With millions of active users searching for financial advice, investment tips, and budgeting strategies, TikTok offers financial brands a unique opportunity to educate, engage, and build trust. In this blog post, let’s find out why TikTok for financial services can be highly effective, as well as best practices for businesses to leverage the power of this platform.

Contents

Why Should Financial Services Providers Use TikTok?

It’s understandable why financial firms might hesitate when it comes to new social platforms like TikTok, given the significant compliance and risk challenges involved.

Many in financial services view TikTok as just a hub for teens and viral challenges, not necessarily a place for serious brands. So, we certainly don’t blame the world of financial services for disregarding TikTok.

But, could this reluctance be causing them to miss out on valuable engagement opportunities with a new generation of consumers?

It’s time for you to reconsider TikTok Ads for financial industry.

1. Growing User Base

TikTok is no longer just for teens and Gen Z. With 1.04 billion monthly active users worldwide, this platform has seen rapid adoption across age groups and demographics.

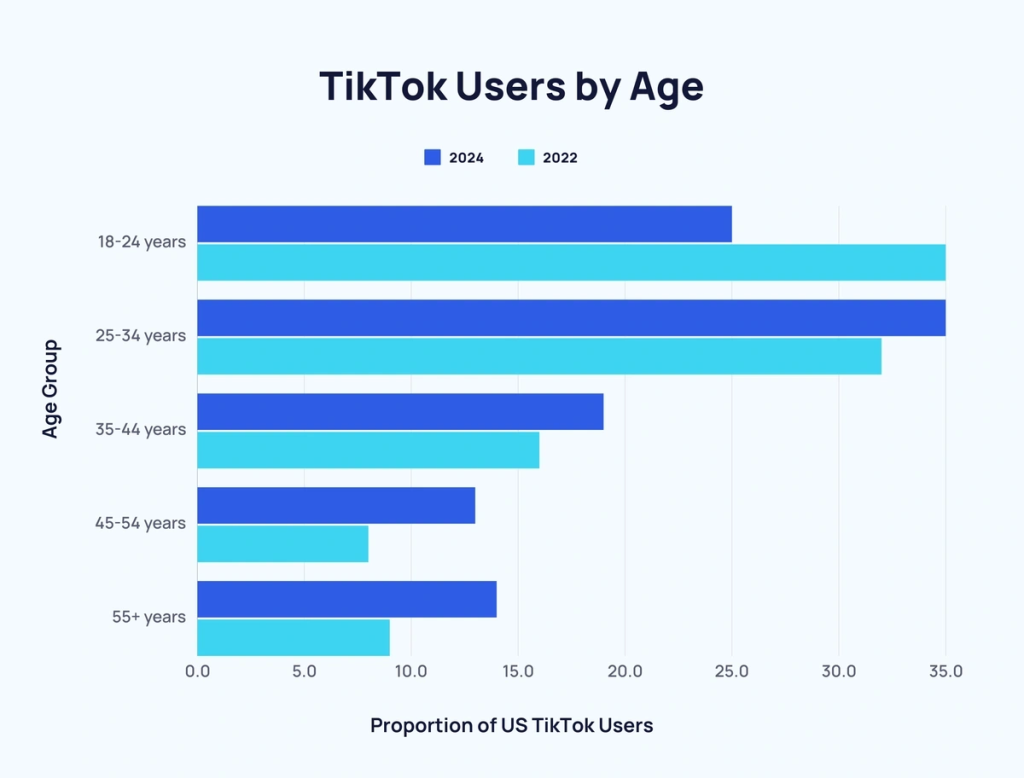

A growing segment of TikTok’s audience – about 35% of users in the U.S. – is between 25-34 years old, many of whom are key decision-makers or in the prime of their financial planning years.

For financial services, this expansive user base offers a unique and targeted way to reach potential clients where they’re highly engaged.

2. Potential for Financial Education

For industries like finance, where education is key, TikTok’s format opens up enormous potential. Financial brands can utilize the platform to simplify complex topics – whether it’s explaining investment options or demystifying credit scores.

Over 70% of users say they’ve learned something new on TikTok, which positions it as a valuable educational tool for financial services. Through engaging, easy-to-digest content, financial brands can build trust with users, guiding them toward informed financial decisions.

>>> Read more: A Case Study of Lend Wallets, in collaboration with Mega Digital

3. High Engagement Rates

TikTok’s engagement rates are some of the highest among social platforms. According to recent data, the average TikTok user spends around 95 minutes per day on the app.

Financial services, by using TikTok ads, can capture the attention of users who are already deeply engaged with content, making it an ideal channel for impactful and lasting impressions.

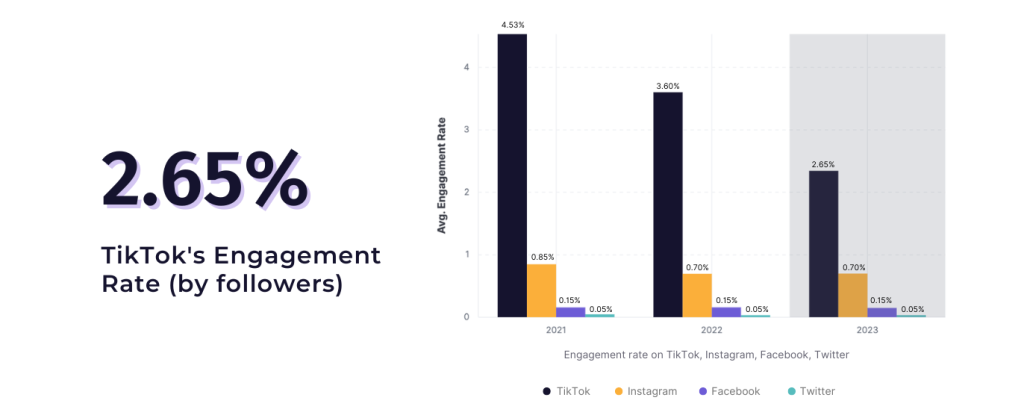

Moreover, in 2023, TikTok’s engagement rate reached 2.65%, which is significantly higher than that of other major platforms.

4. Changing Perception

Financial services have historically been viewed as complex or inaccessible, but TikTok is shifting this perception. The platform’s short-form, engaging content makes it easier to present financial information in a way that feels approachable and relatable.

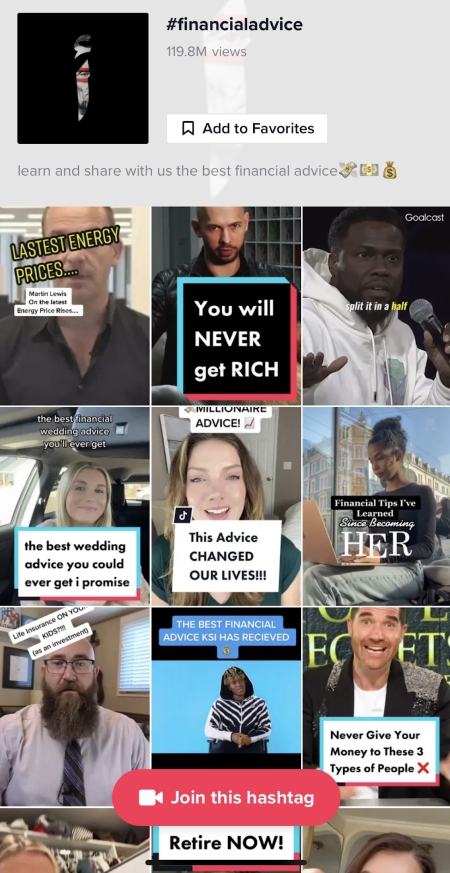

In fact, finance-related content on TikTok has over 4 billion views under hashtags like #PersonalFinance and #Investing. By leveraging this trend, financial brands can reframe their services as essential, interesting, and easy to understand for a modern audience.

Best TikTok Hashtags for Financial Services

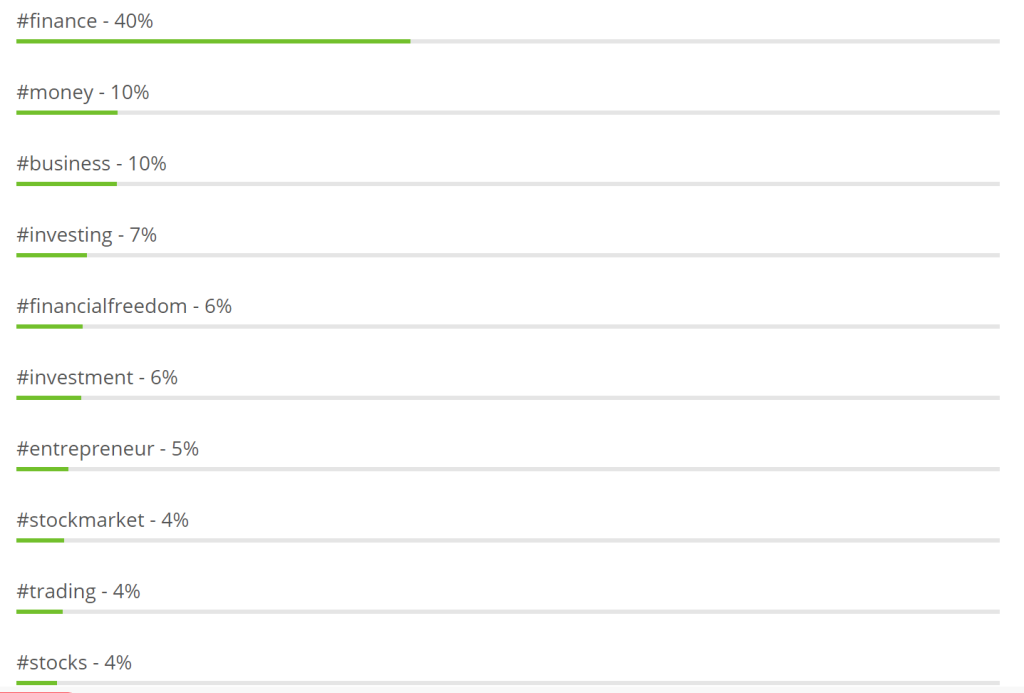

Utilizing effective hashtags is crucial for financial services aiming to enhance their visibility and engagement on TikTok. Here are some top TikTok hashtags for financial services to consider:

Apart from the hashtags above, #FinTok has emerged as a powerful community within TikTok. This hashtag is dedicated to financial content that ranges from personal finance tips to investment strategies.

It’s where financial advisors, industry experts, and everyday users come together to discuss topics like budgeting, credit scores, investing, and financial planning.

Tips and Tricks for Promoting Financial Services with TikTok Ads

To make the most of TikTok’s unique platform, it’s essential to use strategies that resonate with its audience. Here’s how to promote financial services effectively on TikTok, following best practices tailored to its highly engaged user base.

1. Make your content educational

Many people turn to TikTok for quick, digestible learning moments. So why not tap into that with financial insights?

Providing educational content can make financial services feel accessible and build trust. You might wonder if education-based ads will bore TikTok’s audience; however, short, engaging videos can simplify complex topics, making them appealing and valuable.

Create brief videos explaining financial basics, investment tips, or budgeting advice. For example, if your financial service offers budgeting tools, showcase how they help users take control of their finances in three simple steps.

2. Leverage storytelling with relatable scenarios

Finance is personal, so why not use TikTok ads to connect emotionally? Real-life scenarios make it easier for viewers to see how your service fits into their lives.

While finance topics might seem serious, storytelling with relatable situations can transform them into engaging and memorable messages.

@ginellesequitin Story time about the WORST FINANCIAL MISTAKE we made 😓 And why YOU need health insurance in the Philippines! #financeph #financialliteracy #financialadvice #financialeducation #healthinsurance #insurance #filipinorelatable #filipino #storytime

♬ original sound – Ginelle | Financial Advice – Ginelle 🌟 Financial Advice

Use In-Feed ads to tell a story from a customer’s perspective, such as how a young professional managed student loans or saved for their first home with your service. Storytelling resonates when viewers see themselves in the narrative, making them more likely to take action.

3. Stay on trend

TikTok is all about trends, and brands that align with them can capture attention quickly.

Some might argue that trends don’t suit the ‘serious’ nature of financial services, but joining relevant trends can actually humanize your brand. After all, staying current signals that your brand understands and relates to the modern consumer.

Keep an eye on trending hashtags, audio, and video formats and incorporate them into your ads where appropriate. For instance, if there’s a popular challenge focused on saving or budgeting, participate by adding a financial twist that ties back to your service.

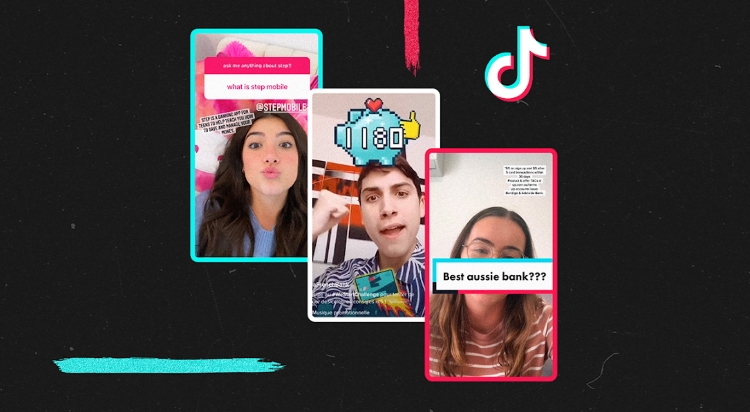

4. Collaborate with “FinTok” influencers

Why go it alone when FinTok influencers already have an established audience seeking financial content? Partnering with influencers builds instant credibility and boosts your reach. Financial services might shy away from influencers, but consider this: when influencers have a loyal following, their recommendations can carry the weight of trust that ads often lack.

Identify FinTok influencers who align with your brand’s values and target audience. Consider sponsored content where they use your service or product in a real-life financial scenario, such as managing monthly expenses, to show followers exactly how it works.

5. Create interactive content

Engaging users interactively, whether through polls, challenges, or Q&A sessions, invites them to actively participate in your content rather than just passively watch. Financial brands may ask, “Is interaction worth it on TikTok?” Yes, because when viewers interact, they remember your brand better and are more likely to engage in the future.

Use Branded Hashtag Challenges or polls to encourage users to share their budgeting tips or financial goals. For example, create a challenge like #MySavingsJourney, encouraging users to share how they’re building savings, with your brand providing tips or support.

6. Use hashtags wisely

TikTok’s algorithm heavily relies on hashtags to categorize content. While it may seem tempting to use popular hashtags only, niche tags related to finance can better target interested viewers. The hashtag mix matters: choose tags that help your content appear in the right places without being lost in a sea of unrelated videos.

Combine popular, trending hashtags (e.g., #FinTok, #Financialadvice) with niche-specific tags (e.g., #SmartInvesting).

Top 5 TikTok Agencies for Financial Services

Sometimes, TikTok can be challenging for financial services, given the need for compliance, trust-building, and creative strategies to engage a younger audience.

Here are the top TikTok agencies that specialize in helping financial brands reach their goals effectively on the platform:

#1 Mega Digital

As an official TikTok partner, Mega Digital has carved out a strong reputation in digital marketing. Mega Digital’s expertise lies in designing campaigns that balance creativity with compliance, helping financial brands expand their reach without compromising regulatory requirements.

Mega Digital offers a tailored approach for each client, leveraging advanced targeting strategies and tracking mechanisms that are essential for high-quality lead generation.

#2 Viral Nation

Viral Nation is a global leader in influencer marketing and social media advertising, known for its data-driven approach.

For financial services, Viral Nation excels in creating campaigns that resonate with audiences while maintaining regulatory compliance. Their expertise in influencer partnerships is particularly beneficial for financial brands looking to build trust through authentic connections.

#3 The Social Shepherd

The Social Shepherd is a results-driven TikTok agency that prioritizes social-first, native content to quickly scale brands on the platform.

For financial services providers, they focus on creating content that educates and engages, making complex financial concepts easy to understand. The Social Shepherd’s strength lies in their ability to deliver strong results in a cost-effective manner.

#4 Ubiquitous

Ubiquitous specializes in TikTok influencer marketing and has a network of creators ready to bring brand stories to life.

Ubiquitous focuses on building campaigns that resonate with audiences through relatable and credible influencers. Their comprehensive campaign management includes everything from content creation to performance tracking.

#5 Disruptive Advertising

Disruptive Advertising is a full-service digital marketing agency with a dedicated focus on financial services.

They understand the unique challenges of advertising in the financial sector and have the expertise to create TikTok ads that meet compliance standards. Disruptive Advertising’s data-focused approach and targeted strategies make them a strong choice for financial brands.

Case Study of a Financial Services Provider Succeeding on TikTok

This case study explores how a financial services provider, Lend Wallets, partnered with Mega Digital to leverage TikTok’s advertising platform for impactful lead generation.

Lend Wallets is a U.S.-based financial services company that offers a range of financial products and services. The company is recognized for its transparent operations and is supported by a team of experienced professionals.

Challenges

Although they had seen success across multiple platforms, TikTok was entirely new, requiring tailored strategies and testing to see if it could deliver the same level of performance.

Besides, their advanced CRM system required precise integration with TikTok Pixel for accurate tracking and optimization.

Solutions

Mega Digital team has worked closely with the client’s technical team to resolve Lend Wallets’ challenges:

- Precise Pixel setup: Mega Digital collaborated with the client’s technical team to configure the TikTok Pixel for accurate tracking across the customer journey.

- Customized UTM parameters: Unique TikTok UTM parameters (aid, subacc, ttclid, etc.) were set for each ad, ensuring precise attribution and meeting the client’s specific tracking requirements.

- Insight-driven creative strategy: Mega Digital identified key audience pain points, such as low credit scores and the need for short-term loan, to develope targeted ad templates focusing on consumer loans.

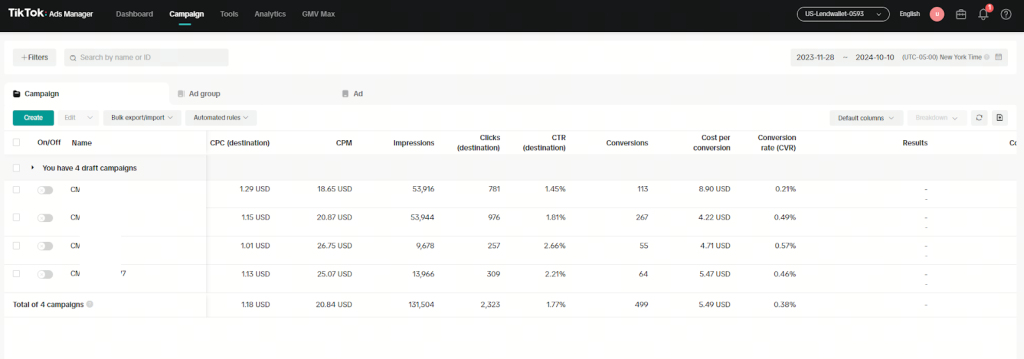

Results

This campaign demonstrated strong performance on TikTok, thanks to the collaborative efforts between Mega Digital and Lend Wallets in refining tracking and ad strategies.

- 2323 clicks

- 499 conversions

- CPC of $1.18

- CPA of $5.49

Wrap-up

TikTok for financial services is more than a trend. For brands willing to step into this innovative space, TikTok offers a chance to make an impact that resonates well beyond the screen. By embracing TikTok, financial brands can break down complex topics, build trust, and help shape the financial futures of young audiences in a memorable and impactful way.