The Vietnam Gaming Outlook 2025 report arrives at a critical juncture for the industry. As local studios face mounting pressure to evolve beyond ad-revenue dependency, this analysis provides the essential intelligence needed to navigate the transition toward sustainable, high-value growth.

Executive Summary

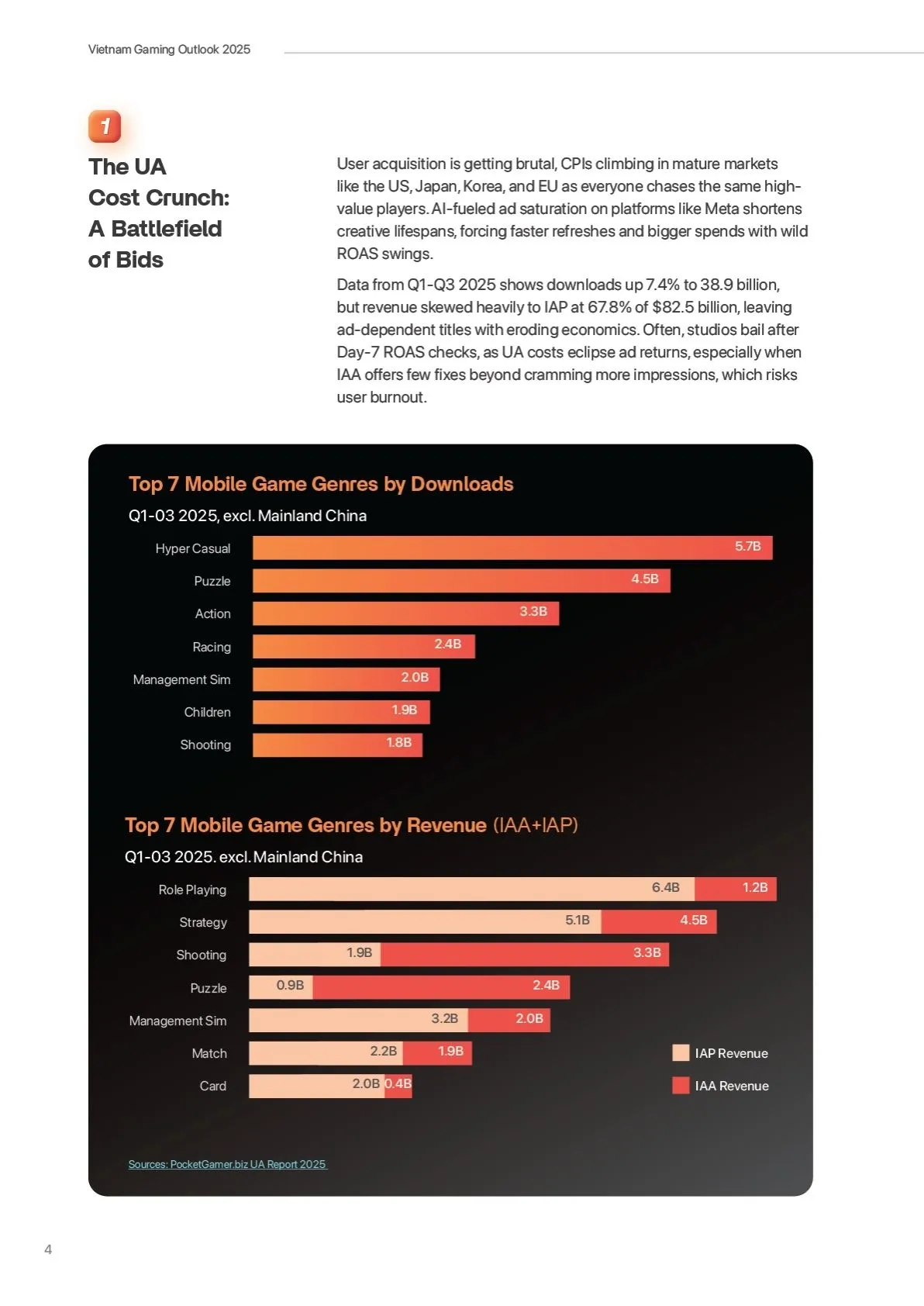

Vietnam has cemented its position as a global mobile gaming powerhouse, ranking #1 globally in Google Play downloads with over 6.1 billion installs in 2024. However, this volume hides a critical paradox: while Vietnamese studios excel at acquiring users, realizing revenue remains a primary challenge compared to mature markets like the US or China.

The “Vietnam Gaming Outlook 2025” report identifies a fundamental structural shift occurring right now:

- The Historic Pivot: The market is moving from pure In-App Advertising (IAA) models toward In-App Purchase (IAP) and Hybrid-Casual economies.

- Profitability Over Traffic: 2025 marks the end of growth at all costs. Studios are forced to prioritize sustainable profit margins and LTV (Lifetime Value) over sheer download volume.

- Infrastructure as a Moat: Success in this new era requires more than just good gameplay; it demands robust cross-border financial infrastructure and direct-to-consumer payment pathways to defend margins.

This is not just a trend, it is a survival adaptation. The studios that will lead 2026 are those building value ladders today, rather than relying on the traffic arbitrage of yesterday.

Why This Topic Matters in 2025

The industry is standing on a burning platform. The pure ad-driven model that fueled the explosion of Hyper-casual games is hitting a saturation point known as the “IAA Ceiling”. Increasing ad frequency is now accelerating user churn rather than driving incremental revenue.

Furthermore, the operational environment has become hostile to the old ways of doing business:

- Signal Loss & UA Inflation: With the maturing of Google Privacy Sandbox and Apple’s ATT, cheap user acquisition is disappearing. Bidding wars for high-quality users in Tier-1 markets are intensifying, making it impossible to survive on thin margins.

- Margin Compression: Volatile eCPMs and platform fees are eroding profitability. Reliance on a single revenue stream is no longer just risky, it is existentially dangerous.

This report serves as a strategic roadmap for studios navigating these turbulent waters, offering a clear path from volume-based fragility to value-based resilience.

Scope & Data Overview

To provide a definitive view of the market, this report synthesizes proprietary data from a strategic coalition of industry leaders:

- Sensor Tower & Adjust: Providing market intelligence and attribution data.

- Airwallex: Offering insights into financial infrastructure and cross-border payments.

- Mega Digital: delivering advertising benchmarks and platform-specific trends.

The analysis spans billions of global user touchpoints and cross-border payment transactions throughout 2024 and early 2025. Key focus areas include global download shifts, payment conversion behaviors, and ad creative performance across the US, APAC, and EU regions.

Key Trends & Insights

Trend #1: The Hybrid-Casual Consolidation

2026 is projected to be the definitive era of Hybrid-Casual. The market is witnessing a quality flight, capital is consolidating around fewer, higher-quality titles that can retain players for months, not days. Games that successfully layer deep meta-systems such as RPG elements or decoration loops onto simple core mechanics are demonstrating significantly higher LTV than traditional formats.

Trend #2: The Cash Flow Shift (From Ads to IAP)

Global IAP revenue has surged, signaling a maturity in player spending behavior as the market hits the $150B milestone. Studios are moving away from models based on “traffic arbitrage” toward building value ladders, where revenue is generated through player progression and asset ownership. Financial resilience now depends on diversifying revenue streams beyond the volatility of ad networks.

Trend #3: First-Party Data Sovereignty

As third-party reliance becomes risky due to privacy changes, successful studios are pivoting to internal data ecosystems. The winning strategy involves personalized offer flows and customized onboarding based on first-party behavioral signals, replacing the broad-strokes targeting of the past.

Platform Perspective: The TikTok Shift

TikTok has evolved from a branding channel into a sophisticated performance engine for IAP games. As a premier partner, Mega Digital highlights several critical shifts on the platform:

- Playable Ads Efficiency: Playable ads on TikTok are showing superior efficiency, driving a significantly higher Payer Rate compared to standard video assets.

- Automation: The integration of AI-driven tools like Smart+ Campaigns is automating ROAS optimization. This allows UA teams to shift their focus from manual bidding to creative strategy, which is now the primary lever for growth.

What This Means for Game Studios

Navigating this transition requires a fundamental mindset shift across the organization:

- Product DNA: Game design must integrate monetization loops naturally from Day 1. IAP cannot be treated as an afterthought; it must be core to the progression system.

- Financial Operations: Studios need to audit their cross-border payment stacks. Minimizing FX fees and mitigating chargeback risks are no longer back-office tasks, they are central to preserving margin.

- Marketing KPIs: The primary metric must shift from CPI to ROAS and Payer Conversion rates. Volume means nothing without value.

Who Should Read This Report?

This strategic guide is curated for decision-makers building the future of Vietnamese gaming:

- C-Level & Founders: Mapping strategic pivots for the 2025 – 2026 horizon.

- Product Owners: Looking to integrate Hybrid mechanics into casual portfolios.

- UA Managers: Seeking to move beyond volume-based traffic to value-based acquisition.

- Finance Leads: Optimizing profit margins in a global market.

What’s Inside the Full Ebook

Download the full report to access exclusive data and frameworks that are not available elsewhere:

- The IAA Profitability Ceiling Analysis: Data-backed proof of ad-model limitations and where the break-even point lies.

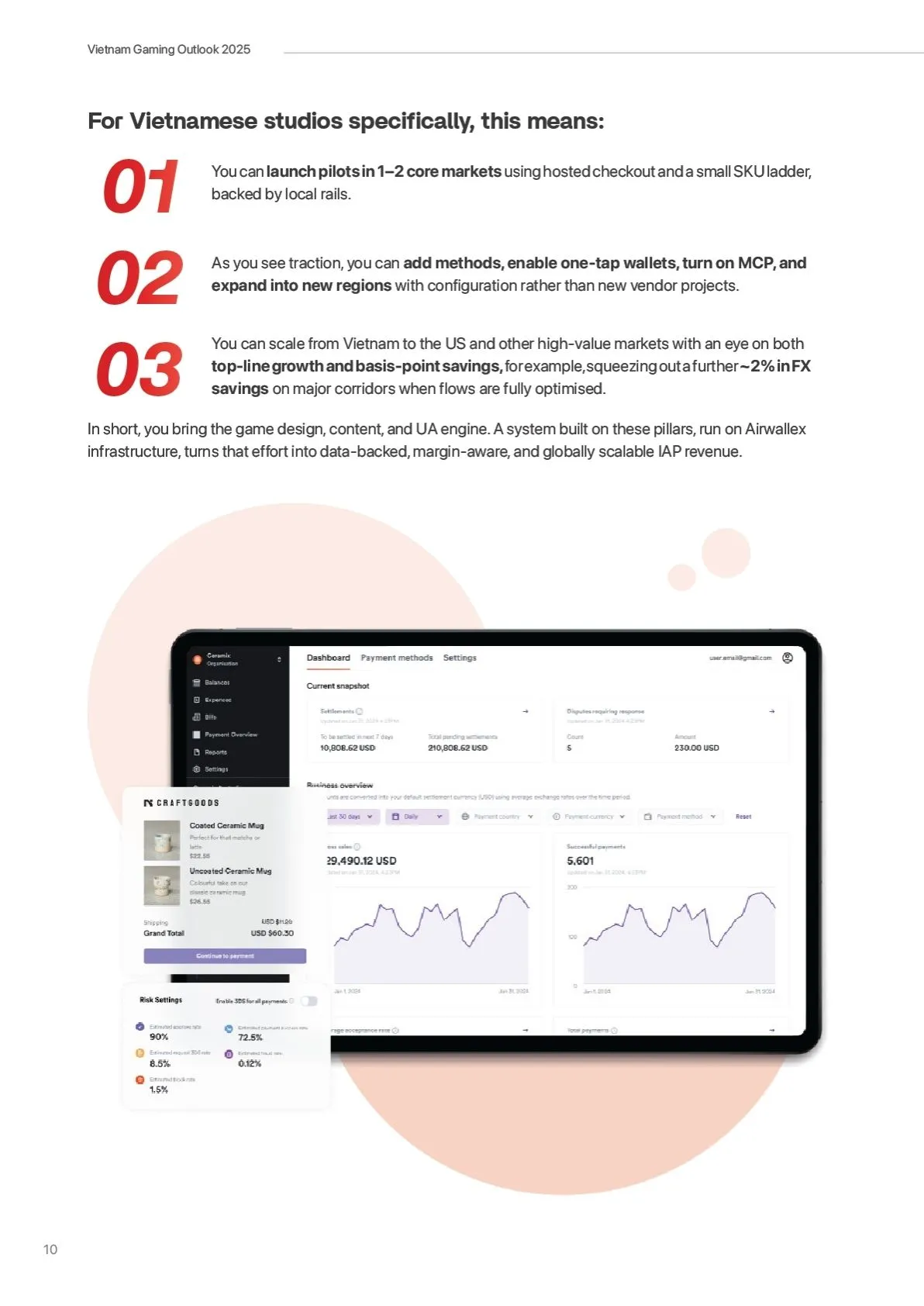

- The Airwallex IAP Blueprint: A comprehensive 4-step financial infrastructure guide covering Foundation, Conversion, Margin, and Sustainability.

- 2025 Winning Creative Framework: Proven scripts and structures for high-converting TikTok Playable Ads.

- Exclusive Case Studies: Real-world transformation stories from industry giants like Gamota, Voodoo, and Falcon Game Studio.

Whether you’re a studio founder, UA manager, or product lead, this report delivers the financial blueprints and creative strategies needed to pivot from IAA dependency to sustainable IAP growth.

Download your free report today and start future-proofing your studio for 2025!