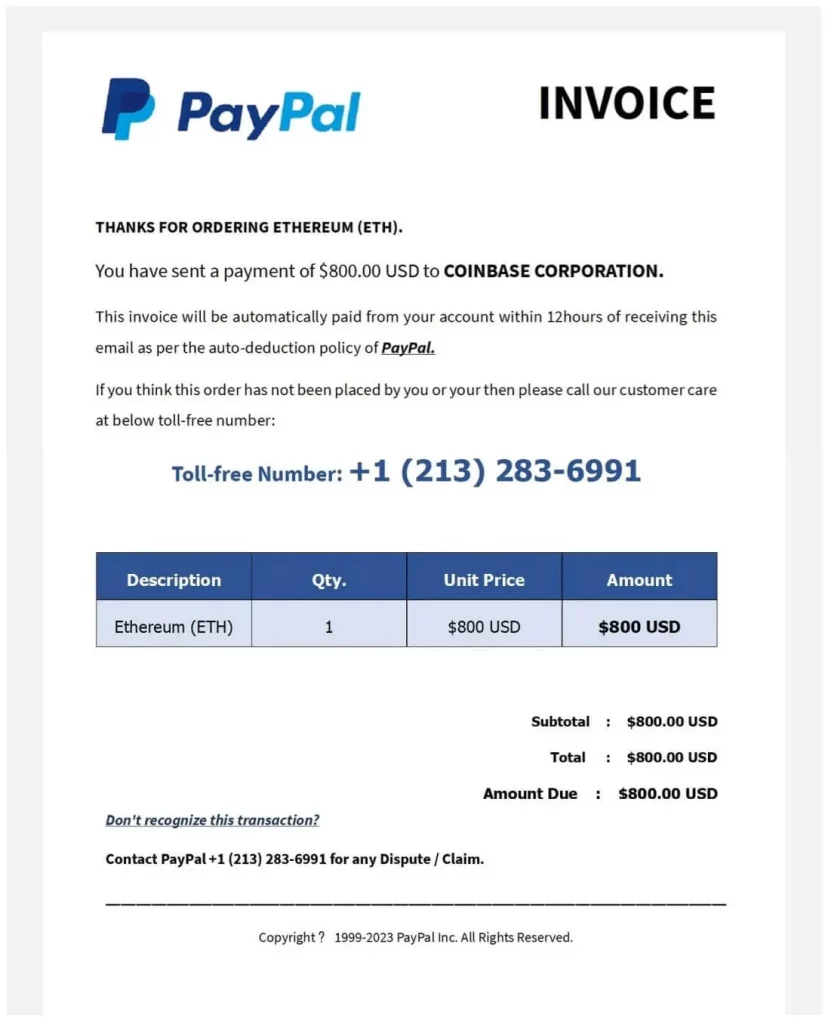

This is a classic example of refund or overpayment scam. Instead of a payable invoice, this invoice is emailed and is completely fake. No Ethereum was purchased, and no money will be directly deducted from the victim’s account.

Non-delivery of Goods or Services

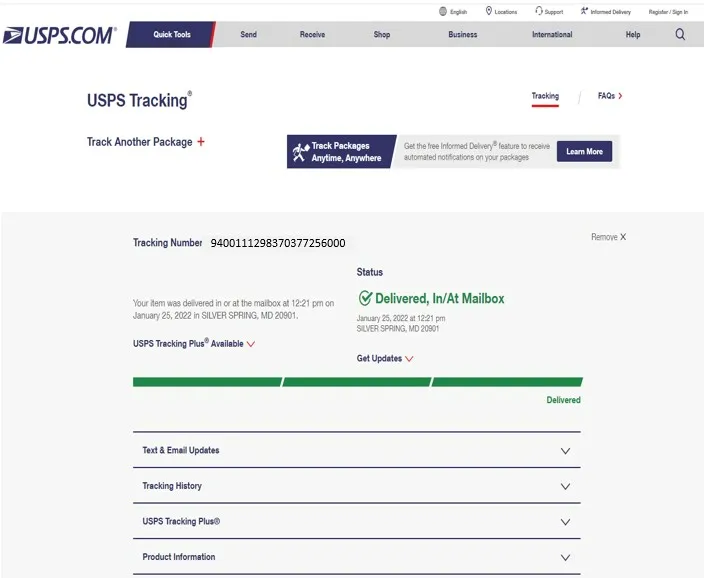

Buyers can file a chargeback when they think that they never received the products they ordered. Such reasons may include: items were delayed by shipping or lost or there was not clear communication about the delivery process. You can ship the item, but if it does not have a proper tracking or proof of delivery, it can result in a dispute.

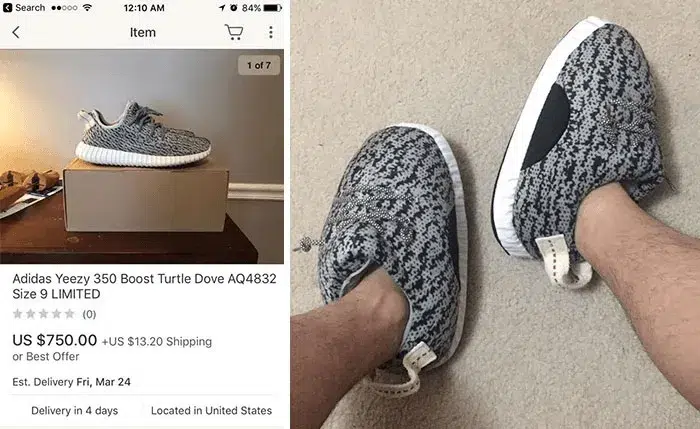

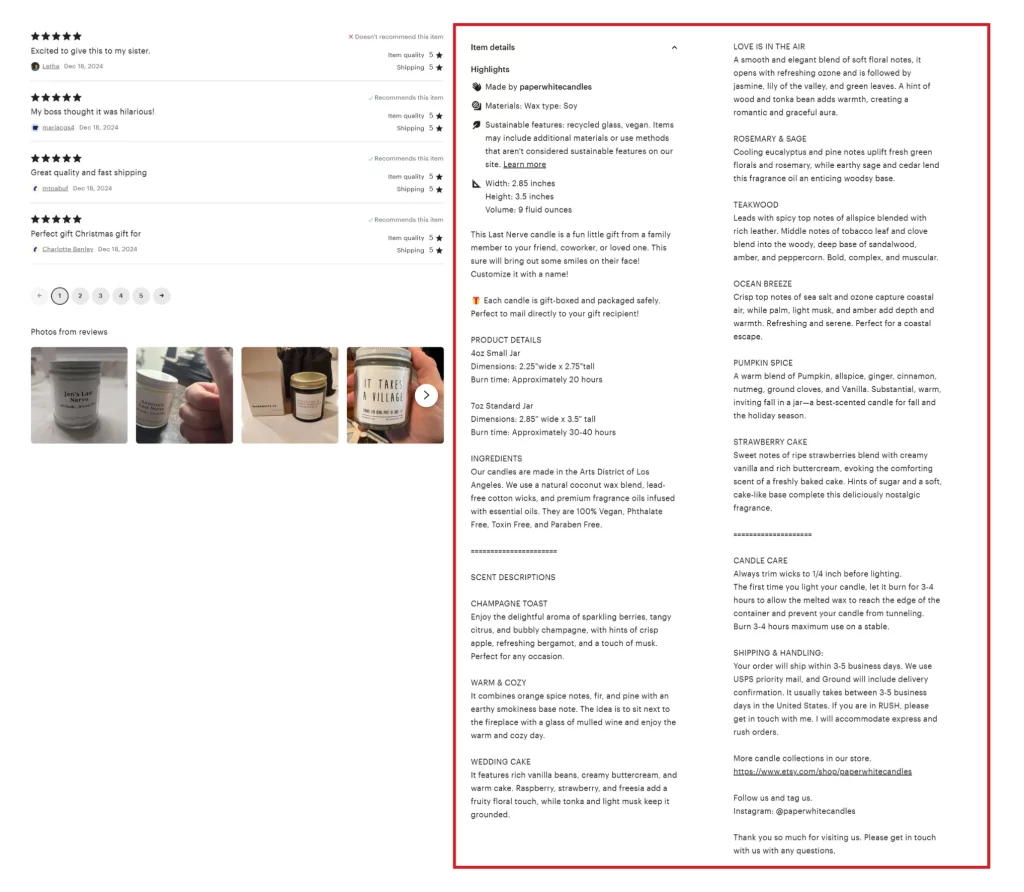

Item Not as Described

The buyer might insist that the product does not match the description on your listing. They may, for example, state that the item is defective, or in an improper size, color, or functionality.

Subscription and Recurring Payment Issues

If buyers forget about or are unaware of recurring payments for subscriptions, they may dispute the charges. Often, this happens because of the absence of clear clamps for cancellation or because they think they have canceled the subscription but are still charged.

>>> Read more: How to Find Dropshipping Suppliers: Complete Order Fulfillment

PayPal Chargeback: How to Resolve

Knowing how to deal with chargeback in PayPal in the best possible way could sometimes mean the difference between keeping your hard-earned money and losing it. Below are the step-by-step guides on handling your disputes with PayPal and responding to chargebacks promptly:

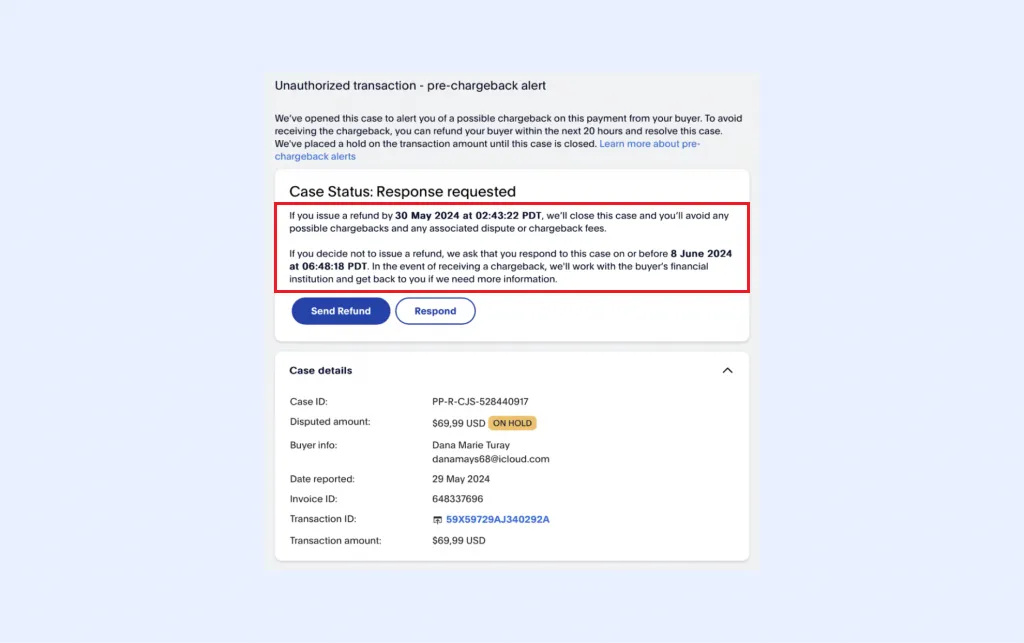

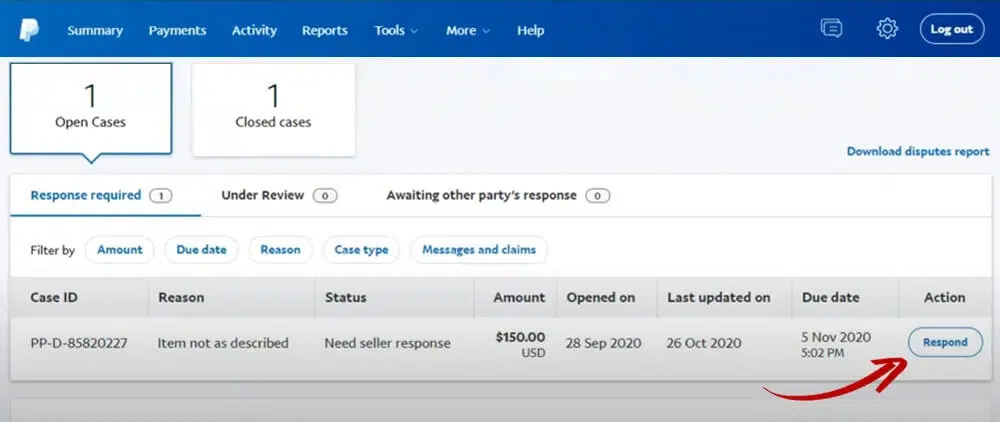

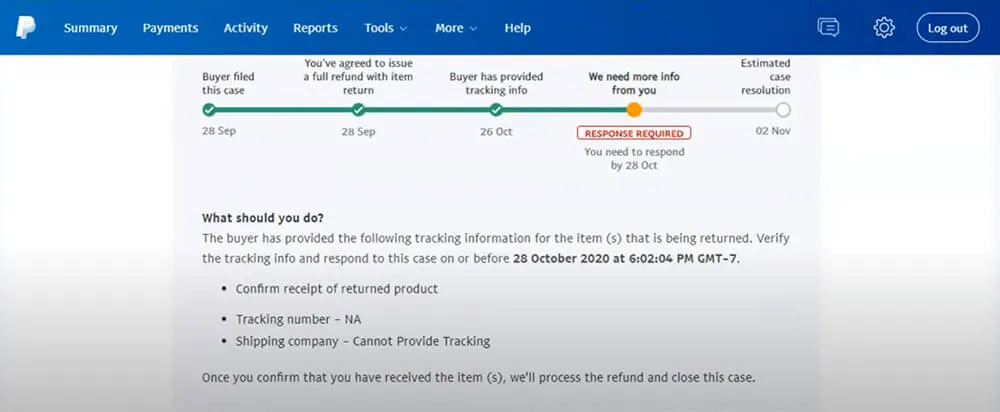

Step 1: Review the Dispute Details

When PayPal sends you a notice about a chargeback, review the information in the dispute carefully to understand why a buyer might contest a given transaction. It will point you to evidence you may need to prepare.

First, under the “Action” tab, click “Respond” next to the case.

Then, review the complaint and click “Resolve Chargeback Now.” This is where you’ll decide whether to fight back or accept liability.

Step 2: Collect Relevant Documentation

Next up, prepare strong evidence to support your case. This might include:

- Proof of delivery (e.g., tracking numbers, shipping confirmations)

- Transaction receipts

- Screenshots of communication with the buyer

- Photos of the product as shipped

The goal is to demonstrate that the transaction was legitimate and that you fulfilled your obligations as a seller.

Step 3: Send Your Evidence to PayPal

Use the PayPal’s Resolution Center to upload evidence within the time limit given (that is usually 10 days). Reply in a clear, concise and professional manner without any emotional language or accusations.

Another option is to use specialized tools integrated into PayPal, like Solidgate, to respond to such disputes. Within Solidgate Hub, it is so easy to submit your evidence: as shown in the below video.

Step 4: Wait for the Card Issuer’s Decision

Your response will now be sent to the buyer’s credit card issuer for evaluation by PayPal. The issuing bank will review the two sides of evidence presented then make its decision. The entire operation may take weeks, so it is important to exercise patience at this time.

Step 5: Learn from the Outcome

Consider every chargeback a learning experience, whether you win or lose. Look for the opportunities to improve when analyzing the case, such as better product descriptions, better shipping practices, or enhanced fraud detection measures.

How to Prevent PayPal Chargebacks?

In many cases, chargebacks are easier to prevent than to have resolved. Here are effective means of minimizing the risks:

Provide Accurate Product Descriptions

Make sure all your listings fairly and honestly describe your products or services. Include high-quality photos, detailed specifications, and clear terms and conditions to help set the right buyer expectations.

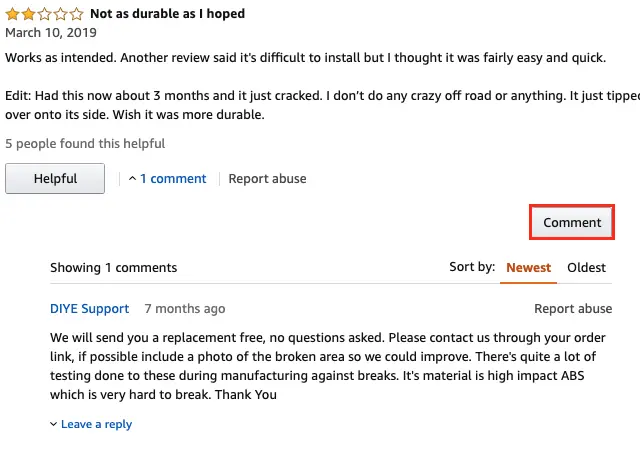

Offer Excellent Customer Support

Good customer service can resolve many issues before they escalate. Make it easy for customers to reach out if they have a question or concern.

Always respond quickly to questions, address any concerns, and follow up on orders to keep your buyers informed and reassured. A fast, polite, and solution-oriented approach can resolve issues before they escalate into chargebacks.

Use Reliable Shipping with Tracking

Shipping-related issues are common causes of disputes; that is why you should always use reputable shipping carriers that offer tracking and delivery confirmation. Providing buyers with tracking information ensures that they are kept informed of the status of their package, therefore reducing non-delivery claims.

Keep Comprehensive Transaction Records

Documentation is your best ally when dealing with chargebacks. Maintain detailed records of all transactions, including invoices, receipts, shipping information, and communication logs with buyers. These documents can serve as evidence to dispute invalid claims.

Monitor for Fraudulent Activity

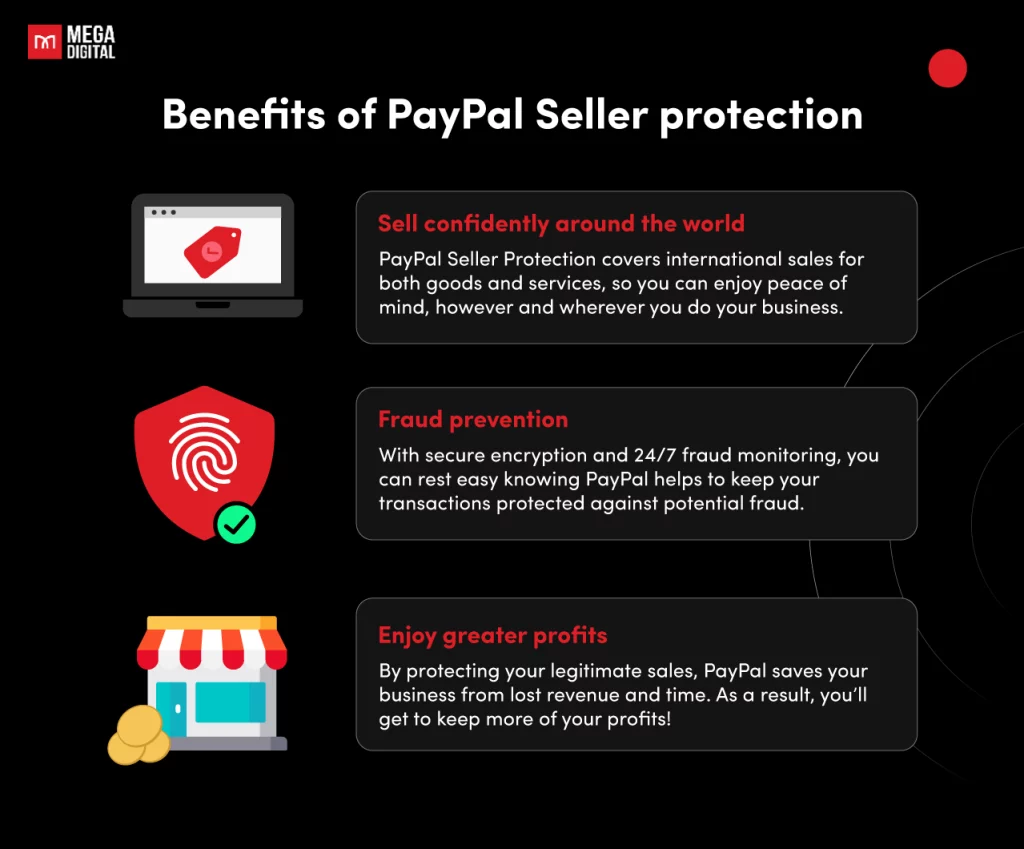

Use tools like PayPal’s Seller Protection and fraud filters to flag suspicious transactions and possible PayPal scam chargebacks. Be cautious with high-value orders, international transactions, or buyers who request unusual shipping arrangements.

Use PayPal’s Chargeback Protection

For an additional fee, PayPal Chargeback Protection saves the day for online businesses that transact a lot. The program removes unauthorized transaction disputes as well as those that are disputed because items are not received, all in a bid to ensure that no money is lost unnecessarily.

>>> Read more: How To Dropship With No Money? 8 Ways to Get Started in 2025

Final Word

There will always be some hassle in business with PayPal and chargebacks. However, they are part of the game that can really be treated wisely with the right knowledge and preparation. To have chargebacks limited in PayPal and to get your company protection, it is of utmost importance to know the process, keep good records, and proactively deal with possible complaints before they arise. You’ve got this!